Real estate general partners (GPs) have a lot of operational tasks to juggle. Historically, investment management activities, like fundraising and distributing payments, have been the most time-consuming responsibilities GPs face, while dealing with legacy banks slows the process to a crawl. The problem? Everything is too manual and often requires in-person appointments.

But what if a platform could combine streamlined investment management with banking to form an all-in-one, fully automated online solution?

That’s where Covercy comes in. The fast-growing, all-in-one CRE management platform, which entered the U.S. market in 2020, handled $500m in capital last year alone and has garnered the trust of many major players in the CRE space thanks to its speed, efficiency, and security. In an exclusive interview, the Real Deal sat down with Doron Cohen, Founder and CEO, and Colin Rau, Director of U.S. Sales, to learn more about how their platform is bringing CRE banking and investing into the Digital Age.

Discovering an Underserved Market

A FinTech veteran, Cohen’s first venture was a retail foreign exchange platform which he sold in 2013. When he started Covercy in 2015, he didn’t intend for the company to have a real estate focus. “The original Covercy was a cross-border payments platform that focused on enabling people and businesses to move money between countries and currencies,” explains Cohen. “But then something interesting happened. We noticed that most of our business was actually real estate-related transactions.” Cohen realized over half of his business consisted of investors trying to fund real estate deals or GPs sending money back to investors. That light bulb moment showed him that Covercy must be meeting the needs of an underserved market.

Fast forward, Covercy continues to process billions of transactions and serves GPs globally.

Managing Investors is a Pain for GPs

Many GPs love finding deals and optimizing assets, but most see managing the operational aspects of the investor side as a challenging, but necessary, part of the business. For instance, fundraising and distributing payments are notoriously manual processes that are time-consuming and error-prone.

“If a real estate firm has 30 buildings under management, and each building has 20 investors, then they actually have 600 investment positions,” says Cohen. “The GP has to process payment distributions to every position, every quarter. That job takes a lot of time.”

Firms would love to automate, but unfortunately, they run into speedbumps because most investment management and legacy bank platforms can’t seamlessly integrate banking or handle complicated distributions.

“If you look at the investment management industry, most software solutions are admin platforms,” notes Cohen. “But most platforms forget the other half of the business, which is the financial side. The Covercy Platform was born at the intersection of banking meets investment management.”

“We really focus on taking a bunch of disconnected processes and streamlining them into one workflow — from fundraising to investor relations and distributions to exit,” adds Rau. “Where other platforms clumsily cobble together tasks and processes, Covercy guides you through one single, painless path.”

The results speak for themselves, as we discovered when we asked Covercy users about how the platform had changed their business. “Before Covercy it felt like we were an accounting firm,” said Ben Harlev, Managing Member at New York City-based investment firm and fund manager Be Aviv. “All we were doing was constantly making payments and dealing with bureaucracy, leaving us no time to truly grow our assets and portfolio. It was a colossal waste of time and energy.”

Michael Skoczylas, CFO of Three Pillar Communities, an investment management firm focused on the manufactured housing space, talked about joining the Covercy Platform, “Making the move from a competitor to Covercy was a game-changer for us. Their platform has helped us raise capital and distribute capital efficiently. We can now make and properly manage 1,200 quarterly distribution payments with ease. We now offer our investors a streamlined online checkout process and provide them with seamless access to the investor portal. Furthermore, with Covercy, we have a team not only dedicated to our growth but dedicated to improving their own product regularly.”

How Covercy Works: 4 Primary Use Cases

How does Covercy make the investment management process easier for general partners? Here are four common use cases that show how the platform automates the difficult time-consuming manual processes for GPs.

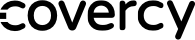

Use Case #1 – Fundraising

The traditional fundraising process can be extremely stressful for GPs. In a limited amount of time, they must: get a deal under contract, find investors to fund the project, open a bank account for funds, transfer documents, get signatures, collect funds, and deposit them. And the more investors are involved, the more cumbersome the process.

Covercy handles all the admin for the fundraising process, from helping GPs find investors to exchanging documents and collecting funds.

