Crime could be correlated to commercial real estate distress in San Francisco, according to a first-of-its-kind report from Trepp, previewed exclusively by TRD and available on the commercial real estate analysis and data company’s website on Thursday.

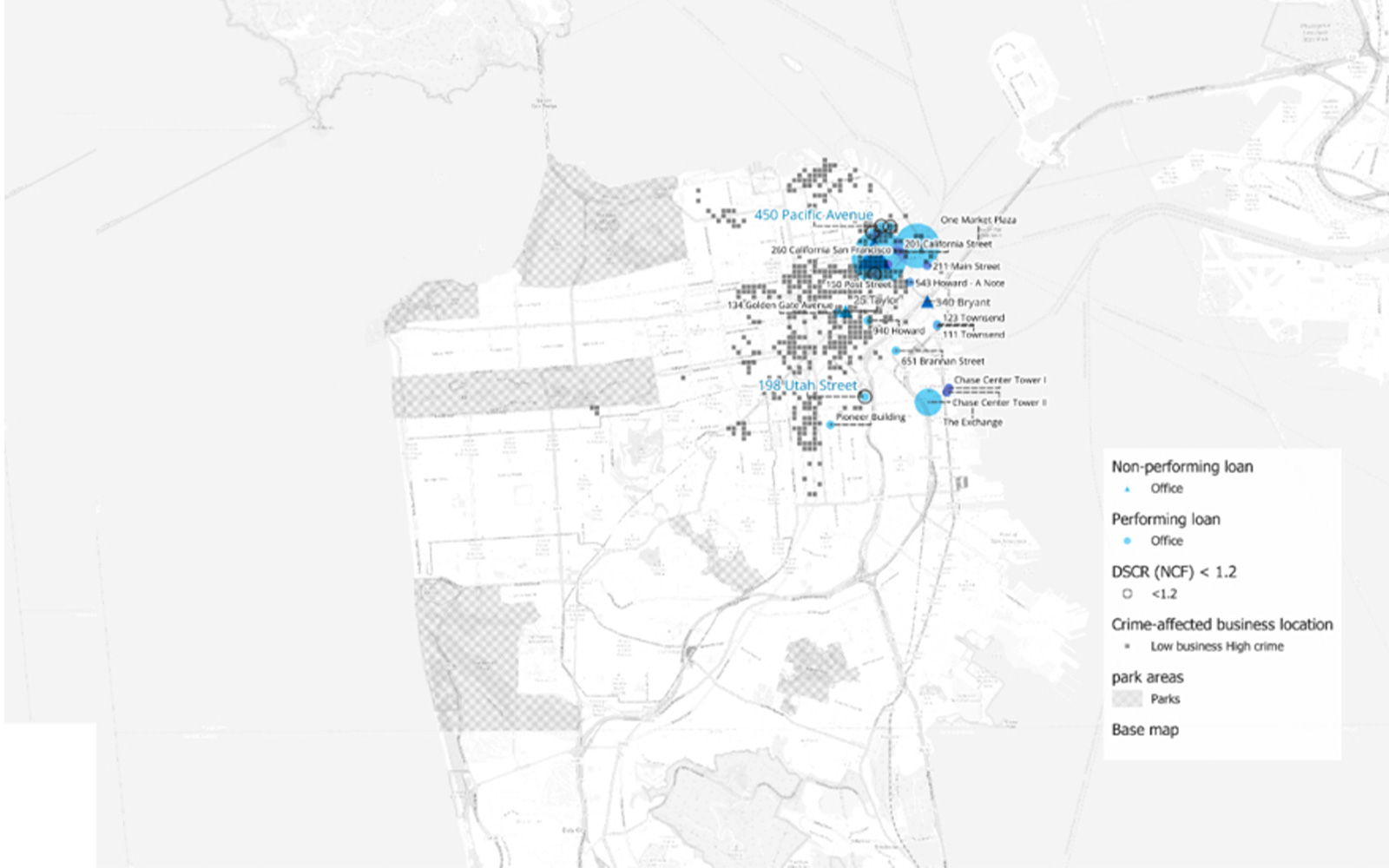

By combining San Francisco Police Department data on both violent and property crimes with business registration data and Trepp data and analysis on troubled loans and properties, the report narrows in on “crime shadow” locations, according to its authors, Trepp analysts Stephen Buschbom and Jiabin Wei.

