After Selling Companies to Google and Facebook, Gheller Tackles the Data Problem Weighing Down Multifamily

The multifamily real estate space is drowning in data. Between Green Street, MRI, Yardi, and many more, the problem for many managers is no longer getting information but being able to use it. Entrepreneur Jonathan Gheller discovered this tangled knot of data problems and developed a solution. His new tool, UDP, was designed from the ground up to cut through the noise generated by a multiplicity of data sources and give those in the multifamily space the power to manipulate their data however they want. The Real Deal sat down with Gheller to talk about the problems that come from working with vast amounts of data and how UDP is helping resolve these issues in the real estate space.

The Problem With Data

Gheller found early success as an entrepreneur when a couple of his companies were acquired by Google and Facebook. “For most of my career, I was focused on consumer-facing products,” recalls Gheller. “But then I decided that I really wanted to build things that were immediately useful to people, more of a service, instead of something speculative.” So he began asking people he knew about the kinds of problems they were facing in their industries and trying to figure out how he could help. The breakthrough came when he spoke with people in the multifamily real estate industry about their struggles managing vast amounts of data and realized that they were dealing with the same issues as the big tech players.

“Facebook has this problem, Google has this problem, Uber has this problem,” says Gheller. “It’s the problem of getting multiple tools and datasets and making them work together.”

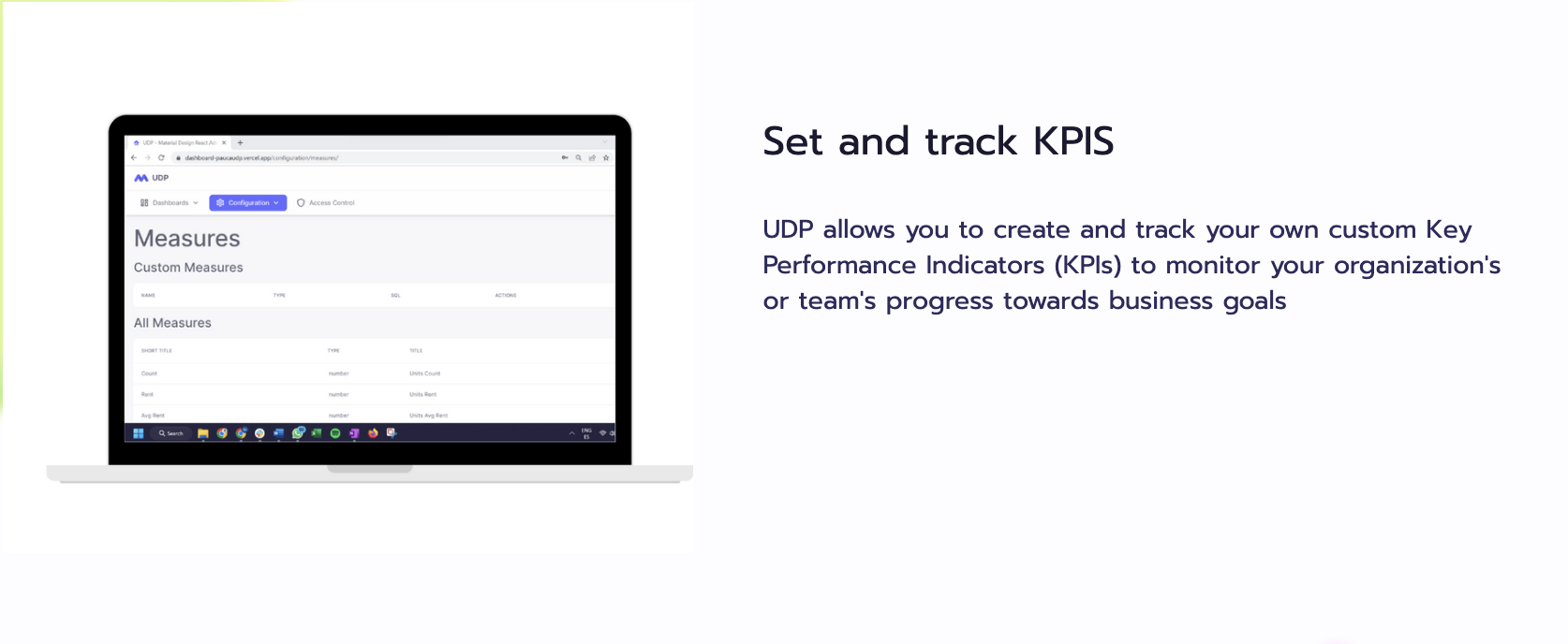

Data is big business for tech, but it’s arguably even more important for multifamily, where setting the correct price on a unit could be the difference between success and failure. In recent years, with a proliferation of data streams aimed at providing owners and operators with discrete information about everything from occupancy rates to rent comps to commute distances that feed into their internal KPIs, many industry leaders have invested heavily in internal systems to normalize and parse this data into a usable form. When he looked at these systems, Gheller discovered that they were expensive to maintain and involved a lot of specialized programming knowledge to accomplish seemingly basic tasks; in essence, they were the equivalent of physical card catalogs, which necessitate vast amounts of money and labor merely to maintain properly, much less access and manipulate efficiently at scale.

