Churchill Real Estate is expanding its residential construction lending platform as developers are stepping more firmly on the gas to deliver new projects in what remains a supply-constrained market for rental housing – and Churchill Real Estate is ready to provide construction financing that reaches high in the capital stack. The company has made a strategic move outside of the New York City metro to provide first lien financing for multifamily and build-for-rent projects in select growth markets across the country.

Churchill’s expansion of its debt platform is landing in a development market that has a strong appetite for capital. Following a COVID-related decline, multifamily construction starts bounced back in 2021, jumping 25% to $116.4 billion, according to data from Dodge Construction Network with momentum carrying into 2022. “We have a robust pipeline of projects across the multifamily spectrum, from affordable and workforce to Class A apartments and build-for-rent communities,” says Sean Robertson, co-head of originations at Churchill Real Estate.

Churchill provides first lien senior mortgages that go up to 80% loan-to-cost. Developers prefer the efficiency of a single financing solution versus the traditional route of layering a mezzanine loan and/or preferred equity on top of a senior loan to enhance leverage. “We’re a one-stop-shop that allows developers to achieve suitable leverage coupled with singular execution,” says Jeff Rosenfeld, co-head of originations at Churchill Real Estate. Churchill also is competitive with other financing sources in that it offers non-recourse financing.

“Churchill’s DNA as a developer in New York City, and the ability to parlay that experience with institutional capital, has provided our borrowers the unique benefit of working with a lender who brings true development expertise” says Robertson. As the company expands outside of the New York metro, they are able to provide financing for middle-market borrowers in high-growth markets across the country. Churchill’s expansion stems from the firm’s successful capital raise in 2020 and 2021. The company secured $2 billion in investment capital, followed by a subsequent $1 billion raise, which has positioned the firm to take advantage of healthy lending opportunities in the residential transition lending (RTL) space, including investor-purpose debt, bridge funding, fix-and-flip financing, condo inventory, lender warehouse lines and new construction loans.

