Shuttered construction company Katerra sued its former CFO, Matthew Marsh, demanding the repayment of a $1 million signing bonus. The lawsuit, filed March 6 on behalf of Katerra, its creditors and its bankruptcy plan administrator, in the United States District Court for the Southern District of Texas, seeks to recover the bonus payment and other damages.

The suit states that Marsh was required to remain employed with the company for 12 months to receive his bonus, but he was terminated for cause three days before his 12-month obligation. Katerra also paid Marsh a $250,000 relocation fee to help cover the costs of moving his family from Texas to California, where the company was headquartered. The lawsuit seeks judgment on whether that “relocation bonus” should be repaid because it was a “fraudulent transfer,” made when the company was insolvent and couldn’t afford to pay its creditors.

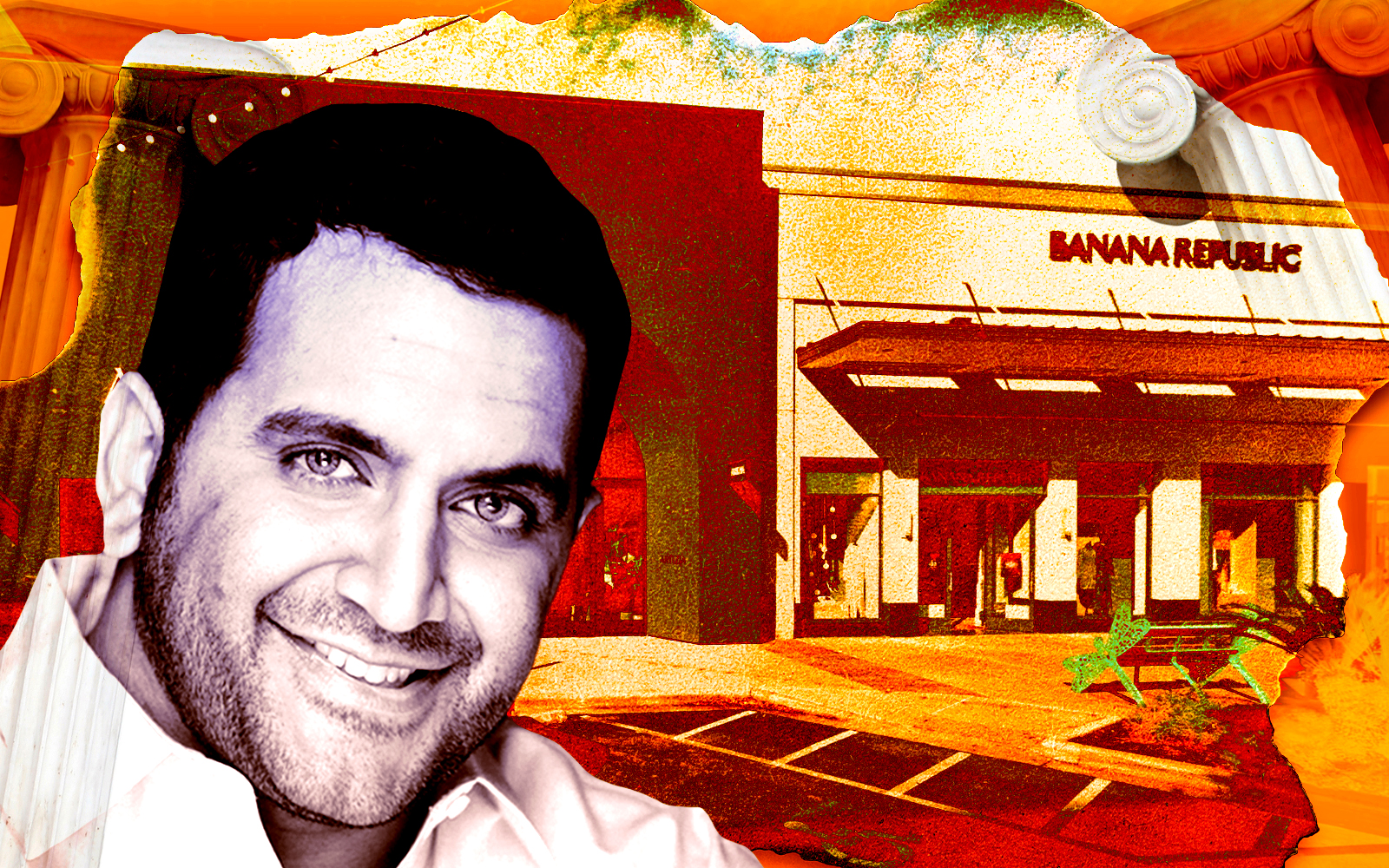

Marsh, who now serves as the CFO of venture capital firm Celesta Capital, was an executive at General Electric and James Hardie before he joined Katerra in 2019. Katerra claims that, as the chief financial officer, Marsh knew about the company’s precarious financial situation and shouldn’t have accepted the payment. Marsh hasn’t responded to a message left at Celesta’s San Francisco office.

The lawsuit seeks to recover the full amount of the bonus payment, along with interest and other damages. It also accuses Marsh of breaching his employment agreement by failing to repay the bonus. This is the latest chapter in the story of the failed eco-conscious construction startup, which filed for bankruptcy in June 2021.

