Portsmouth Square has defaulted for the second time on $117 million in loans secured by the Hilton San Francisco Financial District hotel.

The Los Angeles-based investor was served a termination notice by its lender after failing to pay the loans linked to the 544-room, 27-story hotel at 750 Kearny Street, straddling Chinatown and the Financial District, the San Francisco Business Times reported, citing a regulatory filing.

Portsmouth Square still owes more than $106 million on mortgage and mezzanine loans and was given an extension to Jan. 1, after its first default a year earlier.

But the landlord isn’t ready to walk away.

The owner will “endeavor to refinance the aforementioned loans as soon as possible or seek alternative solutions to resolve this situation,” the company wrote in the filing.

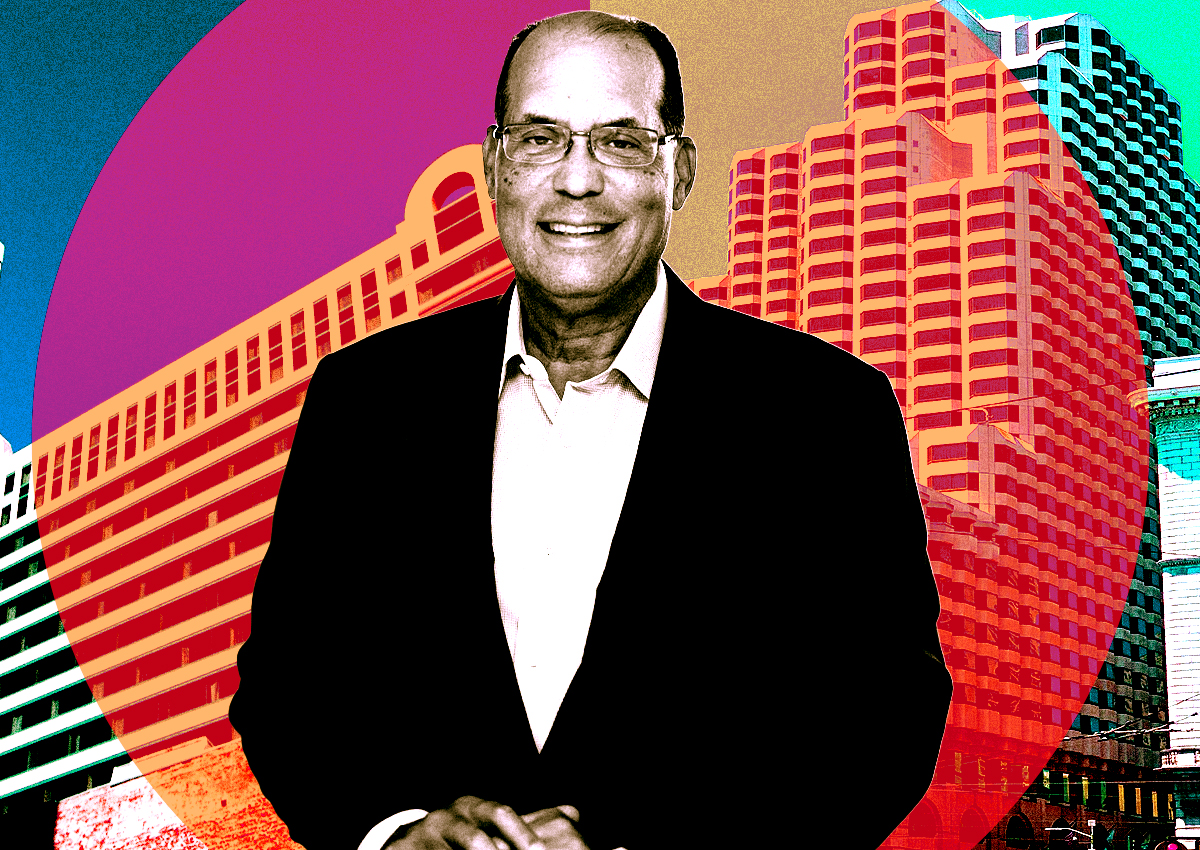

Portsmouth CEO David Gonzalez confirmed the second default to the Business Times and said his company will try to refinance and retain possession of the hotel.

This fall, the company hired Hart Advisors Group to help it in negotiations for loan modifications. It also submitted modification proposals to the loan’s special servicer, LNR Partners.

The owner was served a termination notice on Jan. 3, two days after the expiration date of the forbearance agreement from lenders Bank of America and other financial institutions.

Portsmouth owes $78.6 million on the mortgage loan and $27.5 million on the mezzanine loan, including principal and accrued default interest, according to the filing.

The lenders and the special servicer negotiating on behalf of bondholders could accelerate the loans or foreclose on the property, according to the Business Times.

“The company cannot predict if or when the lender will exercise any of these rights and remedies,” Portsmouth wrote in the filing, adding that “refinancing the company’s hotel debt has been extremely challenging due to obstacles beyond the company’s control.”

Portsmouth joins the owner of other large Downtown hospitality properties that either couldn’t, or wouldn’t, pay off maturing pre-pandemic loans, including some that turned hotels over to their lenders. The San Francisco hotel market hasn’t recovered since the pandemic, with fewer corporate events held in the city.

The Hilton San Francisco Union Square and Parc 55 are in receivership after its owner, Virginia-based Park Hotels and Resorts, turned its back on a $725 million loan. The value of the Hilton Union Square complex has fallen by $1 billion since 2016.

At the same time, the Hilton Financial District has retained its relative value since before the pandemic. In March, the hotel was assessed at $167 million, a 7 percent drop from its 2013 appraisal.

Portsmouth Square, a public company founded in 1967, is a majority-owned unit of The InterGroup Corporation, whose “principal business is conducted through (hotels).”

Read more