Portsmouth Square has defaulted on a nearly $100 million loan tied to the 544-room Hilton San Francisco Financial District hotel.

A subsidiary of the Los Angeles-based hospitality firm defaulted on two loans, including the $97 million mortgage loan tied to the hotel at 750 Kearny Street, next to Chinatown, the San Francisco Business Times reported, citing a regulatory filing.

The mortgage loan originated in 2013 from Bank of America and undisclosed lenders. It matured this month.

The loan was sent to special servicing in October when Portsmouth indicated it wouldn’t be able to pay it off. Talks between the lender and borrower for a workout resolution are ongoing, according to a monthly report on the loan prepared for bondholders.

A recent notice of default sent to Portsmouth says the lenders have the right to accelerate the loans or foreclose on the hotel.

The brutalist concrete Hilton San Francisco Financial District, once known as the Holiday Inn Chinatown, was built in 1970 and renovated in 2006. It’s under a franchising agreement with Hilton through the end of January 2030.

The property was appraised at a value of $179.8 million in late 2013, according to the bondholder report.

Its default marks the third major hotel property in San Francisco to hit the skids.

In October, a receiver took control of two hotels given up by Park Hotels & Resorts — the 1,921-room Hilton Union Square at 333 O’Farrell Street and the 1,024-room Parc 55 at 55 Cyril Magnin Street — with plans to sell them.

The move came as the Virginia-based real estate investment trust approached a November deadline to pay a $725 million mortgage tied to the hotels, after it stopped making payments in June.

Tens of billions of dollars worth of commercial mortgage-backed securities tied to Bay Area commercial properties will reach maturity in the next 18 months, and even the healthiest performing loans face a challenging refinancing environment, according to the Business Times.

Portsmouth’s $97 million mortgage loan was originally obtained to repay a prior $43 million mortgage and redeem limited partnership interests, according to a Portsmouth SEC filing in November.

The unidentified Portsmouth affiliate was also the borrower on a related $20 million mezzanine loan from the same lenders, according to the regulatory filing and bondholder report. It’s not clear if payment on that loan was current as of its maturity date on Jan. 1.

Portsmouth is a unit of Santa Fe Financial, a unit of Intergroup, based in West Los Angeles. Portsmouth Square serves as the managing general partner, and a 97 percent limited partner, of Justice Investors, owner of the Hilton San Francisco Financial District, according to Intergroup.

In September, Portsmouth hired Hart Advisors Group to help negotiate potential loan modification terms, now under review by the senior lender’s special servicer, LNR Partners, as well as undisclosed stakeholders in the loan, according to the regulatory filing.

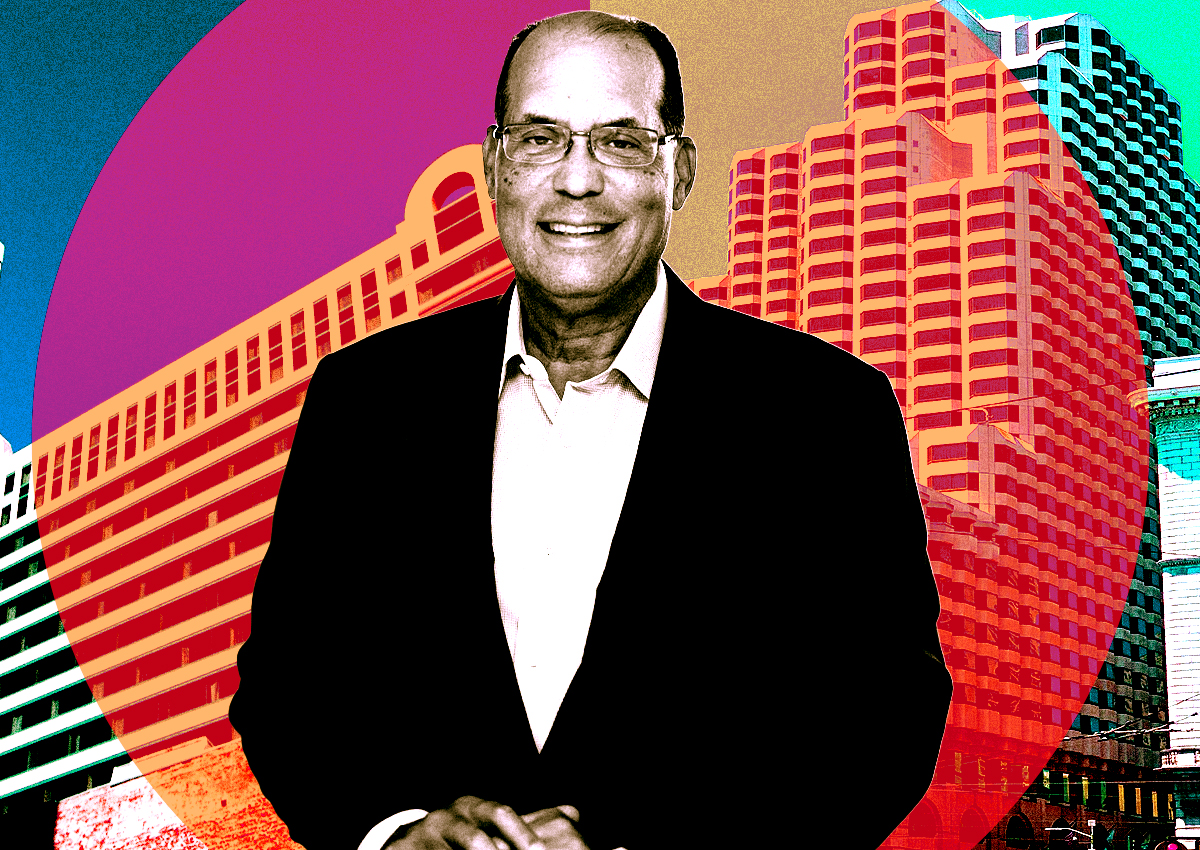

“We are confident that we can achieve the refinancing of this loan,” Portsmouth Square President David Gonzalez, told the San Francisco Chronicle in June. He had said the firm’s loan circumstances were a “very different animal” from that of Park Hotels — owing to strong business and a location next to Chinatown, rather than in the Tenderloin.

— Dana Bartholomew

Read more