One Tool for Everyone

So Gheller set out to build a digital catalog for the real estate industry, a simple, easy-to-use, and powerful tool that would unify all the many data sources that property managers already work with and give them the ability to quickly shape said data to their needs. The result is UDP, which stands for Unified Data Platform, a name that is as much a mission statement as a product description. By unifying the real estate industry’s multifarious datastreams under a single platform, UDP aims to reveal underlying information that is currently being ignored due to the intense resource requirements that burden existing proprietary systems. “Right now, because navigating these systems is so difficult, you have to pick and choose when you’re going to use it,” explains Gheller. “When something is easy to use, you start to ask, ‘How else can I use it?’”

How UDP Works

UDP accomplishes this efficiency in two ways. First and foremost, by limiting the number of potential data inputs to only those produced for and used by the real estate industry, UDP ingests and processes data with a fraction of the effort that is required by tools like Microsoft BI, which necessitate dedicated in-house specialists versed in obscure programming languages to normalize input data before it can begin to be analyzed.

“BI tools have to be very agnostic to the data source, meaning they don’t know who the client is,” says Gheller. “Those tools are very powerful and flexible and adaptable, but that means you have to work to adapt them to your needs.”

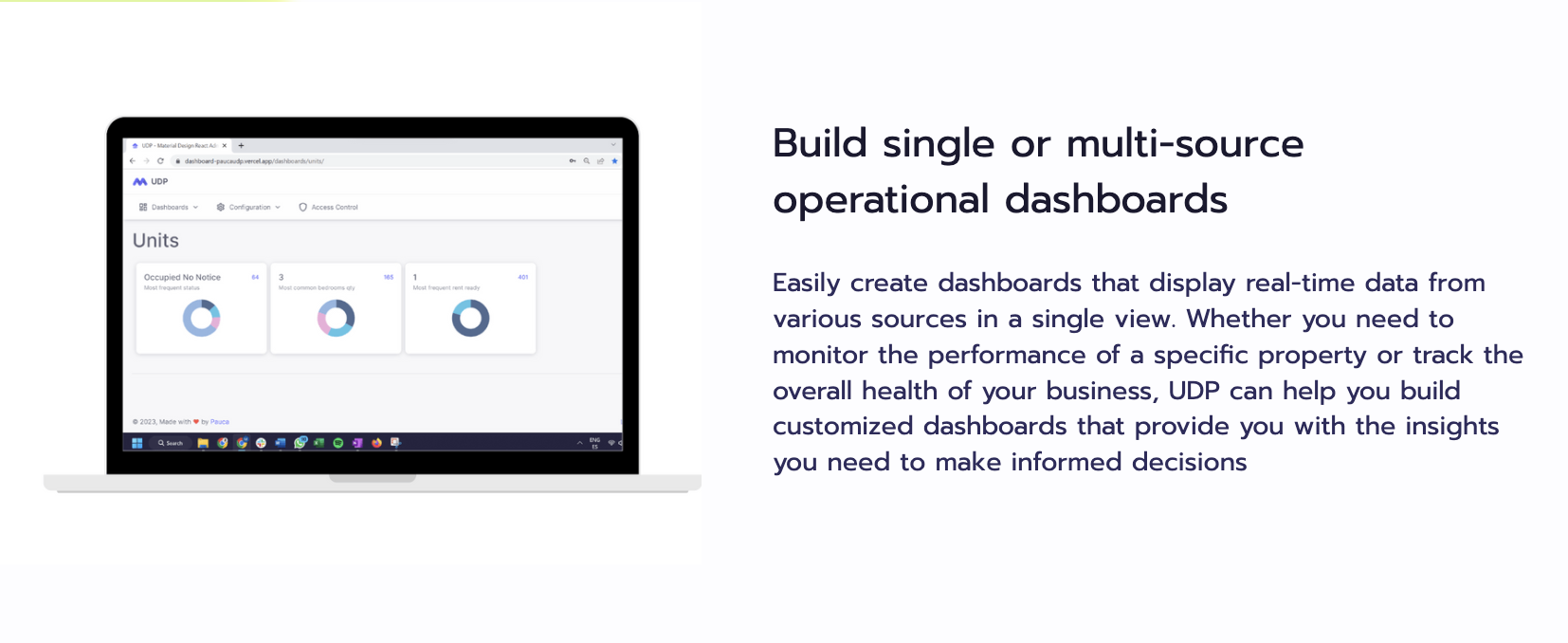

With UDP, the focus is very narrow, with a limited set of potential inputs, removing the need for time-consuming and labor-intensive normalizing of discrete data, instead naturally feeding all of a manager’s data sources into a single dashboard.

