The biggest San Francisco apartment portfolio transfer in over a decade took place on the sidewalk in front of the Memorial Court Gates, across the street from City Hall, on Thursday afternoon.

With an unopposed bid of about $464 million, Brookfield foreclosed on 76 Veritas apartment buildings, totaling 2,150 units, or about $216,000 per door.

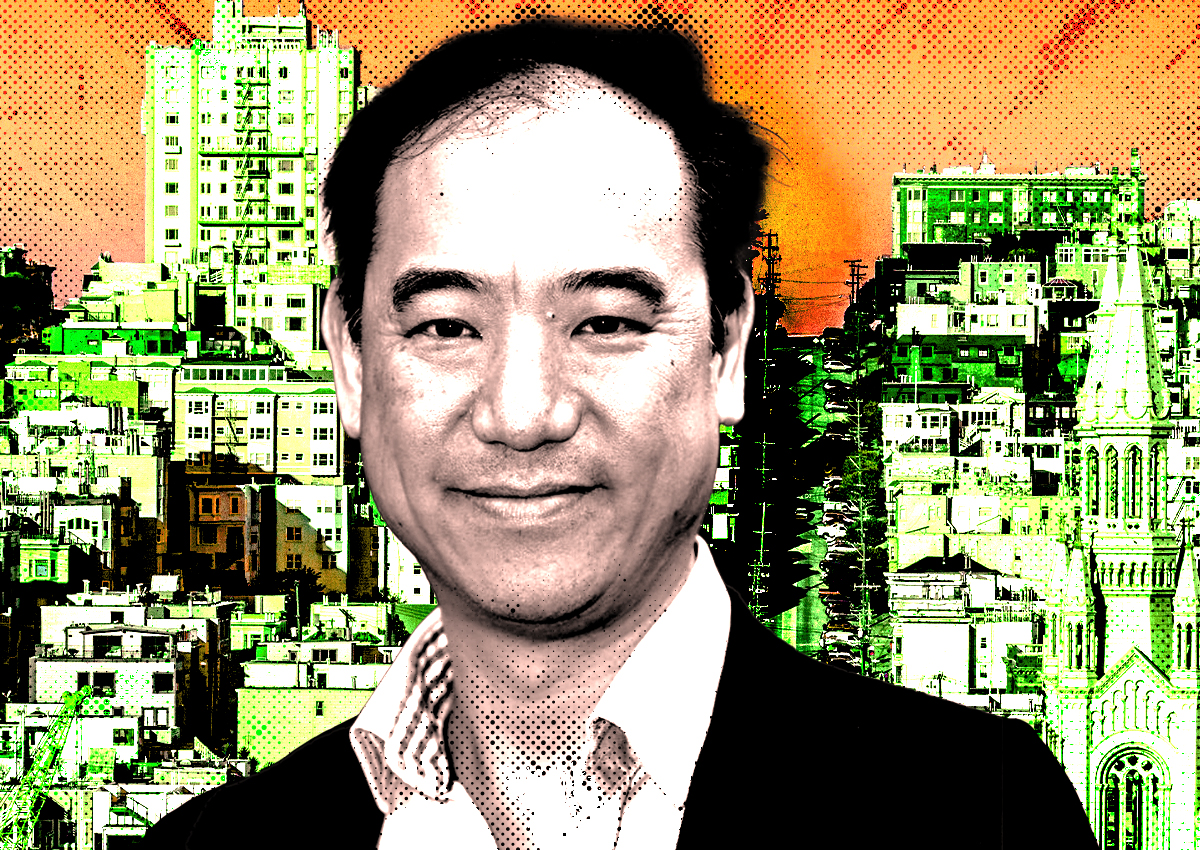

“This is a unique opportunity to own one of the only multifamily portfolios of scale in San Francisco offered in the last decade,” Ben Brown, who runs real estate across the Americas for Brookfield, said in a statement.