The goal is to provide insight into the risks associated with loans and properties in those areas.

It is the first-ever such report from Trepp, though the company may extend the analysis to other metro markets, according to Buschbom. It was inspired by the numerous stories about retailers leaving the city this year, he said via email.

“We wanted to go beyond the headlines and dig into the data to see what story the crime data tells,” he said.

Business-crime correlation

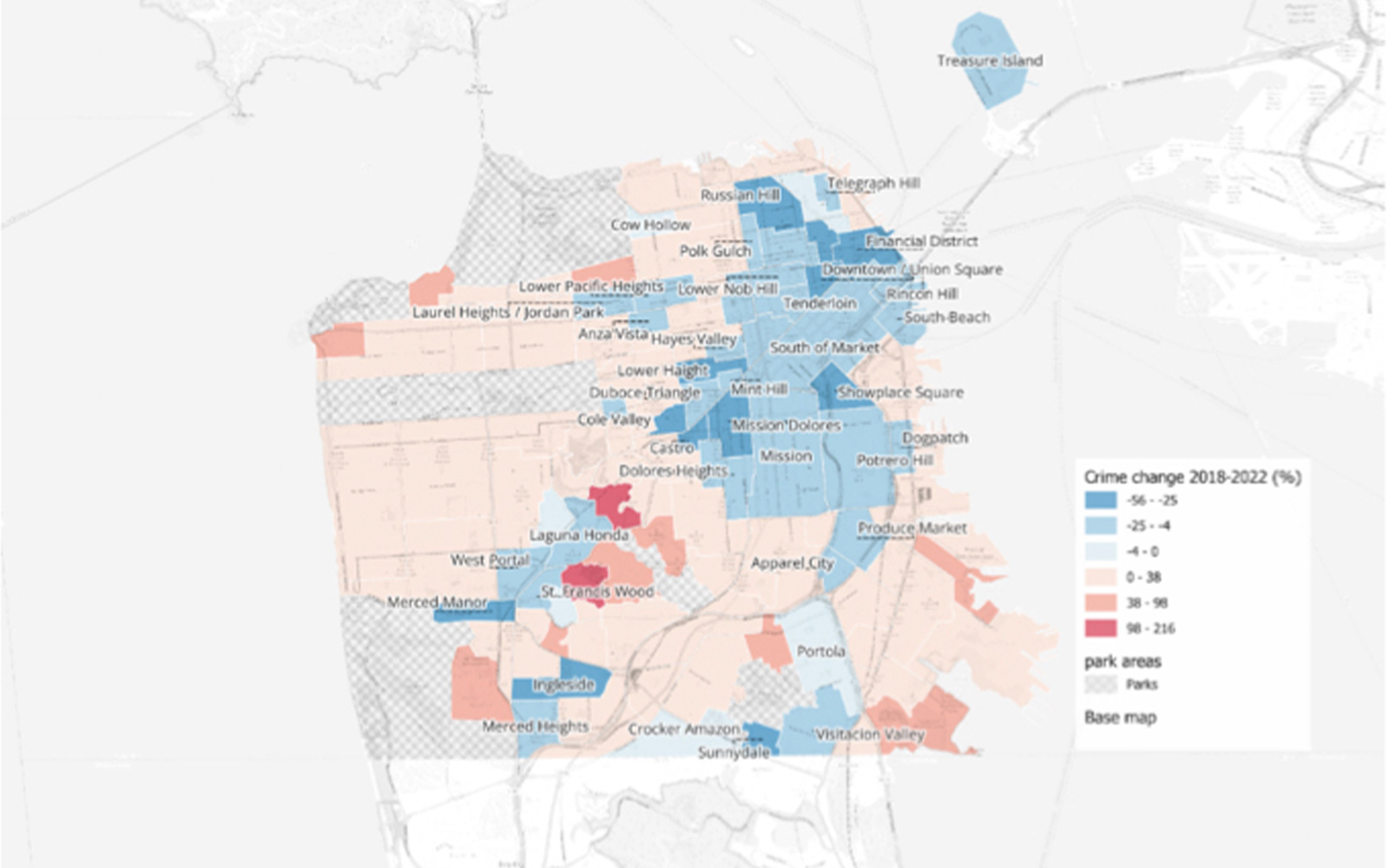

One big surprise was that, despite the headlines, the report found that over the last five years there has actually been a significant decrease in crime rates around the downtown area. Union Square, Chinatown, Russian Hill and the Financial District all saw more than 25 percent declines in crime between 2018 and 2022, which “could present an intriguing longer-term opportunity for businesses to experience a resurgence in these areas,” according to the report.

Yet those numbers can be misleading, Buschbom cautioned.

“The analysis indicates that a high starting level of crime likely put pressure on business profits and, as foot traffic decreased, in part due to COVID but also because of crime, retailers started closing their doors in San Francisco in increasing numbers,” he said. “Fewer businesses and lower foot traffic ultimately means fewer crime targets. Fewer businesses and consumers can also mean that there will be fewer reported crimes if citizens and businesses that remain in the neighborhood have grown to accept a certain level of crime rather than bother with reporting it to the police.”

When breaking down these areas more minutely, the report found there is often a correlation between “high crime clusters” — largely downtown — and business decline.

“Out of all the identified high-crime locations, more than 65.1 percent experience stagnating business growth or even losses, while the remaining 34.9 percent saw relatively high growth in both businesses and crimes,” according to the report. “This finding indicates that the majority of locations with declining businesses are surrounded by high crime areas, emphasizing the detrimental effects of persistent crime on business vitality.”

The fact that some locations are experiencing growth even amidst the same high crime levels “suggests that within the diverse urban landscape of San Francisco, the interplay between crime dynamics and business vitality is nuanced and can differ significantly from one micro-community to another,” according to the report.

The expected return to office this fall by employees at many big tech companies, even just on a hybrid schedule, “will be a good thing for San Francisco” and may put a new focus on these high-crime, high-business neighborhoods, Buschbom said.

“If office utilization does increase, it will be interesting to see if economic activity consolidates to some of the areas identified in our report as having economic resilience in the face of high crime,” he added.