The platform even enables crowdfunding functionality to speed up funding. “We’ve pulled key elements from major crowdfunding sites and incorporated those elements into our platform,” says Rau. “So GPs can take advantage of that crowdfunding functionality on a platform they fully control. Essentially, investors can visit a GP’s website, see new opportunities, register, do accreditation, sign and invest — all without necessitating the GP’s involvement.”

To give prospective clients an idea of how seamlessly Covercy’s platform can be integrated into a GP’s website, the firm created Radcliffe.co. Here, GPs can find inspiration for how they can add Covercy functionality to their own site, improving overall ease of use in the process.

“With Covercy, fundraising can be more like an Amazon one-click checkout,” adds Cohen. “GPs can even create bank accounts for new deals in minutes, so they don’t have to wait weeks to start depositing payments. It cuts that task down from potentially weeks, to just minutes.

Use Case #2 – Distributions

Whereas fundraising is a big event that GPs only do once or twice a year, distributions are a recurring quarterly (or sometimes even monthly) task. And the more a company scales, the more distributions they’re required to process. GPs need to run the calculations of how much to distribute to each investor for each asset, notify investors, and distribute payments. Traditionally, GPs are required to log into every bank account of every asset, make roughly 10-30 transactions, reconcile the transactions to fix any errors, and field investor inquiries about possible discrepancies. It’s a very labor-intensive process.

“We have made distributions a really quick process,” notes Cohen. “Once you set them up properly, you can literally finish all your distributions in about five minutes. Then you’re done.”

“We have the most sophisticated waterfall model ever built,” mentions Rau. “So GPs don’t need to worry about complex waterfall distributions. If Excel can run your waterfall calculations, so can Covercy. It is especially unique since we provide complete transparency, unlike the typical ‘black box’ of most waterfall calculating platforms. Specifically, our GPs can download a spreadsheet from our platform and trace the way we calculate their waterfalls to the final cent”.