With the transfer, which represents about a third of Veritas’ San Francisco rental properties, Brookfield also takes the title of San Francisco’s largest residential landlord, doubling the size of its current apartment holdings in the city.

Ballast Investments will operate the portfolio and already manage assets in the same neighborhoods, according to a Brookfield rep. The partners plan to invest “substantial additional capital into the properties, addressing deferred capital needs as well as life safety issues,” according to the rep.

The loans on the apartment buildings had once been valued at over $900 million before Veritas went into default and Brookfield bought the debt for an as-yet-unknown amount in December.

Veritas declined to comment.

Brookfield paid $386.3 million for the larger of the two portfolios, which had 62 buildings, and $77.3 million for the smaller portfolio with 14 buildings at the auction.

However, that is not necessarily an indication of how much they paid for the debt, according to Gary Kaplan, a restructuring attorney at Farella, Braun and Martel.

As the owners of the debt, Brookfield can make what’s called a “credit bid,” an amount equal to the original debt owed — in this case about $915 million, according to the public notices for the auction sale. Other parties would have to pay “real money,” Kaplan said.

That’s why, in cases like this, there are no other bidders 99 percent of the time, he said.

“I would fall off my chair if someone outbid them,” Kaplan said. “But it wouldn’t be unheard of.”

A Brookfield representative was in attendance at the sale, along with about 15 other onlookers.

Aside from a “Yes!” from the back of the crowd when the final tranche of buildings sold unopposed, there were no comments during the proceedings, other than from the auctioneer, who took about ten minutes to read off the list of foreclosed properties.

He declined to give his name, but said in his eight years of twice weekly trustee sales he has never seen portfolio sales even close to these two, calling the event “unprecedented” in his experience.

After falling into default, Veritas had originally tried to buy back the loans when the trustees put them up for sale in June, but were unsuccessful. Eastdil handled the sale of the debt and did not reply to a request for comment.

Many of the buildings Veritas lost this week were the same ones it bought in 2011, when it purchased a 2,000-unit portfolio for about $500 million from CitiApartments as the Lembi family faced its own defaults in the aftermath of the 2007 banking crisis.

That is the last time a transfer of this size took place in the city, where rents have stabilized but not come anywhere close to their pre-pandemic level in most, but not all, of the city. With high interest rates and management costs, difficult financing and stagnant rents, experts predict it will take years for the multifamily market to recover to pre-pandemic levels.

Oftentimes, debtors will simply sign a deed-in-lieu rather than going through with a foreclosure auction, Kaplan said. That is what Veritas did on a smaller portfolio of 20 San Francisco buildings purchased by Prado Group for $124 million.

The fact that Veritas did not do that this time around could mean that Brookfield did not agree to some kind of concession the apartment owner and manager requested in consideration of signing the deeds-in-lieu, or it could be that Brookfield’s title insurance company preferred a formal foreclosure in this case, Kaplan said.

Foreclosure can also provide a “cleaner break” in terms of title by eliminating junior liens and claims against the property that might exist, according to Trepp analyst Jennifer Spillane. A foreclosure also assures that the lender does not assume any liabilities associated with the property, like back taxes or mechanics liens, and is less susceptible to a reversal if the borrower declares bankruptcy.

Until the recent distress, Veritas was the largest landlord in San Francisco and one of its most voracious buyers. The 76 buildings in this portfolio range from the Marina to the Sunset, with the bulk concentrated in San Francisco’s struggling downtown core.

Now that Brookfield has taken ownership, they could choose to hold onto the entire portfolio or pick and choose which properties to sell off. Brown said that with little future supply in the pipeline, the portfolios represent a “great investment for our partners in the long run.”

Even though it had given up its interest in the Westfield mall downtown, it is moving forward with a redevelopment of the Stonestown mall near San Francisco State, as well as the 5M mixed-use development in SOMA and Pier 70 along with waterfront.

“While some have counted the city out, we have been investing for a long time and have seen San Francisco emerge from every down cycle stronger than before,” Brown said.

This article has been updated to include Brookfield comments.

Read more