The housing market in Houston, the U.S. oil capital, has long been tied to global energy prices, and will likely stay hot as Russia’s invasion of Ukraine, and the associated sanctions, continue. This time, the spike in crude oil may be more of a hazard than a spur to growth.

Home supply is so tight in Houston, as it is elsewhere, that prices have continued to soar, even amid a decade-long trend away from oil jobs. Whatever short-term bump oil companies get from the rising price of crude, it won’t trigger a hiring spree, though it might incentivize a faster transition to sustainable energy. The only short-term threat to home values is the potential of a global recession triggered by the invasion.

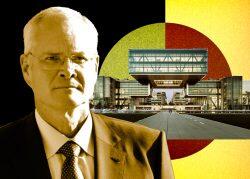

“You have an administration and a majority in Congress and the Senate that would like to go to renewables,” said Ted Jones, economic forecaster for the Houston Association of Realtors. “So what you have is a disincentive for oil and gas to drill more oil. It costs billions of dollars to drill new wells.”

The price of oil rose to $105 dollars a barrel on Feb. 24, the first day of the Russian invasion of Ukraine, due to fears of supply disruption, according to Reuters. There hasn’t been an actual interruption because Russian oil producers were spared sanctions. If Russian oil exports are disrupted, the price could surge even higher.

Still the price already is higher than the “sweet spot” that Builder, a housing industry publication, identified as ideal for spurring demand for homes in Houston. The publication determined in 2014 that $55-$90 a barrel is the Goldilocks zone for Houston homes, based on 35 years of data. When oil drops below $55, the market is depressed due to slow job growth, while a price above $95 per barrel and high prices squeeze consumer budgets.

Read more

Historically, that has led to a boom in Houston’s economy, as oil companies would have used the influx of cash to expand their workforce. But oil and gas extraction and support jobs fell from 525,000 in 2014 to 78,000 in December, as oil prices dropped and companies improved their efficiency. Oil and gas extraction represents less than 2.4 percent of Houston’s job market. Instead, home prices are being sustained due to tight supply–less than two months supply. Houston’s median home price rose by 18 percent in January to $310,000 from a year earlier, driven by a lack of supply, according to the Houston Association of Realtors. The biggest gains were at the high end of the market.

“It is still a seller’s market,” Jones said. “Until we build more, your only hope right now to decrease demand is you either have a major recession or you price people out of the market, and we’re kind of seeing people priced out of the market, it’s just starting.”

While it’s unclear when high prices will start to slow the market, and to what extent, the invasion of Ukraine could trigger a global recession if there’s a sudden withdrawal of Russian oil from the market, Wood Mackenzie analyst Kateryna Filippenko told The Houston Chronicle.

“Prices would be sky high. Industries would need to shut down. Inflation would spiral,” Filippenko said. “The European energy crisis could very well trigger a global recession.”

While President Joe Biden said that “every asset they have in America will be frozen,” on Thursday, sanctions have yet to be applied to Russia’s energy sector, on concern that it could damage the U.S. and global economy.

“We’re not going to do anything which causes an unintended disruption to the flow of energy as a global economic recovery is still underway,” Deputy National Security Advisor Daleep Singh said at a press conference on Thursday.

“My administration is using every tool at our disposal to protect Americans and businesses from rising prices at the pump,” Biden tweeted from his official POTUS account. “We are taking active steps to bring down the costs — and American oil and gas companies should not exploit this moment to hike prices just to raise profits.”