In the month that his home and office were raided by the FBI, Austin real estate investor Nate Paul transferred more than $11.5 million out of his primary corporate entity, World Class Capital Group. Over the course of 16 months surrounding the August 2019 raids, Paul moved more than $87 million out of the account, Harris County court documents show.

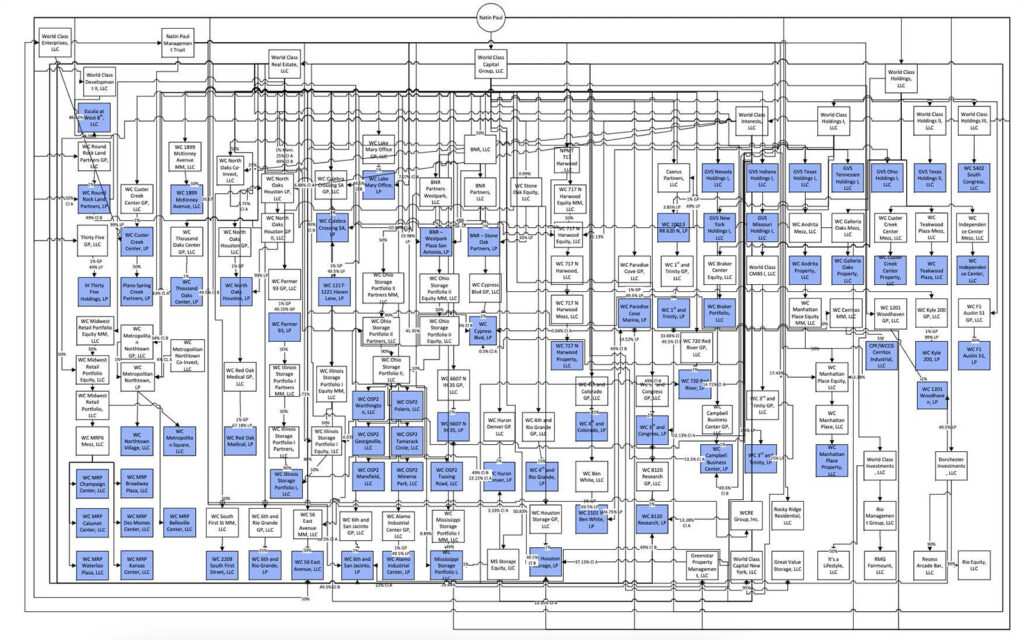

The funds were largely distributed to his subsidiary LLCs, corporate insiders and even family members, as the FBI ramped up its investigation into Paul’s finances. In thousands of allegedly undocumented transfers, Paul distributed the money across his vast, confusing corporate empire of at least 278 shell companies, all while creditors sought to collect on his debts in more than two dozen bankruptcy cases.

The financial records were obtained by Seth Kretzer, a Houston attorney hired as the court-appointed receiver in a lawsuit in which a lender sought to collect on one of Paul’s defaulted loans. Paul appealed the court’s decision in that case, and through his other entities has sued Kretzer at least twice.

“This is just money sloshing around,” Kretzer told The Real Deal.

Last week, Paul was indicted on eight felony counts of making false statements to lenders. The investor is also wrapped up in Texas Attorney General Ken Paxton’s ongoing impeachment, named in at least seven of the 20 charges against Paxton.

The case that put some of Paul’s bank records in the public record began in March 2019, when Princeton Capital Corporation sued to collect on $5.6 million in loans it held against Paul’s self-storage business, Great Value Storage.

