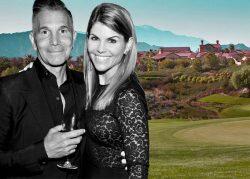

Robert Flaxman, the developer jailed in the same college admissions scandal that netted Lori Loughlin and Felicity Huffman, sold an office campus in Fremont for $85 million.

Lincoln Property and Invesco Real Estate bought two buildings in Fremont’s Ardenwood district from Flaxman, the Mercury News reported. It was an all-cash deal for the pair, which acted through affiliate Paseo Kaiser Office Owner.

The seller was an affiliate controlled by Flaxman, principal executive of Crown Realty & Development. Flaxman made headlines in 2019, when he was sentenced to a month in jail and 250 hours of community service for helping his daughter cheat on college entrance exams. He also had to pay a $50,000 fine.

Read more

The buildings are next to each other at 6900 Paseo Padre Parkway and 6801 Kaiser Drive in Ardenwood, a neighborhood that’s recently attracted multiple tech and life sciences companies. Facebook’s parent company, Meta Platforms, is a tenant in at least 10 nearby buildings.

Other tech companies that call Ardenwood home include Electronics for Imaging, HID Global and Kyocera SLD Laser. Neuralink, Anaspec and Boehringer Ingelheim USA are among pharmaceutical and biotech companies with offices nearby as well.

The primary tenant of the buildings bought by Lincoln and Invesco is consumer electronic creator TE Connectivity, which designs and makes connectors and sensors for multiple industries.

The buildings total 185,700 square feet combined. The property’s assessed value was $51.7 million in mid 2021, meaning the purchase price was 64 percent more than that.

CORRECTION: This story has been corrected to fix identification of one of the buyers to Invesco.

[Mercury] — Victoria Pruitt