Recent improvements in the office sector have come on the heels of a historic recovery for US corporations since the dark depths of the COVID-19 pandemic. Despite some looming economic risks in 2022 and existential questions about the future demand for offices, corporate performance foreshadows a year of relative stability for office tenants and, in turn, office buildings.

According to the recently published Moody’s Investors Service US Corporate Default Monitor, the corporate default rate dropped to its lowest in a decade at 1.2%, compared to the peak of 9% in the summer of 2020. The number of defaults hit a seven-year low in Q4, with just 18 in 2021 compared to 121 the year before.

The economic recovery and ample liquidity for corporations kept defaults at bay throughout the year, and that was largely true across sectors. Although the oil, retail and hospitality sectors suffered tremendously during the pandemic, all bounced back well. Surprisingly, none of the Q4 defaults were retail or hospitality, a good sign for the most troubled commercial real estate (CRE) segments.

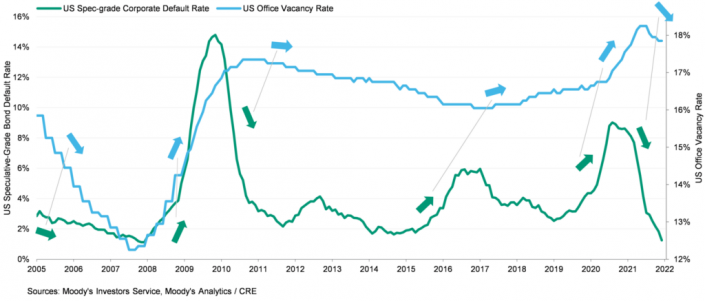

The US speculative-grade corporate bond default rates typically act as a leading indicator of the office space vacancy, as shown in Exhibit 1 below. Over the past 17 years, when corporate default rates rise above roughly 5%, a rise in office vacancy rate generally follows, with the reverse also true. The notable exception is, of course, the black swan event of 2008 when the Global Financial Crisis shocked both the corporate world and CRE simultaneously. This symbiosis helps in part explain the improvement in office vacancy in the latter half of 2021, and why 2022 may be a stable year for offices.

Exhibit 1: Corporate Default Rate Tends to Lead Office Vacancy Rate

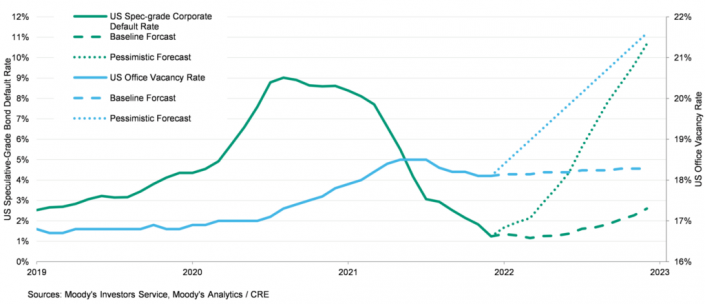

Default rate is projected to rise modestly to 2.6% by the end of 2022 under the baseline forecast scenario per Moody’s Investor Service (see Exhibit 2). The outlook assumes the US high-yield bond spread over US Treasuries (a common barometer of credit risk in the economy) will widen by about 200 basis points (bps) over the next year to 534 bps, reflecting an earlier and faster than expected increase in the Fed funds rate to head off sustained inflation.

Meanwhile, over the same period we expect US office vacancy to remain above average at just over 18% as “back to office” plans continue to be delayed, prolonging many firms’ decisions on their space needs in a post-COVID-19 world of work. However, while the office sector did not demonstrate a recovery as robust as those of multifamily or retail last year, it showed resilience in the face of great uncertainty and many popular calls for the “death of the office”. To wit, many large corporate tenants continued to sign long-term commitments to their office spaces in 2021.

Exhibit 2: Forecasts Portend a Stable Year, with Significant Pessimistic Caveats

What could go wrong?

There are economic and financial risks that, if crystallized, could send the default rate higher than our baseline forecasts. The dotted lines in Exhibit 2 represent our pessimistic forecast scenario for corporate default and office vacancy rates. Here are the bogeys we’re watching out for in the pessimistic scenarios:

- The spread of new virus variants, beyond those which already have emerged, that severely disrupt the economic recovery.

- Inflation fears lead to tighter liquidity conditions and the withdrawal of policy support before the economic recovery is self-sustaining.

- Trade tensions and geopolitical instability intensify.

- China’s regulatory reset triggers a widespread and drastic deterioration in credit and growth trajectories.

If one or more of the above conditions occurs, the speculative-grade default rate could catapult to 10.67% by end of 2022.

At that point, we forecast office vacancy rate could jump to nearly 22% because outmigration of troubled corporate tenants could be too fast for landlords to backfill the vacated space.

One last thing!

Before you go, please give us your thoughts:

- What’s your prediction of the US office vacancy rate in 2022? Up or down?

- What is your expectation for office cap rates by the end of 2022? Lower, same, 0-25 bps higher, greater than 25 bps?

VOTE HERE

Authors:

Kevin Fagan, Head of CRE Economic Analysis, Moody’s Analytics

Stephanie Yu, Senior Product Strategist, Moody’s Analytics