Two big brokerages made some big moves in Texas this week — one with a merger and the other with an acquisition.

Dallas’ United Real Estate Group announced its merger with Kansas-based Platinum Realty, Inman reported. United has 16,000 agents and says it’s the eighth-largest broker in the country. Platinum, which operates 13 offices in five Midwest states, will bring Its 2,100 agents to the Texas company but will keep its brand and compensation structure.

The merger was part of a “strategy of attracting regionally dominant, independent brokerages in key markets,” according to a United statement. RISMedia ranked the company seventh in its 2022 list of top brokerages by transaction sides. United has 110 U.S. offices in 30 states.

The companies didn’t publicly disclose financial details of the deal.

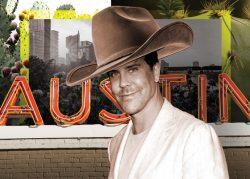

Meanwhile in Central Texas: Compass acquired Austin-based real estate firm Brandon Miller Group (BMG). The Texas company will be part of Compass’ development marketing group, the Austin Business Journal reported. The group is a new division at Compass and will oversee projects at all stages of development.

BMG, which has operated out of Austin for 16 years, specializes in new development representation for luxury residential properties. It has carried out more than 50 residential developments in Texas and New York with sales totaling over $1 billion, according to its website. It recently partnered with Canadian company Intracorp on Congress Lofts at St. Elmo and One Oak condominiums.

Neither company disclosed the details of the acquisition.

Read more