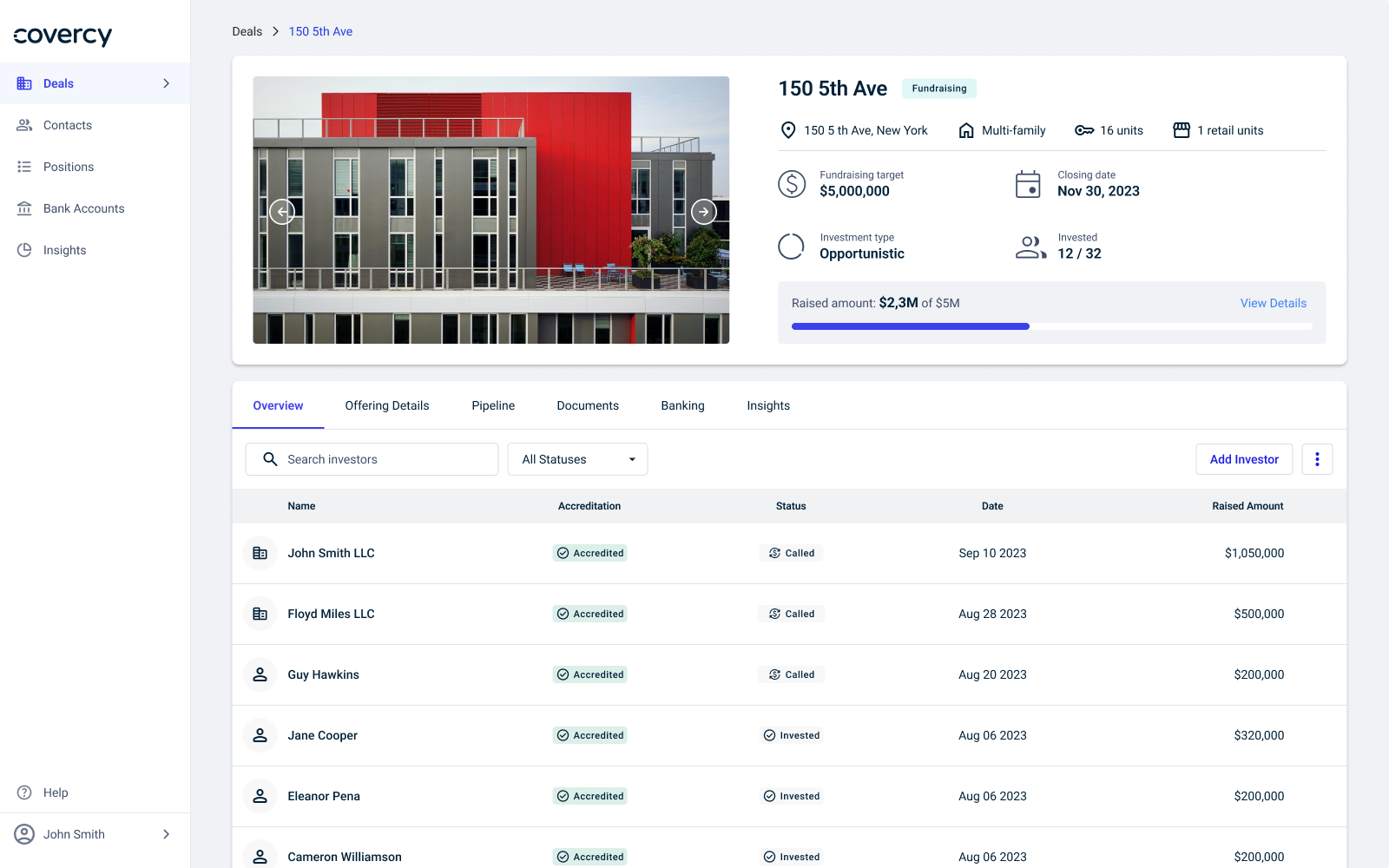

Use Case #3 – Investor Relations, Investor Portal

Conventionally, GPs send their investors (or LPs) a quarterly email with performance data and financials, and then once a year, the LP would receive a K-1 tax form. When the investor can’t find some information, they just contact the GP, which is a clumsy process.

Covercy gives both GPs and LPs one central hub for all data and forms — the investor portal. This portal has features including:

- a quick, two-click login

- visibility into every asset in which an LP has invested

- quarterly performance data by asset

- accessibility to all documents (like agreements, K-1s)

- all data underlying contribution and distribution payments

Additionally, GPs can benefit by having all investor information clearly organized by asset, so they can quickly prepare for investor meetings or find fundraising opportunities. “Everything is in one location, as opposed to scattered across spreadsheets, emails, and paper documents,” says Cohen. “It’s like moving from buying stocks on a 1980s trading floor to using Robinhood. Everything is much more centralized and visible.” For GPs just starting out there is a free plan available for Investment firms that have up to 3 assets. This is a great way for the newcomer GP to look professional to their investors.

