Remodeling and Construction Loans

Construction and renovation loans are attractive options for investors or homeowners who are seeking capital to build a residential or commercial property. These loans feature a different structure than traditional loans and are designed to finance the budget of a project with different draws. This allows the borrower to request funds as needed and pay interest only on the outstanding principal balance. Due to the increased overhead, new construction and remodeled home loans are usually priced higher than stabilized loans.

First Steps

Procuring a construction loan typically takes place once construction plans are approved. However, there is the possibility of obtaining a “Land Loan” to enable the borrower to secure funds for acquisition of the land or initial soft costs of the project. Typically, these loans are offered by specific lenders who will estimate the “As Is Value” of the land and lend a portion in advance.

The Timeline—What lenders Look For

The best time to shop for a loan begins once the city approves the build plans. Most lenders have a similar checklist to determine a borrower’s eligibility and loan costs. Borrowers should be ready to provide:

- Borrower’s background or credit history

- Details of prior construction or renovation projects

- An outlined exit plan or completion strategy

- Borrower’s debt-to-income ratio

- Contractor’s experience

- Feasibility of the budget

- As Is Value and After Repair Value (ARV) of the project

The due diligence process starts once the lender and borrower have negotiated the loan terms and the borrower receives the pre-approval letter. Closing time and requirements can vary depending on the type of lender.

Unlike most other loans, construction and renovation loans initiate on the day of closing. The funds will be held in escrow with the lender coordinating the draw requests with the contractor and inspector. The lender’s job is to verify completion of the work and proper payment of funds before approving each draw.

The Capital Dilemma—Bank vs Private Loans

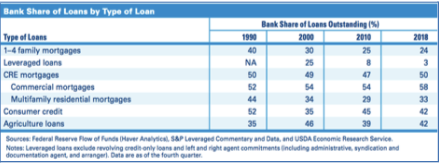

Non-banks continue to account for most of the mortgage market share, citing regulations, technology, and speed of execution as the primary reasons. The Dodd-Frank Act combined with tons of regulations have pulled back construction activity from many traditional banks. According to the 2021 Risk Review of the FDIC, the share of insured institutions with 1-4 family residential construction loans has significantly declined from year 2000, while commercial and multifamily loans have remained stable. (See chart below.)

Construction and remodeling loans require specialized lenders who understand the construction process, as if they were building the property themselves. Historically, banks have been the recognized leaders at originating these types of loans, but now the trend is changing as new players with plenty of capital join the market.

New lenders desperately seek to increase their exposure with these types of loans on account of the attractive returns tied to a booming business that hit record profits in 2020. The average annual rate on a fix-and-flip loan is 7.9%, which is much higher than most low-risk, fixed-income investments. Additionally, fix-and-flip loans are typically short-term, making for a much more attractive investment in an environment of rising-interest rates.

Working with the latest technology, private lenders can offer more flexibility and close loans more quickly than traditional banks that are hindered by additional requirements and regulations

While it is true that alternative lenders price their loans a bit higher, the question remains, “who is willing to pay this higher price?” The answer:

- Small-and-medium sized investors or those who lack deep pockets to pay cash for the properties they wish to purchase to secure the deal.

- Inexperienced investors seeking more loan options due to a limited construction track record.

- Borrowers with less than stellar credit and an unproven debt-to-income ratio.

The table below summarizes the estimated current market conditions for both types of loans.

Florida Real Estate Market

Inventory

As Chief Economist, Dr. Brad O’Connor, states, “We are currently in a strong seller’s market, with fewer new listings and a minor inventory, particularly for single-family existing homes.” O’Conner added, “In a continuing trend, the share of closed sales that were all-cash purchases rose in July compared to the previous year. In July, single-family existing home sales paid in all cash increased by 49.9% year-over-year, while all-cash sales of condo-townhouse units rose by 44%.

A current inventory at an astonishing 40 year low, combined with a strong need to replace old housing stock, has driven the demand for residential construction, according to The National Association of Home Builders (NAHB). The NAHB also reported that new households are being formed faster than single-family and multifamily homes are becoming available to accommodate them. And, in July, the sales of single-family homes (including townhomes, condominiums, and coops) rose 2.0% to 5.99 million units from the revised pace of 5.87 million in June.

