Looking Back to Look Forward

In order to make any sort of predications about what the next year will bring, it’s important to look at where we are today. 2022 has been an intense year for the commercial real estate industry, as we’re beginning to see the effects of the boosted interest rates and uncertainty that have characterized the economy for the past several months. Originations plummeted, financing homes became extremely costly, and rent growth has slowed.

Action from the Federal Reserve will be a key factor in determining what next year will look like for the whole economy and especially for CRE. If geopolitics and supply chain issues persist, inflationary pressure will remain and the Fed will keep upwardly adjusting rates, albeit more slowly, through the first half of 2023, if not longer. However, slower consumer spending, a decline in shelter inflation, and a lack of supply-side surprises could bring about the soft landing we’ve been hoping for – and the end of rate increases.

A Closer Look at Housing

Housing has been a hot button issue in real estate this year – shifting metro popularity, work-from-home measures, and affordability policies have all been in the news. And when one of these factors shifts, it has a ripple effect on the others.

The single-family market dried up considerably, responding to skyrocketing interest and mortgage rates that stemmed from monetary policy. Transaction volumes dipped. Owners were reluctant to leave their low-rate mortgages, and perspective buyers couldn’t afford the new rates. Median home price fell with demand.

As significant as the shift in the single-family market seems, it’s more of a normalization than a crash. Market dynamics are coming back into alignment with labor markets and incomes.

Multifamily performance, as usual, has lagged behind its single-family counterpart, and we’ve yet to see widespread rent declines. Because of shifts in single-family market, potential buyers are staying in the multifamily market for longer, exacerbating supply and demand imbalances.

Perhaps most notably, we’ve seen a shift in which metros are seeing above average success and which aren’t. Sunbelt-area cities, like Fort Worth, Tampa, and San Antonio, which skyrocketed in popularity during the pandemic, now have below-average rent growth as of Q3 2022. Large coastal metros and affordable Midwestern cities have returned as top players. These shifts are due to a variety of factors, including return-to-office policies, rapid rent increases in the sunbelt, and lifestyle shifts as post-pandemic behavior sets in.

Moody’s Analytics Baseline for 2023

Our team of economists’ baseline forecast calls for cautious optimism. The continuation of current trends in low energy prices, supply chain stability, modest wage growth, and softening consumer spending will bring inflation on a path back towards the Fed’s comfort zone of 2-3%. There is even an outside chance rates could reverse their course later in the year.

The Moody’s Analytics baseline forecast for 2023 predicts Real GDP growth of about one percent, unemployment to rise to a shade over 4% by the end of the year, and a peak in the10-year treasury rates to between 4.5 and 5% in Q2, which will slowly recede thereafter.

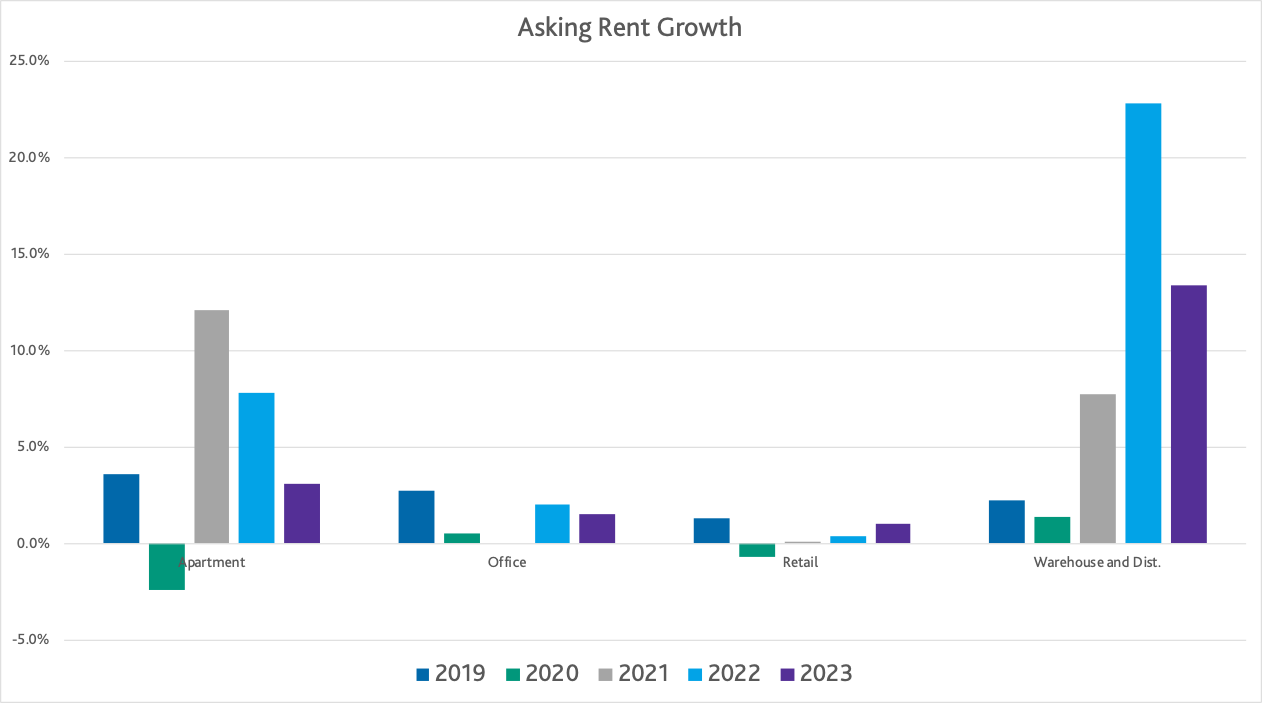

What does this all mean for CRE? If this forecast holds true, rent growth will still lag a bit below 2019, but land well within a normal range, with the exception of the warehouse and distribution sector (W&D). There’s still some pent-up momentum from economic changes during the pandemic, like growth in e-commerce, the re-shoring of some manufacturing processes, and adjustments in logistics. This separates W&D performance from below-average economic performance. We anticipate a one-year runway before W&D success slows down, and the sector settles into its new long-term equilibrium.