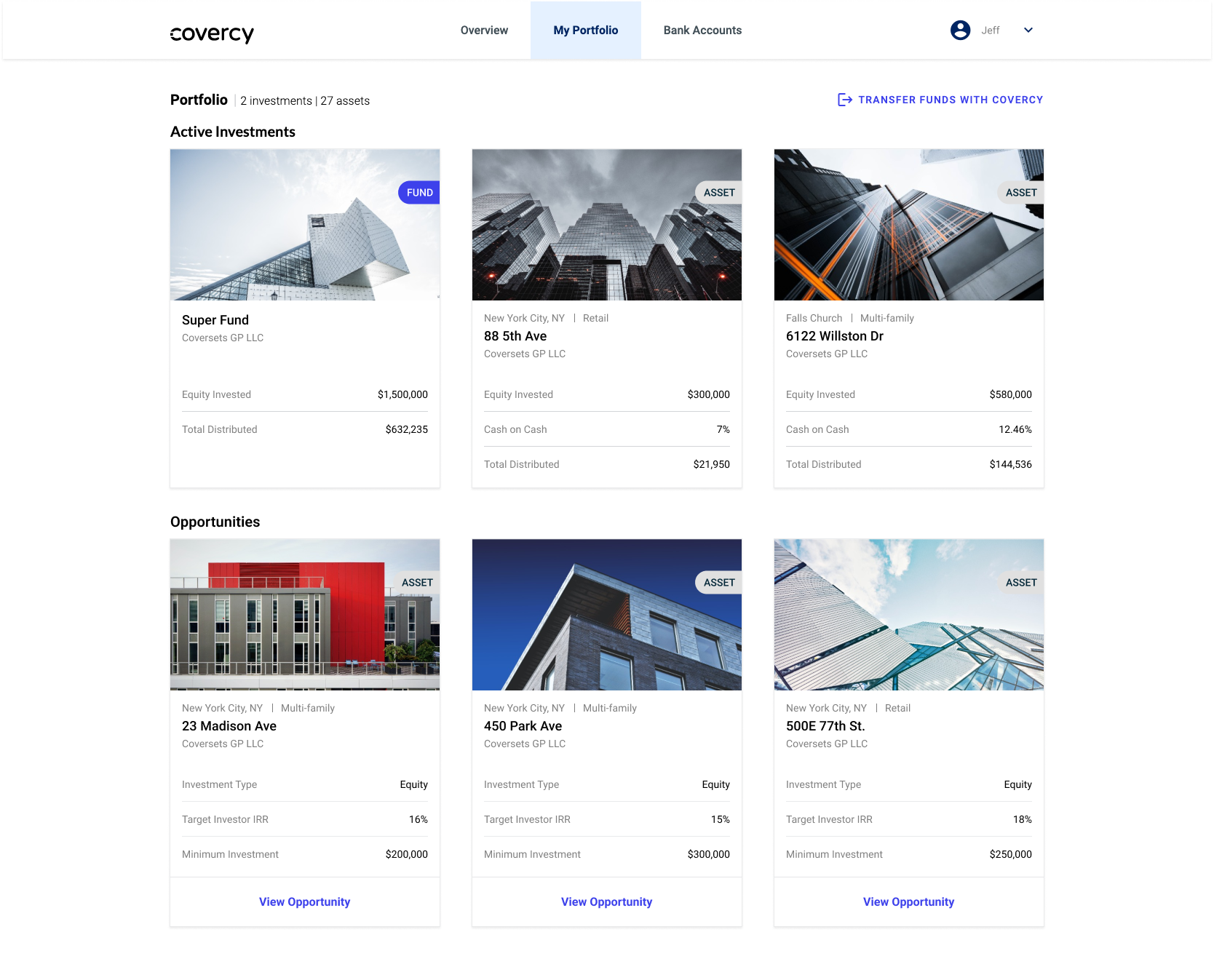

Use Case #4 – Banking

Perhaps Covercy’s biggest point of difference is how seamlessly the platform integrates banking with investment management. Traditionally, the process of opening new bank accounts can take days to weeks. This adds up when every asset could require four or five accounts.

“We make it incredibly easy to apply for and manage GP, Fund, and Asset-level FDIC-insured bank accounts held with our partner banks from within our platform, either instantly or within a few hours,” explains Cohen. “Then you can execute a payment directly from that account, whether it’s ACH, wire transfer, debit card, or another method.” While Covercy isn’t a bank, it partnered with other banks and payment platforms and integrated their services into the Covercy platform, so that GPs get the safety of a traditional bank with the functionality of a FinTech.

“The account is completely integrated into our investor portal and GP product,” added Rau. “So every time there’s a distribution or fundraising event, the money moves automatically. Plus, our systems hold any uninvested cash in an interest-bearing account, which can give the GP significant flexibility.

Growing Quickly in the U.S.

While it started in Israel, Covercy expanded to the U.S. in 2020 with the appointment of former Greenwich Capital and Five Mile Capital CEO Konrad (Chip) Kruger as Covercy’s Chairperson, as well as investments from notable NY investors like the Silverstein Family-owned Silvertech Ventures, Two World Ventures, former Angelo Gordon Partner Dana Roffman, and RE Angels.

And the platform is gaining traction due to its simplicity, ease of use, and end-to-end functionality. As Rau notes, “Where we really excel is significantly reducing the time it takes to move an LP from initial interest to ultimately investing in a project. The platform is so simple that it virtually eliminates the learning curve.”

“We’ve doubled our customer accounts this year alone,” concludes Cohen. “Plus, in Q3 we’ve witnessed an 8X growth in the number of assets added to our platform versus last year’s Q4. We’re thrilled with our growth in North America, and we’re excited to keep improving the platform to better serve our customers.”