Overwatch Fund is bolstering its local leadership team with former Fort Worth Mayor Betsy Price.

The Fort Worth-based investment firm focuses on multifamily asset acquisition and is adding banking executive Barry Kromann and financial manager Tina Bond to its leadership team alongside the former mayor, the Dallas Business Journal reported. Price served 10 years as mayor, until 2021 when she stepped down. She lost a contentious Republican primary race for Tarrant County Judge last year. Price told the Fort Worth Business Press after the loss that she would retire from elective politics to spend time with her family and focus on philanthropy and business.

Kromann, Bond and Price add more than three decades of real estate, investment, finance, banking and business development to the firm.

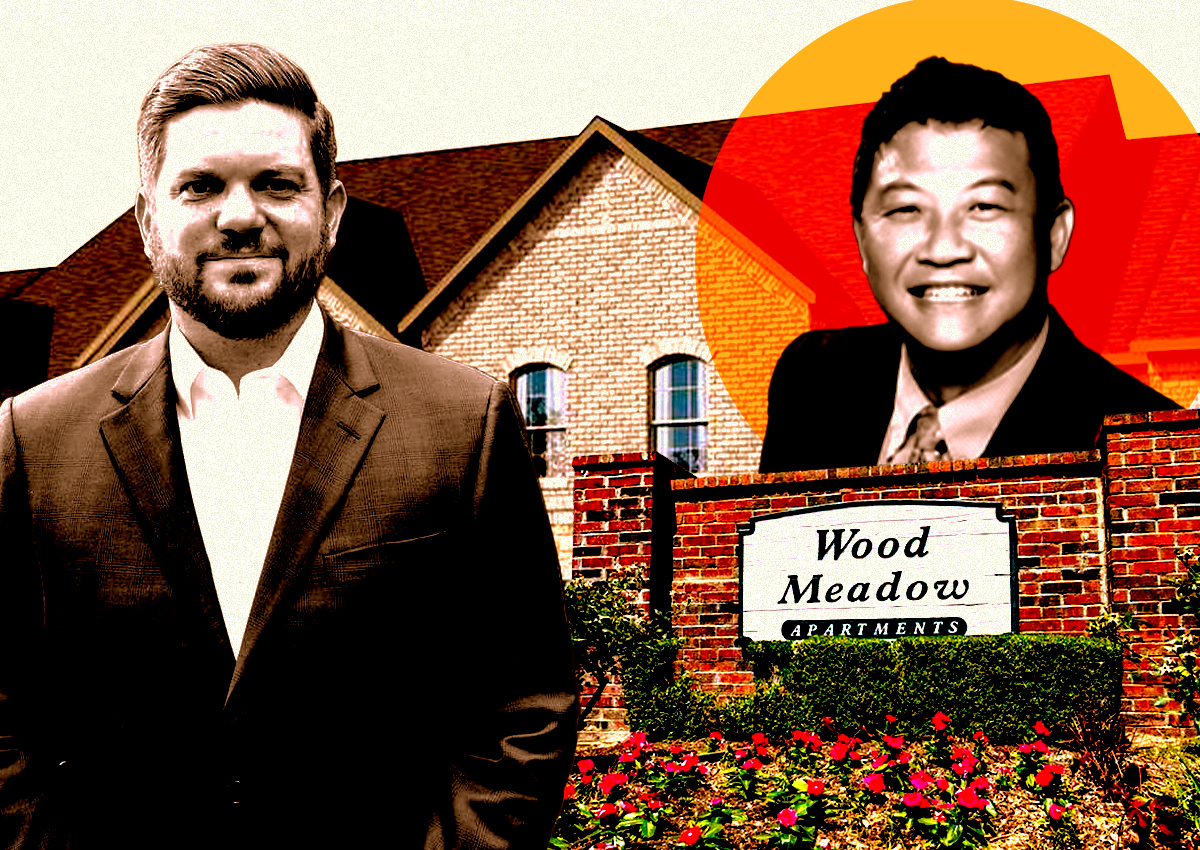

“Overwatch continues to flourish through our investor and sponsor partnerships. We are now invested and continue to actively invest in Dallas, San Antonio, Corpus Christi, South Texas, Austin, Nashville, Tennessee, South Carolina and Oklahoma with several more opportunities on the horizon,” Overwatch CEO Ben Loughry said. “Even with a possible slowdown in the economy, we are preparing for growth.”

Overwatch’s portfolio includes more than 10,000 multifamily units with a valuation of $1.34 billion, according to Loughry. The firm reports a number of sales with 30 percent annual returns and higher on apartment flips, according to its website.

Class B apartment flips have been a popular trend in the multifamily investment game across Texas recently. The state’s booming population has made underperforming Class B assets ripe for acquisition, and those investments have been providing substantial profits for firms that can invest in renovations.

North Texas continues to be a hotspot for multifamily investment as the growing metroplex population flocks to the suburbs. The metroplex ranked second in the nation for new multifamily and commercial construction last year, bringing in over $10 billion worth of investment. Many DFW cities have led the nation in apartment building in recent years.

—Erick Pirayesh

Read more