The COVID-19 crisis is affecting every aspect of our daily lives. There is tremendous uncertainty surrounding the crisis’ ultimate impact on our public health as well as the economy. While there is still so much we don’t know, we do know that the economic effects will weigh heavily on the commercial real estate industry.

Everyone from mom-and-pop stores to Fortune 500 companies are racing to maximize liquidity to weather the uncertainty brought on by the COVID-19 crisis. According to Autonomous Research, during the week of March 11th, US banks made $243 billion in new corporate loans, twice as much as they typically lend in one year.

If one thing is certain, it’s that right now, businesses need cash.

The U.S. commercial real estate market will be facing hard decisions in the near future, as both owners and tenants react to the ongoing impact of COVID-19. Landlords nationwide are evaluating their rent rolls nervously, hoping their tenants are minimally affected by the current economic upheaval. But hoping may not be enough. The initial impact is being felt first by specific segments, as noted by Related CEO Jeff Blau, who told CNBC that while 95% of his commercial rents were paid for April, only 26% of retail tenants had done so by the 6th of the month. The impact on May’s rent roll could be even more dire.

Increasingly, tenants of all types are approaching landlords for some kind of rent relief – from rent deferrals to rent reductions, or even full blown rent forgiveness. Most landlords want to help their tenants, but they still have their own obligations to fulfill like mortgage, tax, and utility payments. Developing a rent relief package tailored to each individual tenant will be a cumbersome process for many landlords.

Fortunately, most landlords have the ability to boost their tenants’ financial health by giving back capital that’s sitting in security deposits.

TheGuarantors estimates that nationwide, businesses have $51 billion tied up in security deposits. These deposits are either in the form of cash or bank letters of credit, which are typically 100% collateralized. By replacing existing security deposits with a Securiti bond, businesses can get 3-6 months of rent (average length of security deposit) back as liquidity on their balance sheets.

So, how does this work?

Here’s an example:

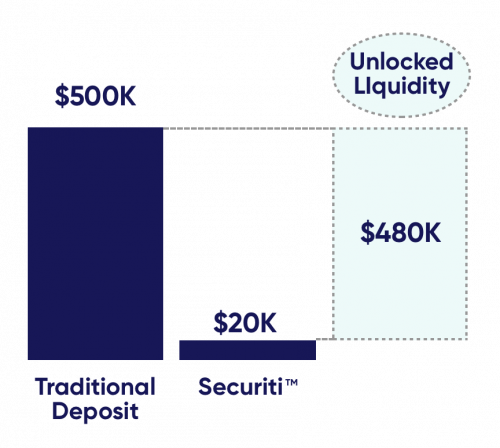

An ad agency leases 20K square feet of office space with a $500K security deposit, the equivalent of 6 months of rent. While overall operations were healthy, business had slowed some due to the COVID-19 crisis, and they looked to increase liquidity as the company braced for an upcoming recession. The agency thought about drawing on their line of credit but didn’t want to constrain future borrowing capacity. Instead, they opted to replace their $500K deposit with TheGuarantors surety bond, Securiti, for just 4% per year (rate determined by underwriting). Securiti is off balance sheet and has no impact on leverage metrics. By replacing their deposit with Securiti, they were able to increase their cash balances by $480K.

Ad Agency Replaced $500K Cash Deposit with Securiti

For landlords, Securiti by TheGuarantors is a way to offer tenants a concession without conceding because they’re not giving up a dollar of protection. Designed specifically for commercial leases, Securiti provides landlords with protection that’s no nonsense and reliable – just like a letter of credit:

- Bankruptcy remote

- Backed by investment grade insurance carriers (All rated AM Best: A- or higher)

- Claims paid on demand, no questions asked

And unlike a letter of credit, it’s cheap and efficient for tenants. It’s a “stimulus package” to help keep the rent roll healthy.

As landlords and tenants work together to re-evaluate their lease obligations to solve for the disruption caused by this crisis, Securiti is an option that can help provide relief right away.

Securiti is offering free risk consultations for owners click here to get started or email them at info@securiti.io to learn more.