Crime and distress

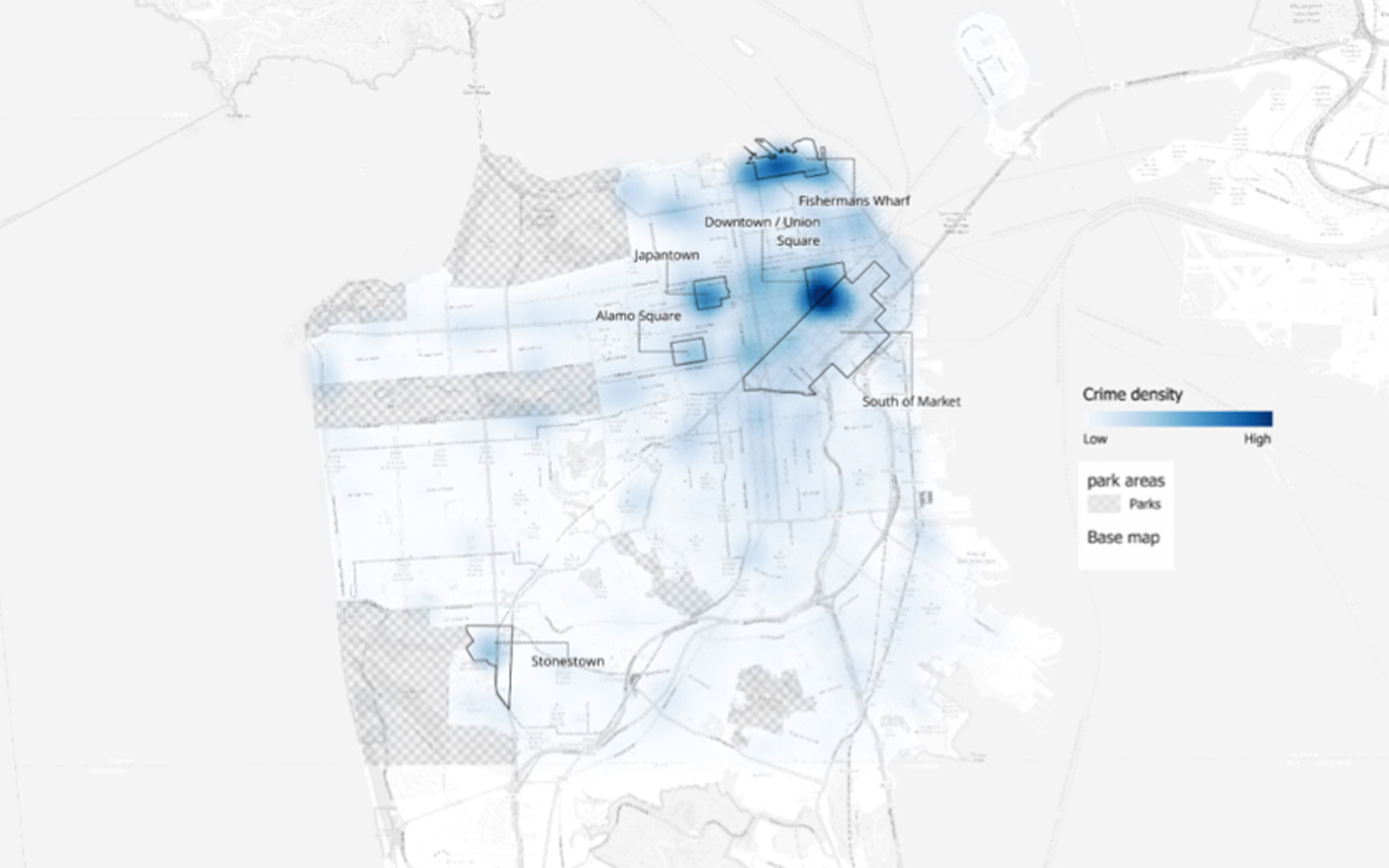

SFPD data show that the highest density of property crime is in Union Square, followed by the area of South of Market closest to Union Square, Fisherman’s Wharf, and Japantown, with the property crime in Japantown attributed to the “deteriorating blocks” in the Western Addition just south of the “charming” shopping district. The Stonestown Galleria was also a notable source of property theft on the city’s west side.

Property crime in these four areas account for more than 90 percent of the total crime in San Francisco classified as “serious crimes” by the federal government, according to the report. Crime in the Financial District is less dense, but the data show a 29 percent increase from 2021 to 2022.

In terms of violent crime, the Tenderloin had the highest density of “more severe incidents,” followed by the Mission and SoMa. Together, these three neighborhoods account for one-third of the city’s violent crime.

