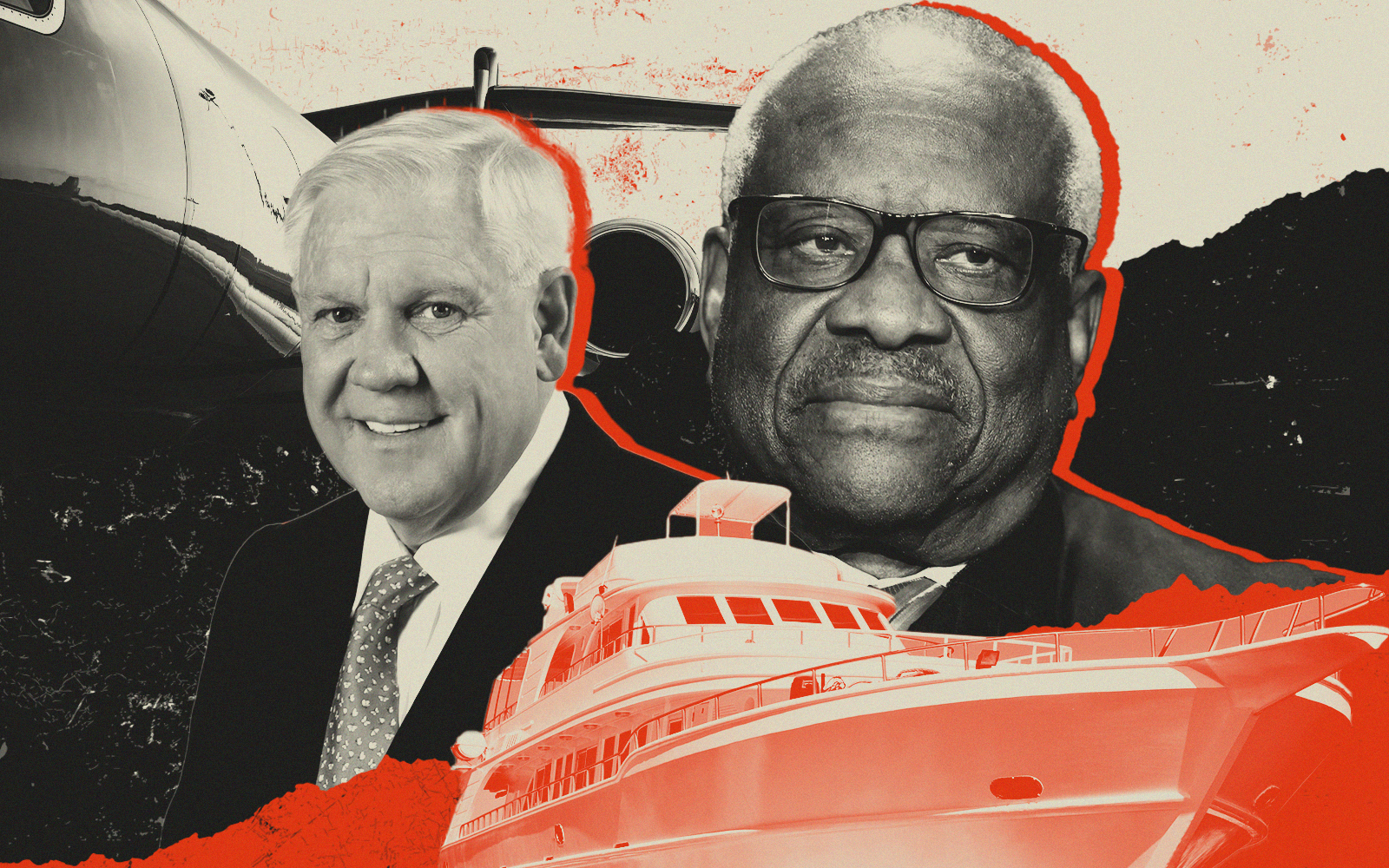

Harlan Crow is under the microscope again.

This time he is accused of taking massive tax deductions based on business losses from his megayacht, the Michaela Rose. But whether the boat is a profit-seeking business is in question.

The investigation started with Crow’s opulent gifts, including trips on the Michaela Rose, to Supreme Court Justice Clarence Thomas, which Thomas didn’t disclose. Senate Democrats went after Crow to seek documentation of the gifts. Crow’s attorneys have resisted, and the billionaire businessman attested that he’s committed no wrongdoing.

But Crow may have violated tax laws related to the yacht, ProPublica reported.

Crow allegedly carried out a scheme common among the super rich, blurring the line between business and pleasure as a way to lower their tax bills. A company called Rochelle Charter, founded by Crow and his father Trammell Crow in 1984, purportedly chartered the Michaela Rose. Yet, there’s no evidence that the company functioned as a for-profit entity, as required by the law.

“Based on what information is available, this has the look of a textbook billionaire tax scam,” Senate Finance Committee chair Ron Wyden told the outlet. “These new details only raise more questions about Mr. Crow’s tax practices, which could begin to explain why he’s been stonewalling the Finance Committee’s investigation for months.”

In 10 of the 12 years from 2003 to 2015, Rochelle Charter had net losses totalling nearly $8 million, with about half of that going to Crow, according to IRS data compiled during those years. The Crow family saved on taxes by using those deductions to offset other sources of income, the outlet reported.

After taking full control of the company in 2014, Crow renovated the yacht. That year, he had a $1.8 million loss from Rochelle Charter, marking his largest deduction on record.

In order to claim such deductions, taxpayers must partake in a legitimate, profit-seeking business. And the IRS might suspect that a purported enterprise is more of a hobby if expenses greatly outweigh revenues year after year.

For a yacht business to meet the criteria of a for-profit business, “You have to be regularly chartering the yacht to third parties at fair market value,” Michael Kosnitzky, co-chair of law firm Pillsbury Winthrop, told the outlet.

Former Michaela Rose crew members said they had no knowledge of the yacht ever being chartered. The vessel also appears to have been reserved for Crow’s family, friends, company executives and their guests.

Read more

Crow also struggled to prove that the Michaela Rose was being used for commercial purposes after the U.S. Patent and Trademark Office requested evidence in 2019. The trademark office deemed that Rochelle Charter was not a legitimate enterprise and refused registration, but Crow’s attorney continued to fight the claim, and eventually the trademark was approved.

Businesses that lean more on the side of leisure, like Rochelle Charter, “should be aggressively audited,” Brian Galle, a professor at Georgetown Law and former federal prosecutor of tax crimes, told the outlet.

—Quinn Donoghue