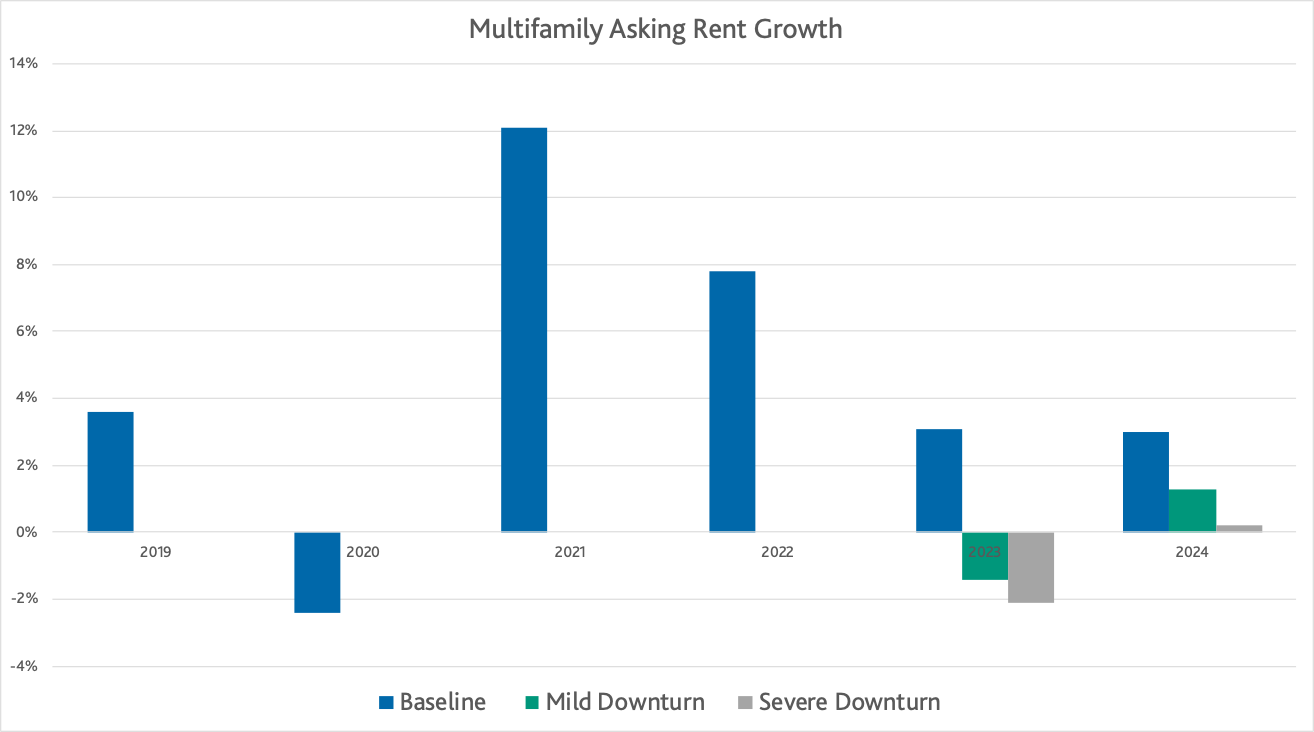

For housing, overall shortages and trouble within single-family will keep multifamily dynamics stable for now. In order for rents to fall, it would require a larger hit to wage and employment than we’re currently predicting. The single-family market will likely tick up again in Summer 2023, but with prices falling single digit percentages below 2019. This, in turn, will ease rental demand, bringing 2023 rent growth to about 3-4%.

An outright freefall for the office and retail sectors is unlikely as both continue their long-term evolutions. We anticipate a wide distribution of market and property outcomes, with the strong outweighing the weak enough to leave both sectors with slightly positive performance.

On the Other Side of the Coin

As convenient as it would be, there is no crystal ball when it comes to the economy. If energy prices spike, or geopolitics sour, or any other number of negative supply shocks occur, there’s a possibility for a deep recession or a stagflation environment. This would lead to even more rate hikes from the Fed, a slowdown in economic performance, and near-term decline in GDP.

The possibility of this scenario is low, but in the event that things turn south, all CRE sectors would take a hit. Lower wages would weaken household formation, and multifamily trouble would lead to slight rent declines. Retail and office would certainly suffer as firms would turn to physical space cuts as a cost-saving measure.

Residential choice will play a big factor in determining CRE performance in 2023. While remote work attracts renters and buyers away from urban areas, renewed interest in city-living from the aging Gen Z population will be a stabilizing factor. Affordability discussions will persist in the new year, and we’ll see an expansion of solutions from public-private partnerships, as well as the potential for new legislation, possibly backed by bipartisan support.

CRE has historically been more resilient to slowdowns than other asset classes. This will remain true in sluggish economics conditions, but a more significant downturn could spell trouble. Our economics team continues to evaluate market conditions and will update forecasts accordingly throughout the next year.