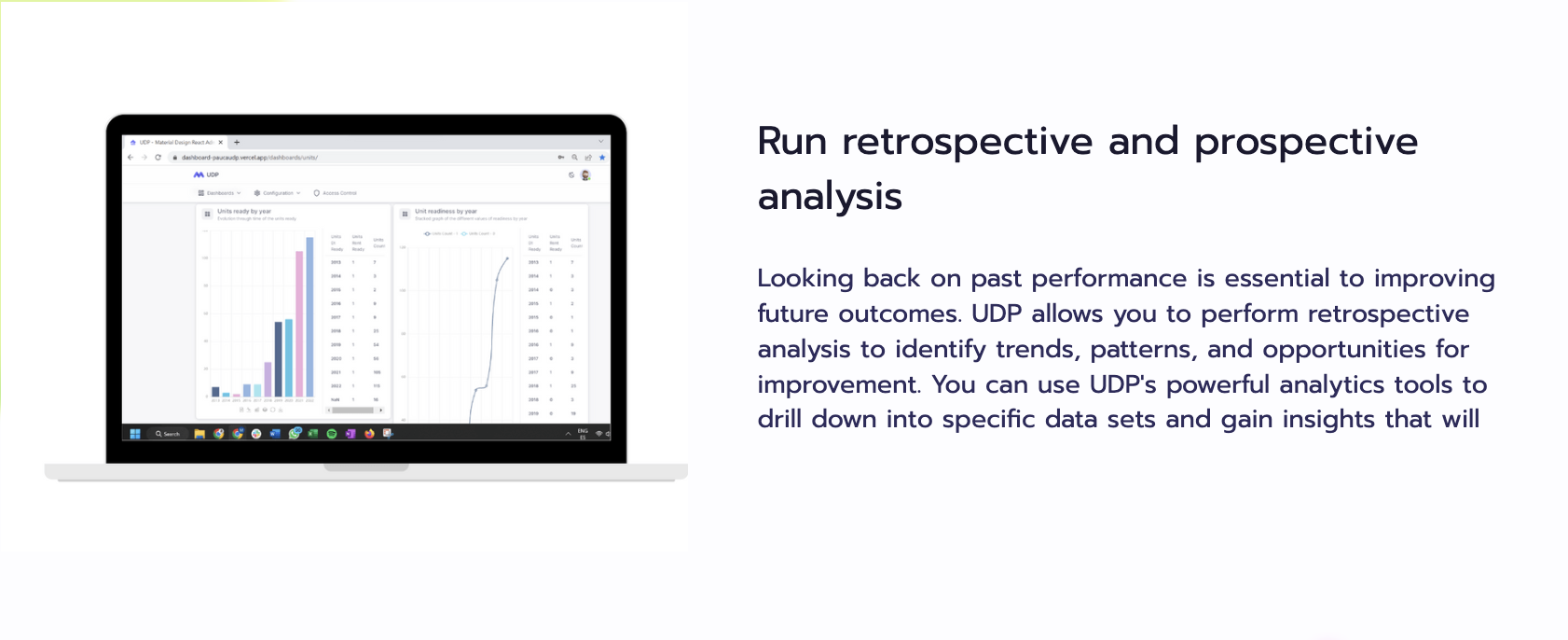

This UDP dashboard is where the second level of efficiency comes in. Gheller’s goal was to make real estate data analysis quick and easy, and UDP accomplishes this by using a natural language query system that gives property managers the power to analyze their data without needing new code. Instead of spending their time managing a team of programmers who have to write every new query manually, managers can play with the data in real time, creating projections and scenarios in minutes that would have previously taken weeks. “If it takes two weeks and $75 thousand to get the answer to question A, you’re going to be disincentivized from asking questions B, C, and D,” says Gheller. “With UDP, you can have an abundance mentality.”

The UDP Advantage

UDP allows users to create operational dashboards from single or multiple sources with customized KPIs and metrics, all presented in a simple, easy-to-understand web client. The tool lets users create projections as well as do retrospective analysis in minutes, giving managers fresh insight into trends and opportunities that were previously obscured by the high time and cost barrier presented by simply integrating all of the relevant data successfully. In this way, UDP not only saves money for a firm that currently uses an in-house team or consultants to run their data platform, but it also creates new opportunities for analysis simply by reducing the amount of time it takes a manager to get an answer to their question.

“UDP allows you to take the guesswork out of all your decisions, not just the big ones but the small ones as well,” says Gheller. “Which is important because they compound. And over the course of 2, 5, 7 years, the firm that’s using our tool to make their small decisions will do better than the one who isn’t.”