Katerra was a California-based residential and commercial construction company that opened in 2015 and rapidly expanded its footprint through the acquisition of 20 construction and manufacturing facilities, including UEB Builders and Michael Green Architecture. Katerra branded itself as a technology-centric, eco-conscious construction management firm that simplified the construction process by acting as the designer, construction manager, and in some instances, the developer for projects.

At its peak, it was valued at $4 billion. Its largest backer, SoftBank, invested $2 billion but declined to provide additional funds after bailing Katerra out in December 2020 with a $200 million investment. In a comedy of errors, Katerra’s largest lender, Greensill Capital, went bankrupt months before Katerra filed for bankruptcy, becoming one of the largest tech startups to do so and losing $3 billion in investor money.

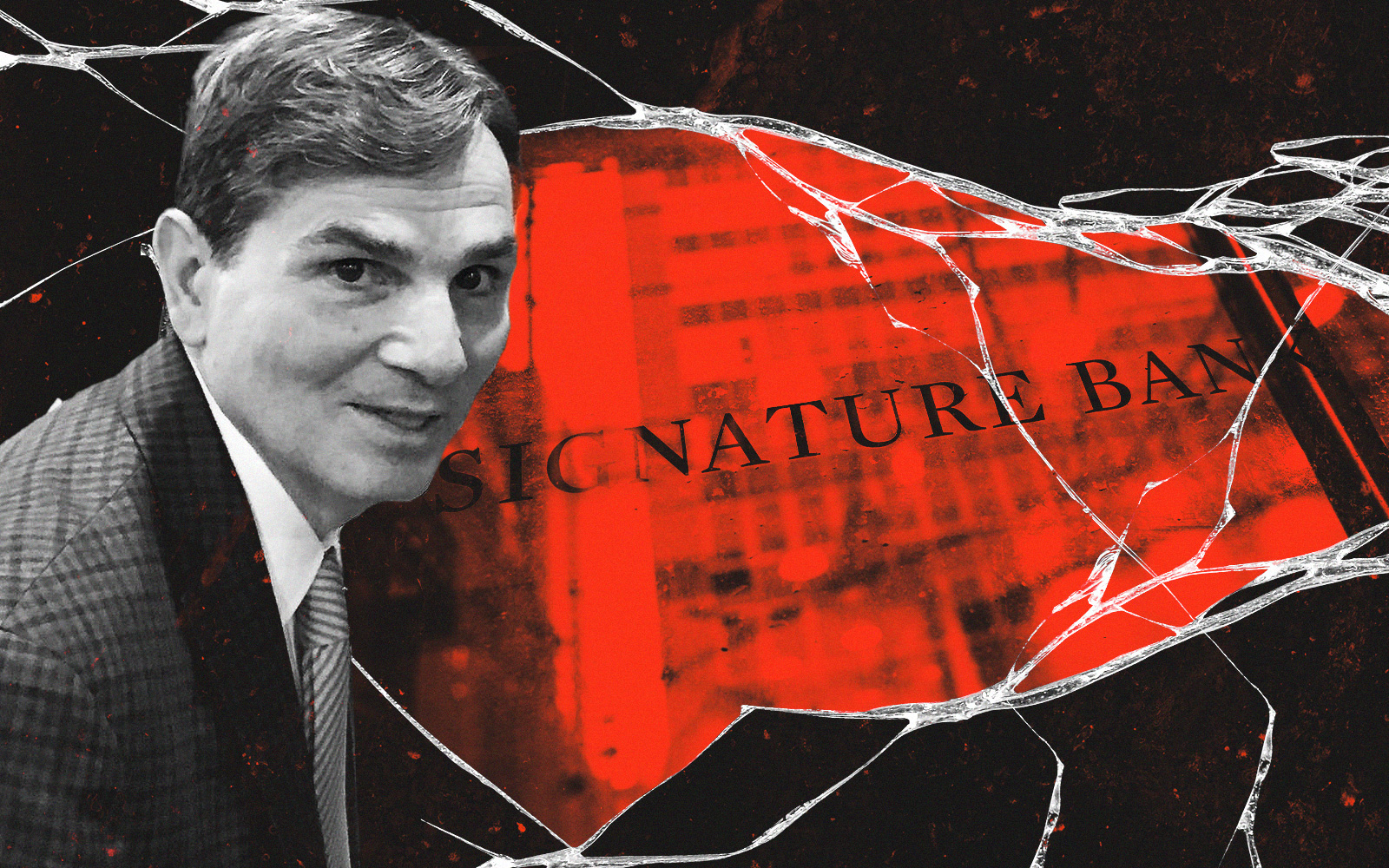

The Marsh lawsuit comes amid ongoing scrutiny of Katerra’s financial practices and the circumstances that led to the company’s bankruptcy. Last April, Katerra and some of its creditors filed a lawsuit against ousted CEO Michael Marks and other leaders for “self-dealing and self-interested transactions” such as using company money to buy a private jet and box at Golden State Warriors games. Marks currently serves as the founding managing partner at Celesta Capital, where Marsh also holds a C-suite position.

Read more