“Last question before we open it up for audience questions: what inning are we in?”

I can’t remember just how many panel discussions featuring prominent real estate investors I have heard end with this question over the last few years. For those not familiar with the metaphor, all baseball games come to an end, but it’s a bit of a mystery how long that will take because the game is not timed, it’s based on events. But they all end, even if the teams need to play some extra innings.

After all, the consensus is that the real estate industry is cyclical — that there are ups and downs that each come periodically and last for a while, before some event ends the game. It had been quite a long expansion period since the Global Financial Crisis of 2008-2009, but it seems we’re finally hearing the umpire call out “That’s the ball game!”.

As the industry sits at home waiting to see when the economy will even try to start back up, there’s a lot of lingering uncertainty. Uncertainty, as you know from any Economics professor, is bad for financial markets. The direct effects from the pandemic don’t help either. As real estate investments are largely reliant on debt to reach their expected returns, this makes the real estate investor’s job even harder, even if the economic undertow from this pandemic hasn’t pulled their portfolios underwater, like it has done in short order to many hotel and retail landlords.

The Current Lender Landscape

Two months ago, naming the types of lenders providing commercial mortgages would have produced a longer list. But in that time, the CLO market has dried up, the CMBS market has stalled, and mortgage REITs have cried out for help. Even Fannie Mae and Freddie Mac raised their rates by about a full percentage point, even as bond yields sunk to new historical lows (they’ve since come back down a bit). There are many lenders that source capital behind the loans they provide in varied ways – but most of them require a liquid capital markets environment to function properly.

In some ways, the pandemic has simplified a sponsor’s financing options. You are either borrowing from a bank or credit union that has available balance sheet funds, from a life insurance company, or from that subset of private lenders who actually have some dry powder available. When the CMBS market comes back, there will likely be some pent up demand for those non-recourse permanent loans.

But if the categories have simplified, the actual lender landscape has not. Many would-be borrowers are hearing from their bank “Sorry, we’re pulling back to focus on our current loan portfolio until the virus situation has more clarity.” Many of these lenders have good reason to be focusing on their own portfolio – any hotel loans are instantly facing the prospect of defaults, along with many retail and some office properties. Tenants small and large that have ceased operations won’t be able to pay rent, so a lender needs to work out their deal with the landlord too.

But not all lenders have shut their doors.

The Price of Risk

If making a commercial mortgage seems like a riskier proposition today than it did a few months ago, lenders can respond in other ways than to shut down origination.

Leverage and Reserves

Some (many) lenders are reducing the maximum leverage they’ll supply on a property, particularly in categories that are less stable in an economic downturn. The major agencies (Fannie and Freddie) have added new capital reserve requirements, essentially killing the 80% multifamily perm loan as we knew it. Lower leverage points and higher reserve requirements both accomplish the same goal for the lender: more equity cushion to absorb before their loan principal can face losses.

Spreads and Floors

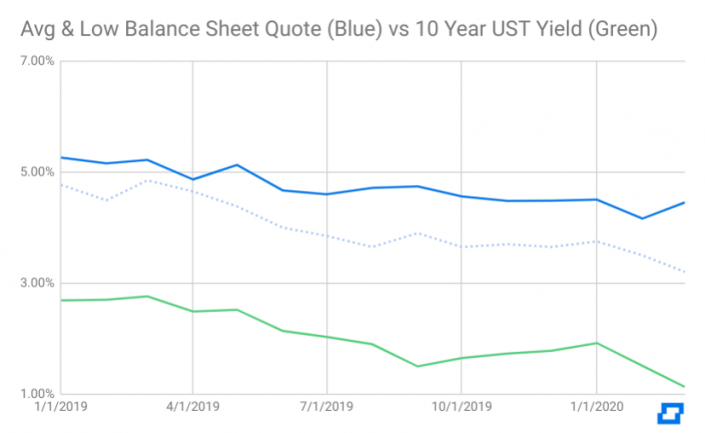

While other lenders have raised their interest rate spreads or set rate floors to protect their yield in a volatile market, a saving grace for those financing their commercial properties now is that bond yields, swap rates, and overnight lending rates, which are the most prominent anchors for commercial mortgage rates, have all fallen. This keeps the cost of capital in check for deals that can still underwrite.

The best available interest rates did fall largely in line with the drop in Treasury yields in March – these are for “A Paper” type deals that showcase healthy cash flow and stable borrowers. Average interest rates rose slightly as spreads widened out quickly on the average loan quote.

With the volatile downward trajectory of underlying rates, and the rush of news impacting the economic outlook, tracking commercial mortgage interest rates has become a daily task.

Is it all bad news for those seeking financing for their investments today?

Not quite. Finding the right lending partner may take more work if you go it alone. The chances of walking into your local bank and getting the right commercial mortgage have definitely fallen. But there are still lenders with plenty of “dry powder”, and great rates, out there if you know where to look. Buying or refinancing well today can go a long way to stabilize your cash flow through this downturn.

The new capital markets are here, they are just not evenly distributed.