As developers expand their production of residential homes, Florida Private Money Lenders like RBI Mortgages have found a niche by offering competitive loans to Real Estate Investors. RBI is one of Florida’s top private lenders, composed by an experienced team to assist both novice and experienced real estate investors. RBI offers quick and competitive solution while developing a simple and transparent process to help get each deal closed within a short timeframe as opposed to the traditional 30-60 days. RBI understands investors and wants to help them capture those attractive real estate opportunities.

Covid -19

Although the real estate market appeared to crash in the early stage of the Covid-19 crisis, changes in the opposite direction propelled the market toward a housing boom. A federal stimulus plan, issued under the CARES Act, gave homeowners with mortgages backed by the Federal Reserve (approximately 30% of U.S. mortgages) a forbearance protecting them from foreclosure. This foreclosure moratorium allowed borrowers to defer payments to survive the crisis, resulting in a near high record of delinquent loans and a low record of foreclosure activity in 2020.

While lawmakers continue to battle it out on Capitol Hill, several state governors have recently signed legislation extending the temporary ban on evictions and foreclosure that expired in August, pushing the moratorium issue into 2022. Some economists say there will be a backlog of foreclosures increasing the supply of homes for sale within the next year.

Interest Rates:

Freddie Mac reports interest rates averaged 2.87% in July 2021 for the 30-year fixed mortgage, compared to 3.02% July 2020. While rates are not expected to rise in the short-term, according to the Federal Reserve, economists anticipate they will become a factor in the medium-to-long term, slowing the pace of home sales. A fueled demand for homebuyers is partly responsible for driving historically low interest rates.

Migration to Florida

Florida has always been a popular state to move to, especially for retirees who find benefits in better weather quality, low cost-of-living, and the lack of state income tax. Economists estimate an average of 701 new residents per day (from Jul 2019 to Jul 2020) migrate to Florida, while some economists say one thousand new residents per day as of 2021. Florida consistently ranks as one of the topmost attractive states to live, and realtor economists predict there will be an additional 1.4 million Floridians by the year 2025. These numbers are promising indicators for people looking to invest in the Florida real estate market.

South Florida

Like most areas in Florida, the Miami real estate market continues to break records. Inventory remains low due to an influx of migration and low interest rates, causing home prices to continue to rise because of demand. According to the Miami Association of Realtors, a one month of supply of single-family homes is 2.2 months homes and 5.1 months for condos, all indicators of a seller’s market. Typically, a balanced market between buyers and sellers offers between six-and nine-months supply.

Likewise, lots of players have joined the market offering alternatives to bank loans. Private and Hard Money Lenders in Miami have increased their share in Non-Qualified Mortgages, Bridge Loans, Fix and Flip Loans, and Construction Loans.

According to Realtor.com, in July 2021, the median listing home price in Miami was $450K, trending up 15.4% year-over-year. The median percent of the original list price received for single-family homes was 99% in June 2021. The median percent of the original list price received for existing condominiums was 96%, up 4% from last year.

While home prices continue to rise in Miami, the affordability crisis is getting worse. According to Richard Florida and Steven Pedigo, in their 2019 Miami Housing Affordability Crisis Report, “Housing is unaffordable for too many Miamians. It’s not just that housing is expensive in Miami, wages and incomes are also low. Six in ten employed adult residents of Greater Miami are housing cost-burdened, meaning they spend more than 30 percent of their incomes on housing—the highest rate of any large metro in the nation. And low-income service workers, who make up more than half of the region’s workforce, bear the greatest burden of all”

Outlook 2021-2022

According to the National Association of Realtors rates are expected to average 3.1% in the year 2021. The Federal Reserves monetary easing, and the banks monthly purchases of mortgage-backed securities has created downward pressures on mortgages rates. Most of the Fed members do not expect rates hikes until 2023.

According to Zillow, home values will continue to grow 12.1% between July 2021 and July 2022, and to end 2021 up 20.3% from December 2020.

The forecast for real estate investors remains strong through 2021, due to a limited supply and high demand, resulting in higher appreciation of home prices; although Freddie Mac is predicting prices will slow down to 4.4% in 2022, after rising 6.6% in 2021. The NAHB predicts prices for some building materials will stabilize in 2022 and new construction may begin to flourish. This led the MBA to project new housing starts to for single-family homes to reach an optimistic 1.165 million in 2022 and 1.210 million in 2023.

All factors considered; it is important to keep an eye out for wildcards that might affect the market. Interest rates, new housings, affordability, rising inflation, and the looming possibility of foreclosures that have effectively been pushed out into 2022 – all of which could significantly impact housing market forecasts.