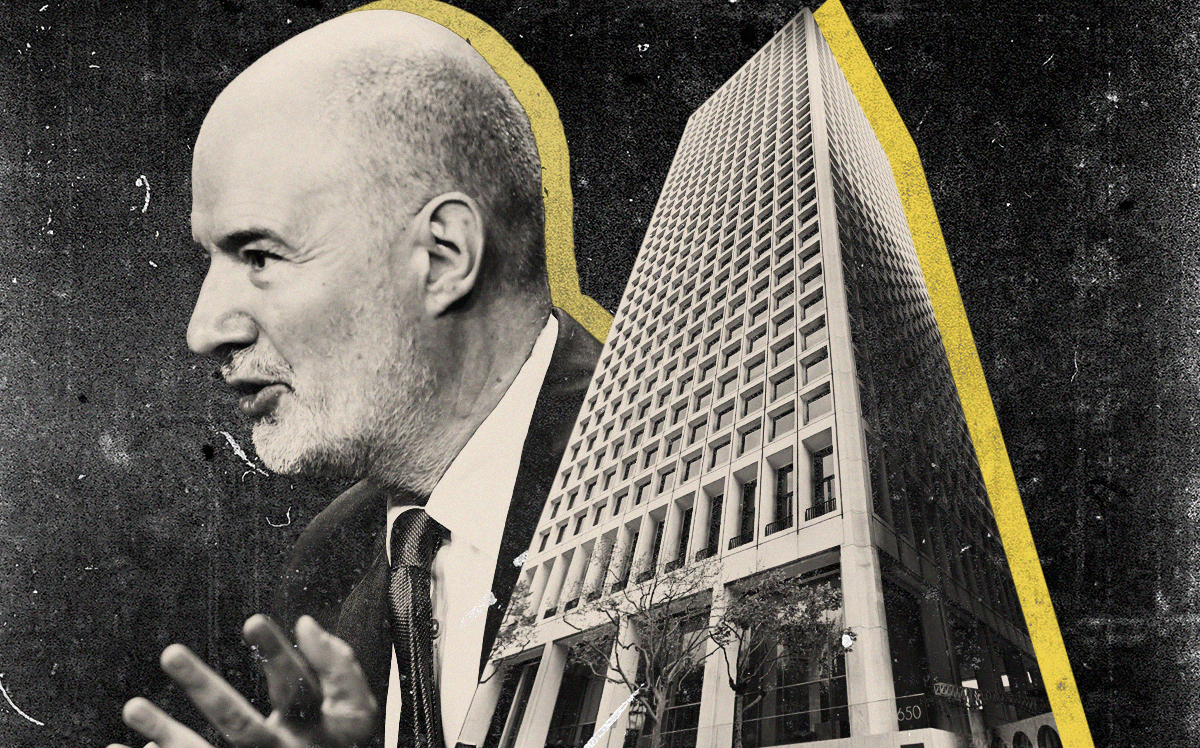

Columbia Property Trust, which defaulted on a San Francisco office tower last year linked to $1.7 billion in loans, is now filling it up with tenants.

The New York-based real estate investment trust has signed four leases for a combined 79,000 square feet in the 33-story building at 650 California Street, the San Francisco Chronicle reported.

The deals signed by an affiliate of the firm owned by Newport Beach-based PIMCO came after the $1.7 billion loan default linked to office buildings across the U.S., among the biggest during the pandemic and since the 2008 financial crisis.

Some $469 million of that Columbia debt was tied to two office buildings at 650 California Street and 201 California Street in San Francisco. Valuations fell by 30 percent.

At the same time, the city’s office vacancy was marching toward a record 37 percent last month after a broad shift to remote work.

Now the 483,000-square-foot Mid-Century tower at 650 California is on the rebound, with long-term and expanded agreements with four tenants who had previously subleased offices.

The combined office leases bring the building’s occupancy to “approximately 90 percent,” Columbia said in a statement.

The newly signed deals involve two law firms, a global investment firm and a consultancy. Financial terms were not disclosed.

The newly signed contracts at 650 California involve an expanded lease with Debevoise & Plimpton, a law firm that recommitted to the tower through 2037, adding another floor to offices that now total 31,600 square feet, according to Columbia.

Another law firm, Cleary Gottlieb Steen & Hamilton, converted a 7,000-square-foot sublease into a direct contract for 23,800 square feet. The firm will occupy the 25th floor and part of the 24th floor for 11 and a half years.

Global investment firm HPS Investment Partners converted a 4,400-square-foot sublease into an 11-year direct lease for part of the 28th floor, where it will take up 8,000 square feet.

And Analysis Group, which had a presence in the tower since 2008, signed a lease extension for its 23rd floor.

Other building tenants include fintech Affirm, Shell and Credit Suisse.

The white concrete building, built in 1964 and renovated in 2015, has sweeping views of the bay, from the Bay Bridge to the Golden Gate.

Read more

“650 California’s leasing momentum and strong occupancy rate are proof that the highest quality office product continues to perform well, even in today’s current market,” Ted Koltis, Columbia’s head of real estate, told the Chronicle.

In 2021, PIMCO acquired Columbia for $2.2 billion. In February 2023, Columbia defaulted on the $1.7 billion in loans tied to seven office buildings across the U.S.

In May, Columbia cut deals with lenders Goldman Sachs, Citigroup and Deutsche Bank to extend the commercial mortgage-backed securities loan to July 2025, with a six-month extension option.

— Dana Bartholomew