Dallas considers restrictions on real estate investors

Dallas considers restrictions on real estate investors

Trending

Investors go wild on Texas multifamily

Deals in Dallas, Houston and San Antonio reveal healthy appetite for rentals

Multifamily investors continued to exhibit a robust appetite for Texas properties, if these four recent deals are any indication.

Infinity on the Landing, Euless

Los Angeles’ ShainRealty Capital bought the Landing, picking up 267 multifamily units at 3720 Post Oak Boulevard near the Dallas-Fort Worth airport in the suburb of Euless. The Class B+ property was built in 1983. Average apartment size is 770 square feet, and average rents are 30 percent below market. ShainRealty will put $3 million into renovations and upgrades and rebrand the property Infinity on the Landing.

Bard Hoover and Wes Racht of California’s Marcus & Millichap brokered the transaction. Miami-based Rialto Capital provided the bridge loan. The seller was John Barker of Arlington’s 180 Multifamily Properties, headquartered in Arlington, Texas.

ShainRealty entered the Dallas market with its purchase of a 373-unit rental complex, Infinity on the Mark, for $46.4 million. The company made a second Dallas multifamily purchase paying $51 million for a 249-unit complex nearby, now called Infinity on the Point. The privately owned investment firm specializes in Class B and workforce housing projects. The company said it plans continued growth in the Sun Belt.

Axio, San Antonio

One Real Estate Investment’s Jeronimo Hirschfeld and 8722 Cinnamon Creek Drive

Miami’s One Real Estate Investment picked up a 360-unit apartment community in an off-market deal in San Antonio. Called Axio, the Class B multifamily property at 8722 Cinnamon Creek Drive was built in 1985. It’s less than a mile from the South Texas Medical Center and within 10 miles of large area employers including the National Security Agency and the Southwest Research Institute. OREI put $6 million into apartment renovations and will enhance common amenities.

Axio is OREI’s second multifamily acquisition in the city. The company’s Texas portfolio includes eight multifamily communities in Houston, Dallas, College Station, San Antonio and Austin, bringing total units under management to 2,200 in Texas and 6,000 nationally. It has acquired and sold over 11,000 value-add multifamily units nationwide since 2001.

Rancho Mirage, Irving

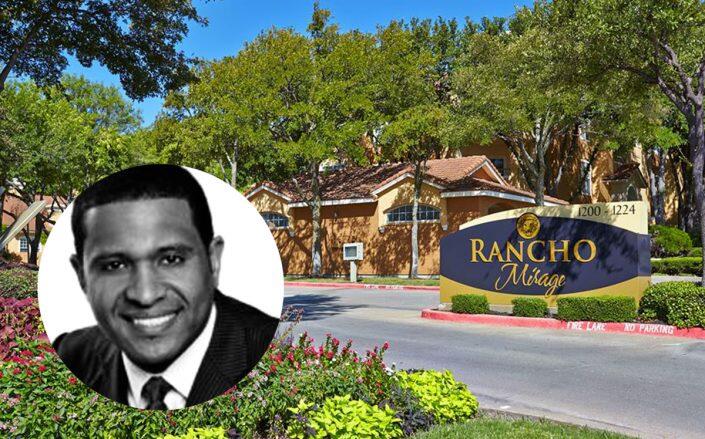

TruAmerica Multifamily’s Ammanuel Metta and 1200 Hidden Ridge

California-based TruAmerica Multifamily, bought Rancho Mirage at 1200 Hidden Ridge in the Dallas/Fort Worth submarket of Irving. The 310-unit complex has a mix of one- and two- bedroom apartments. Community amenities include a 24-hour fitness center, a lap pool, and a racquetball court. TruAmerica plans a multimillion dollar capital improvement program to renovate the property’s interiors and enhance its curb appeal.

In the past 18 months, TruAmerica Multifamily has acquired 3,000 units in Texas. Its portfolio includes nine properties in Dallas/Fort Worth, Houston and San Antonio. The firm established a Dallas regional headquarters in December 2020.

Houston Apartments

Capital Square’s Whitson Hudson and 3623 West Alabama Street

Virginia’s Capital Square bought a Class A, 304-unit multifamily community in Houston. The community was developed by Wood Partners and acquired on behalf of CS1031 Houston Apartments, a Delaware statutory trust offering for Section 1031 exchange, and cash investors, according to a press release.

The complex at 3623 West Alabama Street has studios and one-, two- and three-bedroom units and community amenities including a swimming pool, a sky lounge and a pinball machine.

The Flats at West Alabama, as it’s currently called, is in River Oaks, one of Houston’s wealthiest neighborhoods. The average annual household income within a three-mile radius of the property is $163,000, and the property’s submarket has experienced year-over-year rent growth of approximately 9.5 percent since the beginning of 2021, according to a press release that references CoStar for the stats.

CS1031 Houston Apartments, DST looks to raise $56.5 million in equity from accredited investors.

Involved parties did not disclose sales amounts for any of the four deals.

Read more

Dallas considers restrictions on real estate investors

Dallas considers restrictions on real estate investors

Bascom Group loves the Texas multifamily market

Bascom Group loves the Texas multifamily market

Tides spends north of $165M on Texas portfolio

Tides spends north of $165M on Texas portfolio