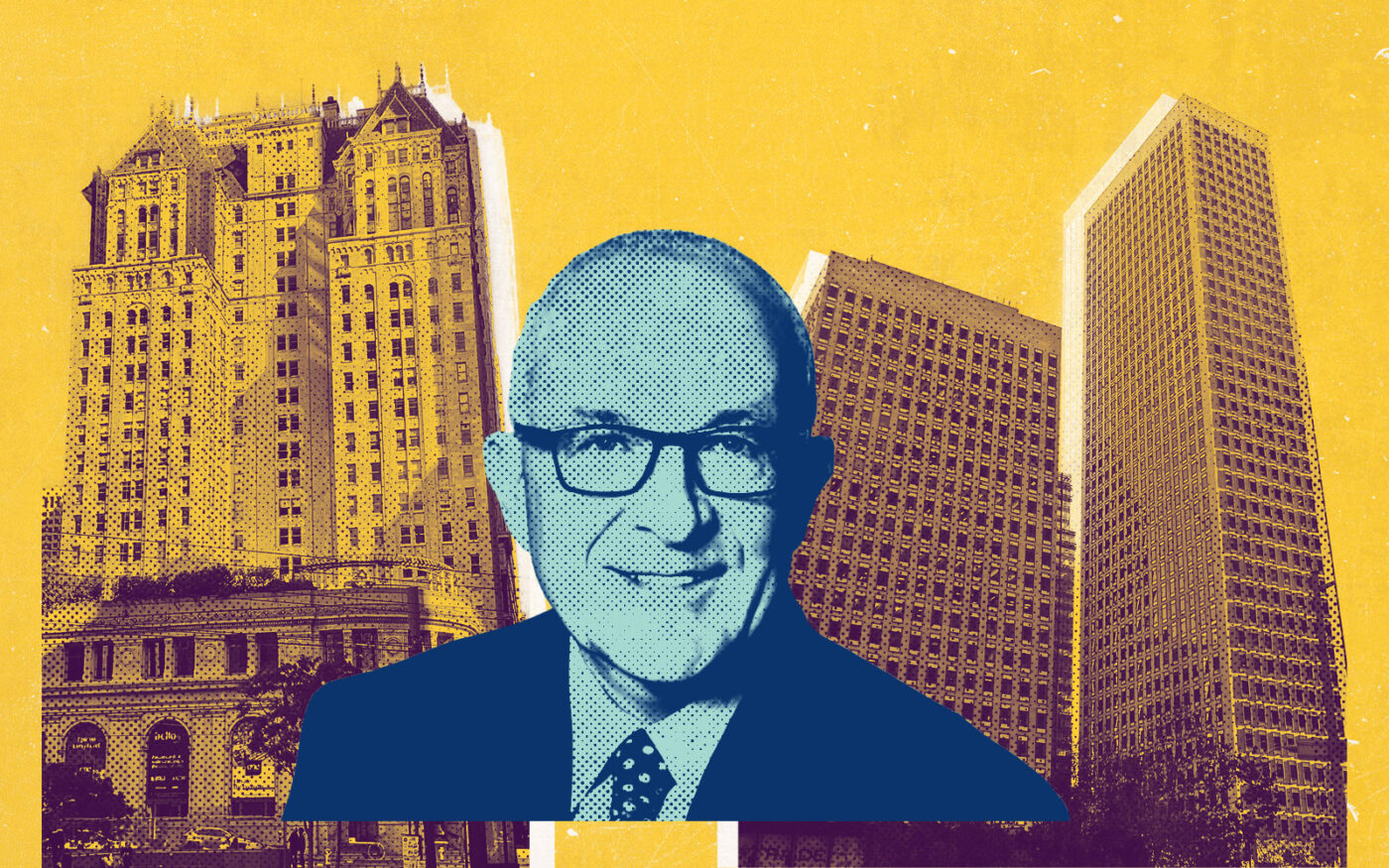

Paramount Group appears poised to surrender three office buildings in Downtown San Francisco after defaulting on at least one loan.

The New York-based investor has written down to zero a 293,000-square-foot tower at 111 Sutter Street, and the two-tower, 750,000-square-foot Market Center at 555 and 575 Market Street, in the Financial District, the San Francisco Business Times reported.

Paramount bought the century-old Hunter-Dulin Building at 111 Sutter with partner Harbor Group International in early 2019 for $227 million, or $775 per square foot. The lender was Mesa West Capital.

Later that year, the firm and an unidentified partner bought the 22- and 40-story Market Center for $722 million, or $960 per square foot. The lender was ING.

“These two assets are in workout mode,” Paramount CEO Albert Behler told analysts on a Feb. 15 earnings call. “We do not know what an ultimate resolution will look like, and there is a strong possibility that these assets may not be in the Paramount portfolio going forward.”

At the end of 2022, Paramount wrote its investment for the 25-story building at 111 Sutter Street down to zero. It then defaulted on its loan for the property before negotiating a cash flow loan through which the company does not have to use any of its own capital for loan service.

Late last year, Paramount also wrote its investment on Market Street down to zero.

The fair market value of both properties has dropped “significantly” below the debt used to acquire them, Behler said. Both properties have maturity dates coming due: 111 Sutter in May and Market Center in January.

Wilbur Paes, chief financial officer for Paramount, told analysts last month that the firm had removed the two properties from its core portfolio.

“By excluding it from the get-go,” Paes said, “investors are able to appreciate the impact, on a go-forward basis, should the resolution be where we end up handing the keys back to the lender.”

Paes said the world had “changed dramatically” since Paramount bought both properties five years ago. Despite heightened venture capital investment in artificial intelligence startups, which have leased offices, overall leasing activity remains muted.

Office vacancy in San Francisco hit 35.9 percent in December, according to CBRE, after a broad shift to remote work led by tech firms. Valuations have plunged, with delinquent loans, and buildings surrendered to lenders or sold at steep discounts.

In January, Paramount and partner Blackstone cut a deal to extend a $975 million loan tied to One Market Plaza, a 1.6 million-square-foot trio of office towers at 1 Market Street. The loan was turned over to special servicing, but the borrowers managed to secure an extension ahead of the loan’s February maturity date, in return for paying down the loan amount

The pair paid the loan down to $850 million, Paramount reported in regulatory documents filed with the Securities and Exchange Commission last month, extending the maturity date until February 2027, with interest rising from 4.03 percent to 4.08 percent, according to the Business Times. The firm negotiated a similar extension early last year for 300 Mission Street.

Behler said last month that an extension deal “didn’t make sense” for properties like 111 Sutter, where Paramount and Harbor Group have presumably had their equity wiped out.

— Dana Bartholomew

Read more