A year ago, Portsmouth Square won time to pay its bills in San Francisco after defaulting on $117 million in loans secured by the Hilton San Francisco Financial District hotel.

Now the Los Angeles-based hospitality firm may default again on loans tied to the 544-room, 27-story hotel straddling Chinatown and the Financial District, the San Francisco Business Times reported.

A year ago this week, the publicly traded 75-percent unit of The InterGroup Corporation defaulted on a $97 million mortgage loan from Bank of America and a $20 million mezzanine loan, then won a one-year forbearance to pay them off.

As of Sept. 30, the outstanding balance on the mortgage loan was $76.4 million, according to a Securities and Exchange Commission filing.

The forbearance agreement on the mortgage included a 10 percent pay-down of the principal and a 4 percent default interest retroactive to the Jan. 1, 2024 maturity date. During the forbearance period, no payments on the mezzanine loan were due until the revised maturity date this week.

It’s not clear if Portsmouth paid off the debt in time for the New Year’s maturity for both loans.

A Dec. 15 bondholder report says Portsmouth “has indicated it may not be able to pay the loan off once the forbearance expires.” Talks between the company and its lenders were ongoing.

“We continue our efforts to place a longer-term refinancing solution to its current senior mortgage and mezzanine debt with potential lenders,” Portsmouth Square said in a November filing.

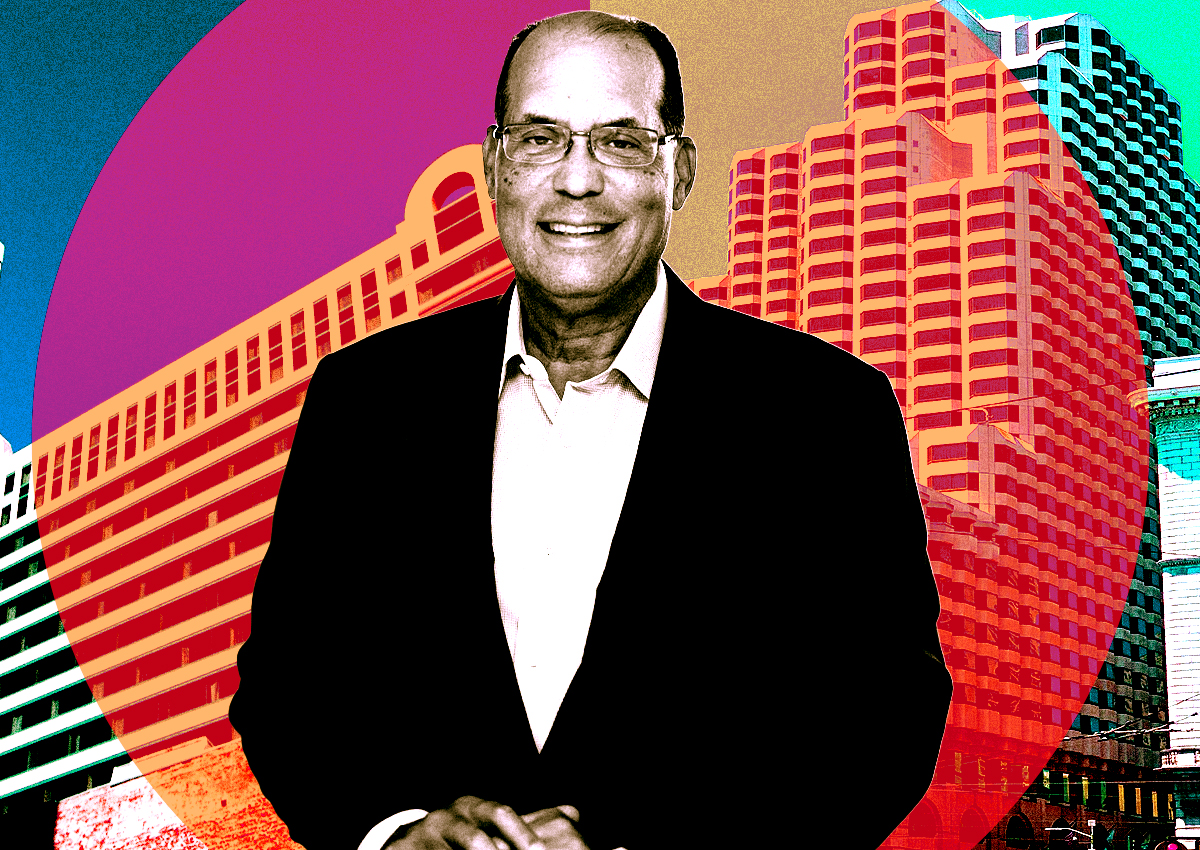

David Gonzalez, president of Portsmouth Square, told the San Francisco Chronicle last year “we are confident that we can achieve the refinancing of this loan.” He said business was strong and the hotel was a “very different animal” than others in Downtown San Francisco.

For example, the Hilton San Francisco Union Square and Parc 55 are in receivership after its owners, Virginia-based Park Hotels and Resorts, turned their backs on a $725 million loan. Compared to the time before the pandemic, the value of the Hilton Union Square complex has fallen by $1 billion.

In contrast, the Hilton Financial District has retained its relative value since before the pandemic. The hotel was assessed in March at $167 million, a 7 percent drop from its 2013 appraisal.

Read more

The Brutalist concrete Hilton San Francisco Financial District, once known as the Holiday Inn Chinatown, was built in 1970 and renovated in 2006. It’s under a franchising agreement with Hilton through the end of January 2030.

The mortgage from Bank of America in 2013 has an original interest rate of 5.3 percent. The mezzanine loan from New York-based Cred Reit Holdco has a 7.3 percent interest rate and was last financed in 2019, according to the Business Times.