Growth shifts to sister cities

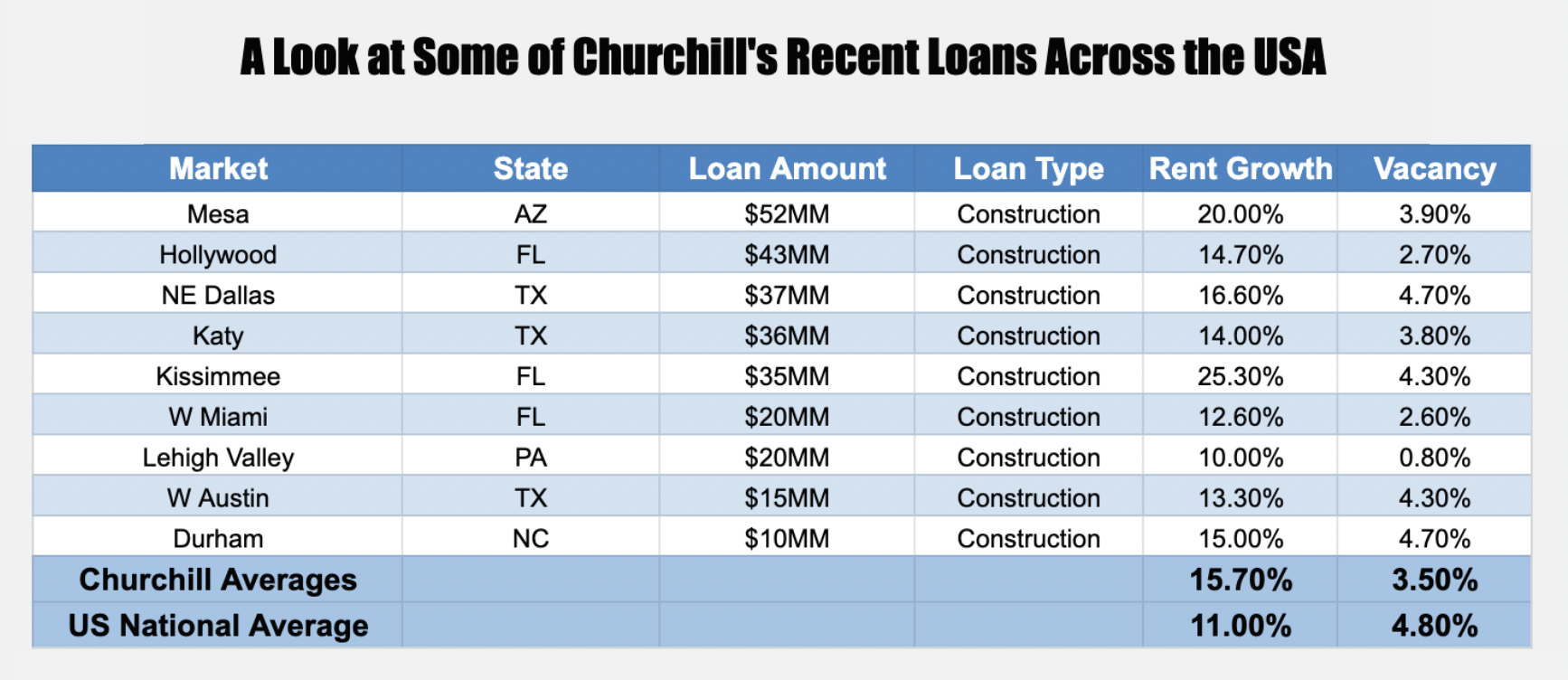

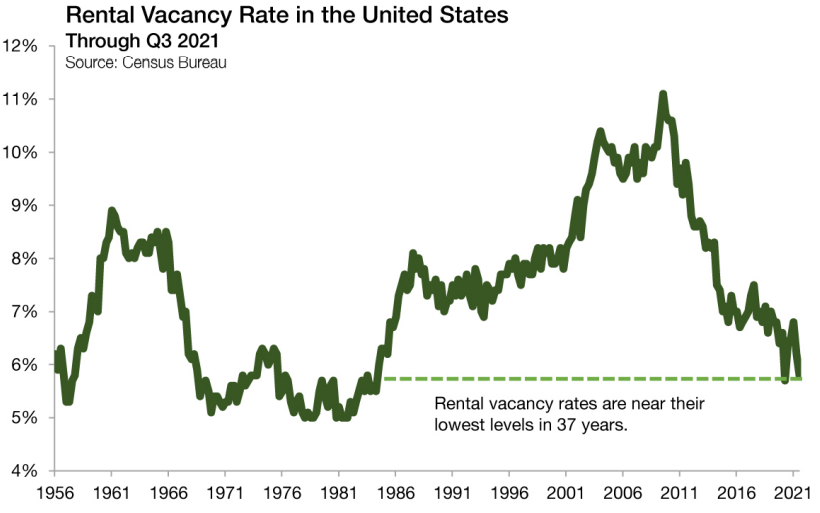

Developers see plenty of runway ahead for growth, with historically low occupancies and rent keeping track, and often exceeding the rate of inflation. According to CoStar, national apartment vacancies are averaging 4.8%, while rent growth is at an annual pace of 11.0%. Churchill is actively lending in core growth markets, with an emphasis on Southeast, Southwest and Western MSAs. In addition, the company is following the population shift out of central business districts that is driving demand for housing in “sister cities” – growth markets that are supply-constrained and chronically underbuilt. In many cases, fundamentals in those sister cities are even stronger than the national average, with vacancies below 4% and rent growth ranging from the mid-teens to above 20% in some cases, according to CoStar.

“We’ve surveyed a really fascinating, and universal, investment dynamic wherein markets 30 to 90 minutes outside of the CBD are seeing vacancy compression and growth rates that are far more pronounced than their more urban peers,” says Rosenfeld. This fundamental work-from-home induced shift manifests itself in the 30- to 60-minute distance segment having fewer apartments than the 15-minute ring while experiencing the best cumulative growth rate since 2015, according to CoStar.

Churchill’s investment team is attracted to markets where there is a compelling growth story, even if that growth is occurring off the beaten path. For example, the company closed a $20 million construction loan for a 102-unit apartment project in Lehigh Valley, Pa. “Many people in the tri-state were unfamiliar with this submarket, but the energy in the market is palpable, and it remains incredibly supply-constrained,” says Rosenfeld. The Lehigh Valley is the distribution and logistics hub for the Northeast, and demand for housing has driven multifamily vacancies to extreme lows of 0.8-1.2% with 12-15% rent growth in some sub-markets, he adds. “This is an example of a market that other lenders have overlooked, but we are actively lending in because of the unabating demand drivers,” he says.

Churchill also did a deal in the San Francisco suburb of Pleasant Hill, California during the height of COVID. Although some would view that as a contrarian move, the company’s research found that while San Francisco was experiencing a decline in occupancies and rent growth, many of the suburbs and submarkets around the city were clocking double-digit growth in population, housing prices and rental rates. “This reflects the theme across the country right now where these sister cities to larger MSAs have benefited from COVID tailwinds and outmigration from urban areas,” says Robertson.

Demand rises for build-for-rent

Remote working and population shifts out of city centers are driving growing demand for single-family rental housing. Rents for single-family houses in December 2021 were up 12 percent compared to the year before, according to the CoreLogic Single-Family Rent Index. “We’re seeing tremendous opportunity in the still nascent build-for-rent space,” says Rosenfeld. Churchill is financing the development of build-to-rent communities ranging from 100 to upwards of 250 single-family rental units. For example, the firm recently provided $35 million in financing for a 210-unit build-for-rent project in the high-demand market of Kissimmee, Fla. The sister city to Orlando is experiencing annual multifamily rent growth of 25%+, according to CoStar, more than double the national average.

The development of housing subdivisions is certainly nothing new. However, the interest in build-for-rent communities plays into the post-COVID theme where people are leaving downtown business districts in search of more space, but they still want to rent. People are willing to reside further out from city centers because they expect to have more flexibility with remote or hybrid work schedules, notes Robertson. Additionally, the build-for-rent market is being propelled by affordability issues in the for-sale single-family home market, he adds.

A key part of Churchill’s investment process is to dig into the local market dynamics to fully understand the drivers and fundamentals. The team’s diligence is hyper-focused on vacancy, projected deliveries, net migration, job growth, the employer base and other drivers for housing demand in a local market. “We look for the stories in every market, and the markets we’re serving are those where a compelling story is still being written,” says Rosenfeld. Over the past six months, the construction lending team has closed loans in 11 states. “We really sharpened our teeth in understanding the esoteric New York City development market, and we’re excited to take that knowledge and apply it to markets with demand drivers and continued development opportunity,” he adds.

In addition to construction lending, Churchill continues to focus on its warehouse lending arm, which provides credit lines to other mortgage originators. “We are able to decrypt an unparalleled amount of data, which directs our focus to a few select areas of the market that we deem to be the most compelling,” says Travis Masters, managing partner at Churchill.

Ready to learn more? Click here to reach the Churchill team today