Why has Silicon Valley gone L.A. on luxe real estate?

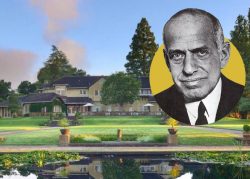

Because the “Green Gables” compound in Woodside needs a little Hollywood magic in order to get younger billionaire buyers to imagine themselves in the historic 74-acre property with a $125 million asking price, says new listing agent Zach Goldsmith of Hilton & Hyland in Beverly Hills.

Little wonder the cameras are already rolling.

“We wanted to capture the cinematic aspects of the property,” Goldsmith said of the new marketing campaign shot over four days by an LA-based cinematographer that took over six months to put together. “We wanted to set the tone and mood that you can’t see unless you come to the property. That’s what pulls the trigger buttons, emotionally, to get people to move.”

The Beverly Hills-based agent said that the Fleischhacker family, which has owned the estate for five generations, seriously considered him for the listing when they were bringing the property to market a few years ago. He even flew up to meet them and spend a night on the grounds, which have a historic main home designed by famed Arts and Crafts architects Greene and Greene, six other homes, three pools, a Roman-style reflecting pool with stone arches surrounding it, two private roads and a stone tea house.

Goldsmith said he lost out on representing the property at the time because his agency was severing ties with Christie’s and the family wanted the cachet associated with the fine art auction house. But he kept in touch with Marc Fleishhacker, great-grandson of banker Mortimer Fleischhacker Sr., who began assembling the nine-parcel family compound in the early 1900s. After changing agents several times, first listing without a price and then coming back in March 2021 with a $135 million list price, Fleischhacker told Goldsmith “it wasn’t working out and we should have gone with you,” according to the agent.

Goldsmith said he could have kept the property as an exclusive listing but felt it would be a “disservice” to not have a local agent for the “boots on the ground” prep work the home needed. After a search, he ended up bringing back Brad and Helen Miller of Compass, who held the listing last spring. There was no awkwardness about the new arrangement, Goldsmith said, adding that the Millers are “over the moon” to still be involved after working on the listing for over a year.

With its sprawling grounds, panoramic views, and a total of 34 bedrooms and 26 bathrooms, the estate is a popular wedding and corporate retreat rental and the smaller homes can also be rented out individually—one is leased by former Theranos CEO Elizabeth Holmes. She still lives at the property with her husband and one-year-old son and “doesn’t plan on leaving, though she may have to leave,” Goldsmith said. Holmes was found guilty of four counts of investor fraud in January and is set to be sentenced in September, though she is appealing her conviction.

Goldsmith said the future owner can decide to keep the property as an income-producing entity, but he thinks the great likelihood is that it will be delivered vacant so that the new buyer can realize their own vision of the property. He thinks the best spot for a new owner’s home is near the property Holmes is renting.

“I can see someone building their own woodsy glass modern unit there,” he said, adding that the historic main home and one other historic home on the property can have substantial interior work done, but they cannot be torn down. The other five can be replaced with new homes up to 7,500-square-feet each.

As part of his newly created marketing materials, Goldsmith has had renderings made of a new two-story kitchen in the main home to replace the “awful” one currently in place, as well as drawings of completely new homes with the “earthy modern” look that he thinks local buyers want more than the “glitz and glam” that appeals to his high-end L.A. buyers.

Southern California buyers might be interested in the Woodside property, however, given that more and more of the area’s “megawealthy” buyers have been looking for a “refuge” outside of LA, he said. There’s been “some international interest” as well, but Goldsmith thinks it’s likely that a billionaire who already has a primary home in the Bay Area will be the eventual buyer.

His agency has the “history and relationships” to get direct access to some of the area’s wealthiest people and has been reaching out repeatedly to see if they can get those “titans of industry” out to see the house. He’s been concentrating on appealing to some of the younger tech titans, those in their 30s and 40s, with more youthful staging and a new five-minute promotional video that incorporates hip-hop into the soundtrack. But he certainly isn’t looking to alienate the older billionaires that he feels were the emphasis the last time around.

Given the price point, “Only a few hundred people in the entire world are a fit for this property,” he said.

After sending out the new materials to “one of the top 20 wealthiest people in the world” three times, Goldsmith scored his first in-person showing, which should take place soon, he said. He will fly up for the presentation to the local buyer, who is in his 50s, and will emphasize the grounds and their potential more than the current structures.

“Someone could really make their own Neverland,” he said.

The ask of $125 million would be the biggest sale ever for the Peninsula enclave where a $110-million listing across the street from Larry Ellison dropped to $84 million in March and $64 million in May. Of course that doesn’t include the costs associated with building five new homes on the site or the possible lengthy permitting timeline.

But Goldsmith said the $10 million he knocked off the previous asking price is “a big discount” for the “once-in-a-generation world class estate.” He acknowledged it wasn’t a very big percentage off the last ask but indicated that the family may be negotiable.

“Come in and make an offer and get another percentage discount,” he said.

Read more