Kairos Investment Management has purchased an $89.9 million loan tied to a 10-story office building in San Francisco.

The Irvine investor led by Carl Chang paid $35.4 million for the mortgage loan for 550 Kearny Street, in the Financial District, the San Francisco Business Times reported, citing an unidentified source. The seller was the Canadian Imperial Bank of Commerce.

The deal effectively values the 196,400-square-foot building at $180 per square foot, positioning Kairos to take control at a steep discount.

The building was bought in 2017 by New York-based Brickman and Miami-based BGO for $113 million, or $575 per square foot. Their $89.9 million loan was originated by Canadian Imperial Bank of Commerce, but the status of the loan is unclear.

The sale by Toronto-based Canadian Imperial Bank is part of a strategy to reduce its exposure to U.S. office buildings, according to an earnings call last summer.

The company then directed CBRE to find buyers for a $316 million portfolio of loans backed by eight office buildings in the U.S., according to Bloomberg. The portfolio included 550 Kearny, according to a Business Times source.

Kairos could acquire the building if Brickman and BGO fail to make a monthly payment on the loan, fail to repay or refinance the loan once it matures, or walk away from the building, according to the Business Times.

Lenders are selling loans now because they’re afraid real estate values will fall further, Fortress Co-CEO Joshua Pack told Bloomberg in February.

The office building at 550 Kearny has a vacancy of 37 percent, according to online listings.

Read more

Brickman has maintained an equity interest in the building through a series of transactions involving different equity partners, trading in and out of the building, each time boosting its valuation. In 2013, Brickman bought the building for $78 million, or $397 per square foot

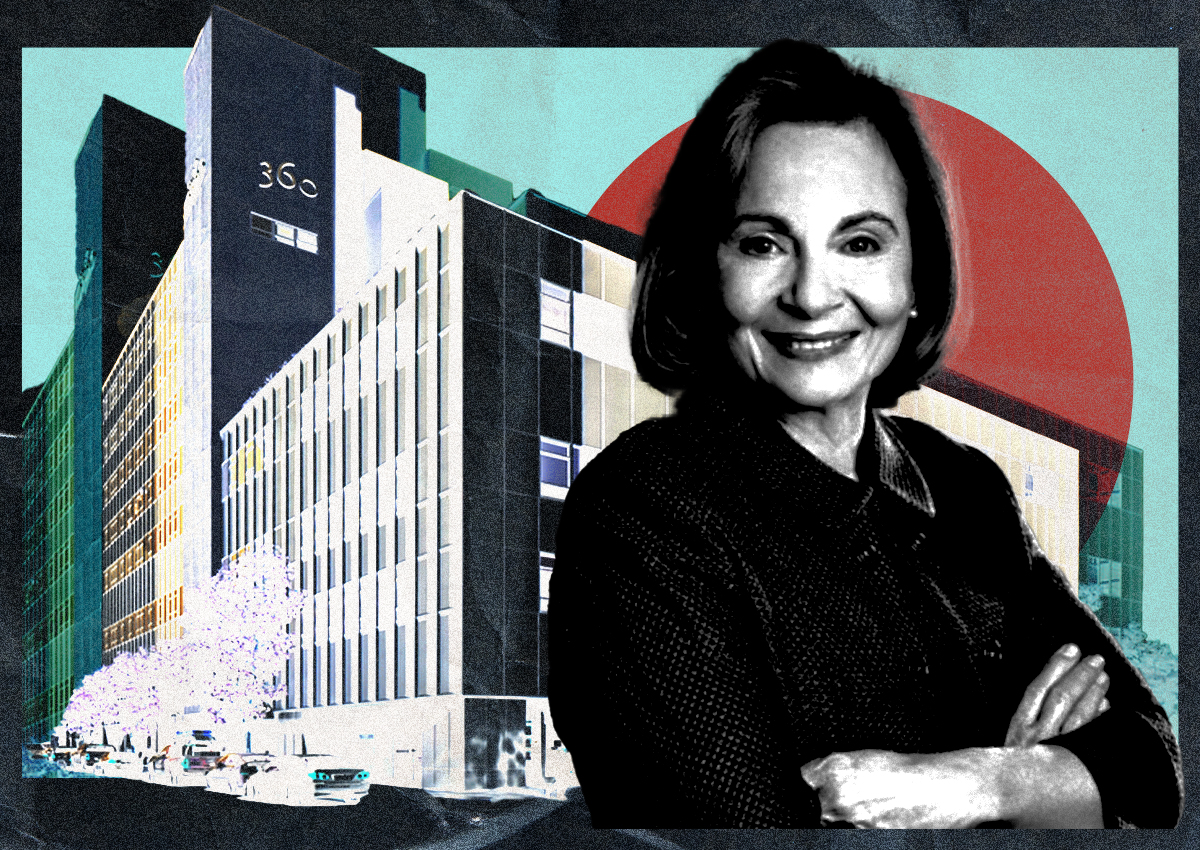

The investor previously owned Plaza 360 in Oakland, a 116,000-square-foot office building at 360 22nd Street that was foreclosed upon by lenders after defaulting on a $35 million loan.

Kairos Investment Management, founded by Chang in 2005, in December had $4.2 billion in assets under management, including 25,000 apartments and 21.5 million square feet of real estate, according to its website.

— Dana Bartholomew