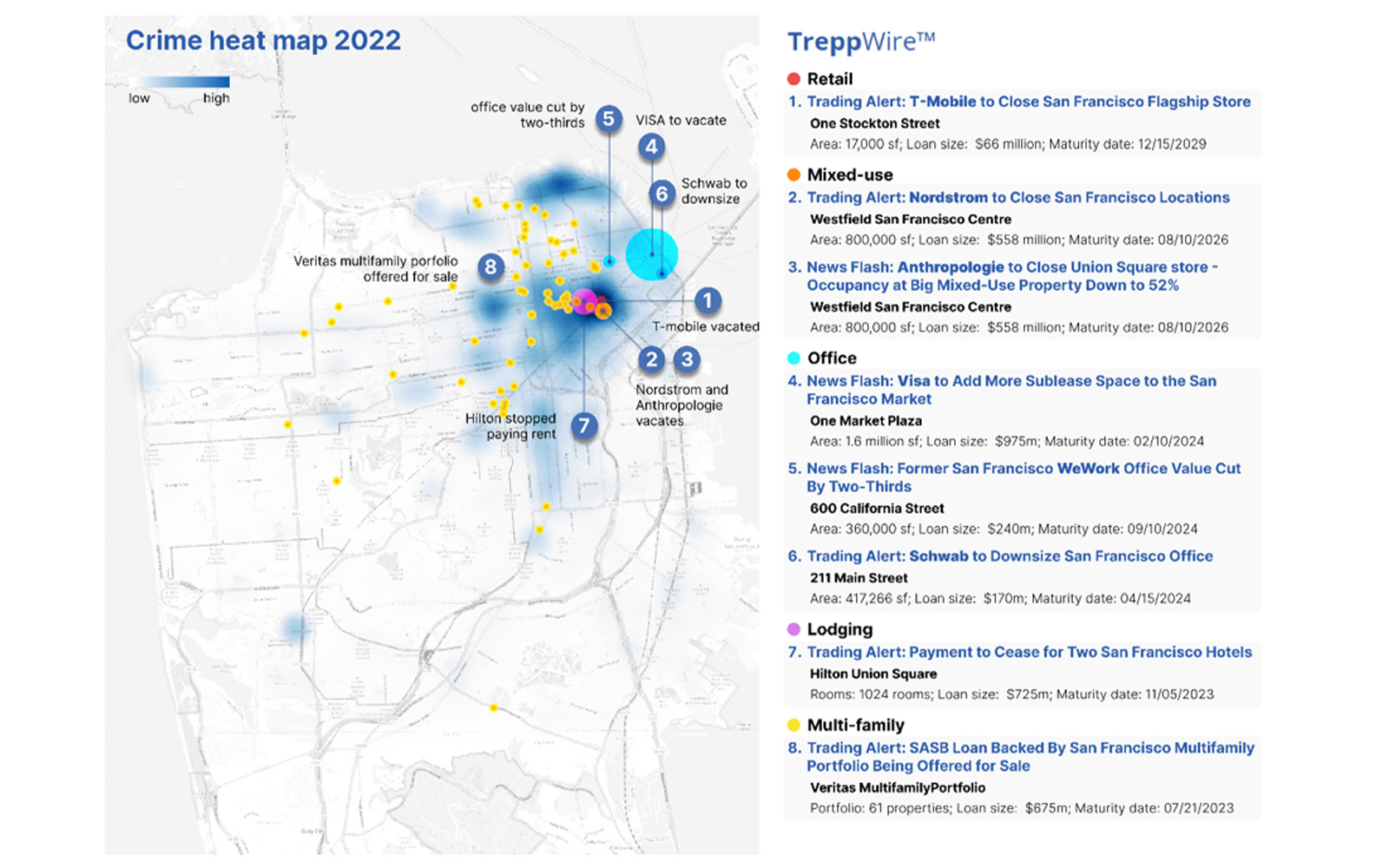

The report then overlaid the city’s biggest commercial distressed properties, as determined by Trepp, with these violent and property crime statistics. It found that many distress examples, including the Westfield and Hilton defaults, substantial Visa downsizing at 1 Market Plaza and Charles Schwab’s downsizing at 211 Main Street all took place in areas with high or rising crime. It also pointed out that more than 17 percent of the apartment buildings in this year’s Veritas loan default are in the Tenderloin and nearby lower Nob Hill, which “underscores the potential challenges and risks associated with multifamily properties within high crime neighborhoods.”

The authors went on to identify loans that could be at increased risk of default, at least in part because they are backed by properties in crime-affected areas, with a focus on loans maturing in the next two years with a debt service coverage ratio less than 1.2. In the office sector, the most concerning loans that fit those parameters were 450 Pacific Avenue, 315 Pacific Avenue and 900 Kearny Street, as well as the aforementioned 1 Market Plaza.

In the lodging sector, six out of seven maturing loans have a DSCR below 1.2 and all six are located in or near a “crime shadow” location. In addition to the two Hilton properties already in default, there is a third Hilton in the Financial District, plus The Ritz-Carlton, Petite Auberge and Park Central.

Crime rates are particularly important for hotel performance, according to the report.

“A small decline in crime may be accompanied by a huge improvement in lodging properties’ financial performance,” it reads.

In the multifamily sector, the report saw reasons to be concerned about both Parkmerced and the Mosser-Swig portfolio. In the latter’s case, all five properties have DSCR levels below 1.2 and all but one are in or near the Tenderloin neighborhood, “which is identified as the epicenter of crime-affected business areas.”

Read more