Two Wine Country hotels face an $80 million foreclosure, according to documents filed with Napa and Sonoma County. If the foreclosure is not resolved this week, the two properties will sell at auction to the highest bidder later this month.

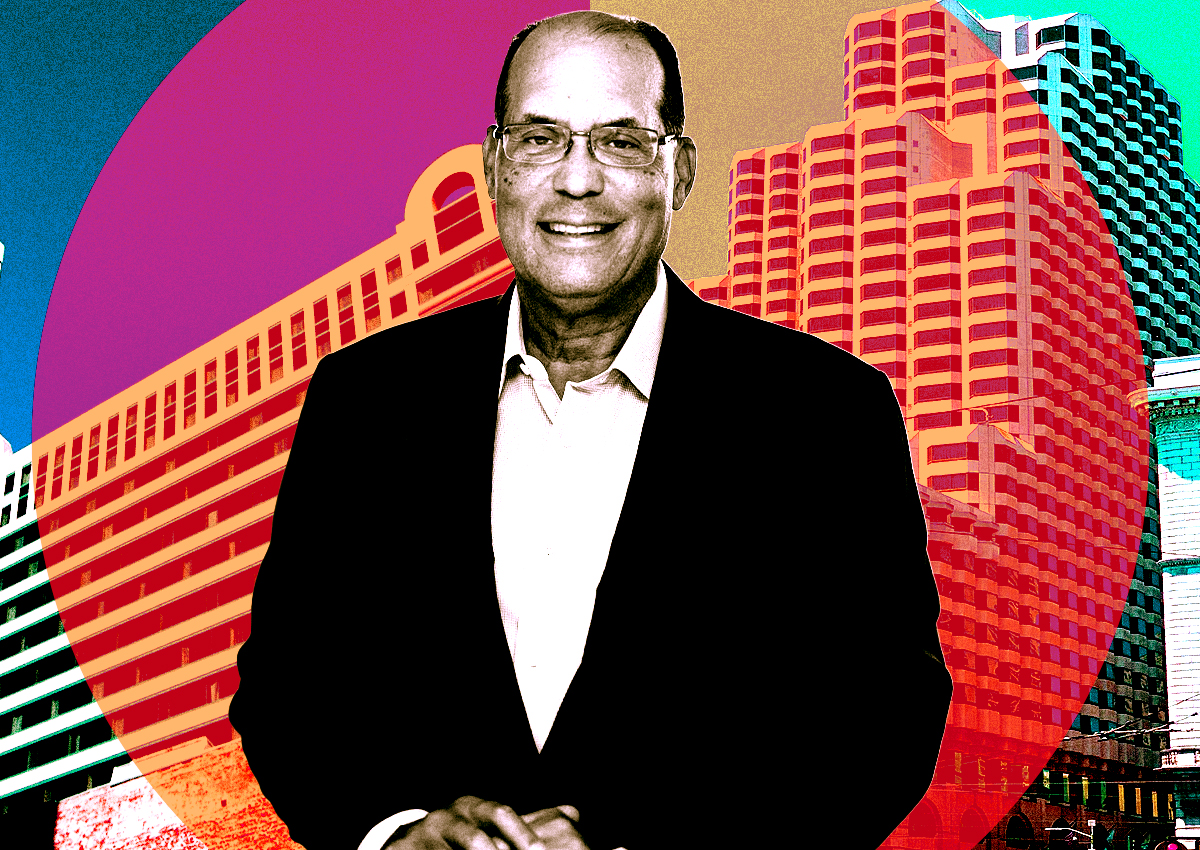

The two hotels are Cambria Napa Valley, which opened in August 2021 and is located at 320 Soscol Avenue in Napa, and Cambria Hotel Sonoma Wine Country, which opened in August 2020 at 5870 Labath Avenue in Rohnert Park. Both hotels were developed by Irvine-based Stratus Development Partners. They were put up for sale in a portfolio last year for an undisclosed price.

“As of right now, development for new hotel construction in Napa and Sonoma is rare, and securing local and state approval is a lengthy and tumultuous process, deterring new supply in the immediate future,” brokerage Avision Young, which represented Stratus, said at the time.

Together, the two hotels are expected to generate $14.5 million in total revenue by the end of 2023, with Cambria Napa generating $7.8 million and Sonoma generating $6.7 million. The Cambria Napa Valley features a “Modern-agrarian” design and has a two-story lobby. Amenities include an outdoor heated whirlpool, a shop for snacks and essentials, a restaurant and a bar that features local wine and craft beers.

Cambria Sonoma has a “Northern California-inspired décor” with a layout that emphasizes scenic views of local vineyards. Amenities at Sonoma also feature a restaurant and bar, an outdoor heated pool and a meeting room/event space.The pair of Cambria hotels are not the only Bay Area hospitality properties facing financial uncertainty. According to a report by Trepp, 89 percent of lodging CMBS loans in the market are barely covering their debt payments. The largest of these loans were for Park Hotels & Resorts’ two-asset portfolio of Hilton Union Square and Parc 55 in San Francisco. The company announced that it will cease making payments and the combined $725 million in loans became delinquent last month.

Read more