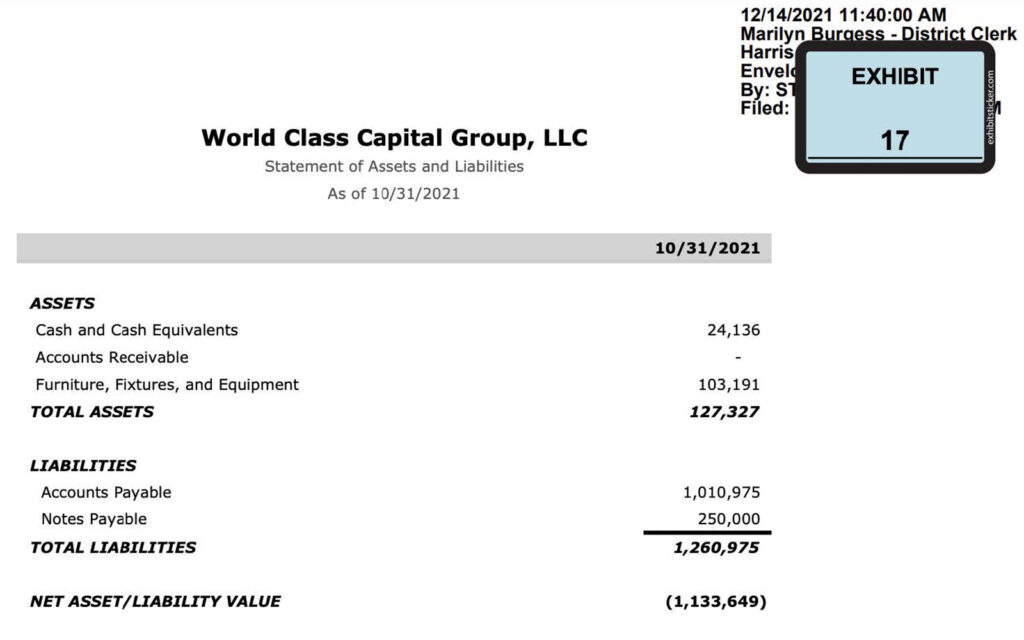

After two years of grinding legal battles, the court ruled in favor of Princeton, granting the lender $9.8 million. Paul appealed, and in October 2021, he filed a financial statement with the court for World Class Capital Group LLC, showing that the entity was more than $1 million underwater. Its only assets were $24,136 in cash and about $100,000 in office furnishings.

In the course of his investigation, Kretzer only had access to the bank records of the World Class Capital Group and Great Value Storage entities — two of Paul’s 400-plus Wells Fargo accounts, according to the report.

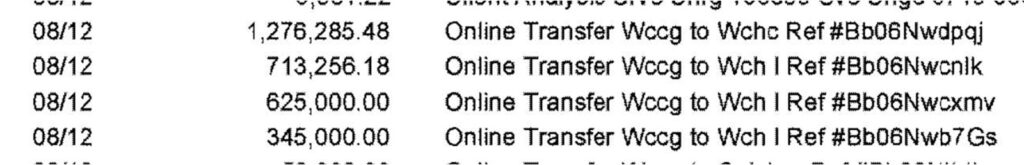

Between October 2018 and January 2020, however, $87.6 million had come into the LLC. Bank records show that in that same span, Paul moved that money out of the account, with the bulk of it transferred to other entities in his business empire and people close to the firm.

Just where the money went is hard to tell as it flowed through a web of shell companies that is tangled even by real estate standards. According to an internal organizational chart revealed in the proceedings, Paul owned more than 200 such shells. He freely moved money from one to the other, the court-appointed receiver wrote in his report, and even transferred funds from World Class Capital Group LLC to his personal credit card, his family members and business associates.

“Paul does not have, or will not reveal, a single page, not a single email, documenting the propriety of any of these cash transfers,” Kretzer said in the report.

Many of the transfers are to similarly named shell companies, like the $1.27 million transfer from World Class Capital Group to World Class Holding Company on August 12, two days before the FBI raid. That same day, he moved $1.68 million to another barely distinct LLC, World Class Holdings I (there are also entities called World Class Holdings, World Class Holdings II and World Class Holdings III, according to the organizational chart).

The parties settled last year; Princeton received $11.37 million to sell the loans to Phoenix Lending, an LLC associated with Paul. Paul bought the loans with part of the proceeds of the bankruptcy sale of some of his storage assets.

Paul sued Kretzer, accusing the receiver of “bully behavior” and arguing he overstepped his authority in the investigation. He later discontinued the case.

Two of Paul’s lawyers did not return requests for comment.

But the bank records revealed in the case take on a new significance as Paul faces heightened peril from the FBI and Paxton’s impeachment.

Read more