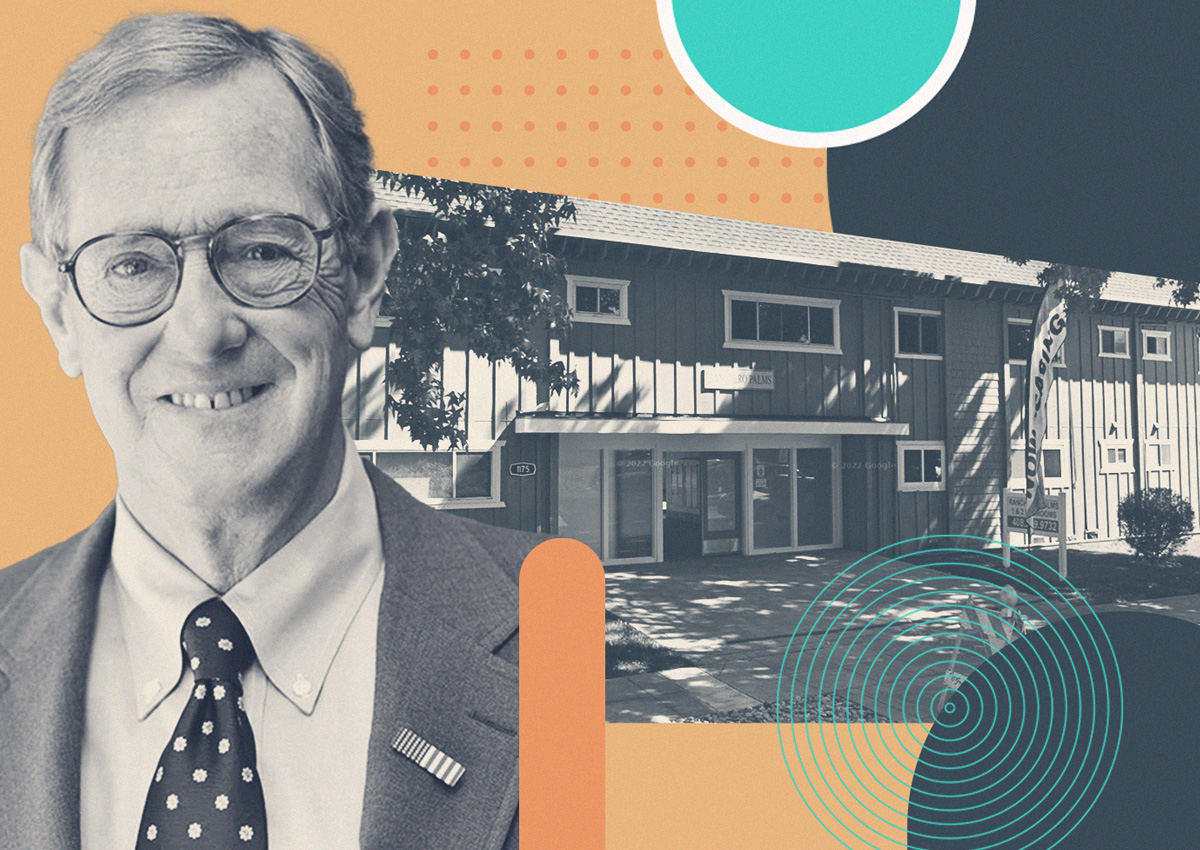

A Bay Area construction veteran has entered a contract to sell one of the priciest multifamily deals of the year. Mario Wijtam is close to selling his apartment complex in San Jose for $14 million, or $513 per square foot.

The apartment building is located at 975 Boynton Avenue and is a 48-unit garden-style property in West San Jose. The units include 16 one-bedrooms and 32 two-bedroom units, all recently renovated to include balconies.

The property was acquired by Wijtam, who has worked in Bay Area construction since the early 1980s, in 2015 for almost $12 million. The apartment building is located four miles from Apple’s Cupertino campus and five miles from San Jose Mineta International Airport.

The San Jose multifamily market is one of the hottest in the country, according to a new report by brokerage Marcus & Millichap. San Jose is the only major U.S. market with an average effective rent above $3,000 per month. The average effective rent rose over the past year to $3,040 in March, a 7.4 percent increase year-over-year. That figure was more than $200 above all other Bay Area markets.

“Although the average effective rent in San Jose is the highest among all major U.S. markets, many residents in the region have few alternative options for housing,” the report said.

New units added to the development pipeline increased by just 1.3 percent, the smallest gain since 2019. More than half of all units completed this year will be delivered in Mountain View, according to the report.

Multifamily sales reached a four-year high in 2022, but started to trail off in the fourth quarter and into this year. Current economic conditions have buyers looking for low cost of entry acquisitions, which has resulted in Class C transactions accounting for more than 80 percent of deal flow in San Jose.

“Hurdles in the financial markets spurred a disconnect between buyer and seller expectations, creating complications in the deal-making process,” the report said.

Read more