Trending

Silver Star chairman accuses former CEO Allen Hartman of mismanagement, unauthorized borrowing

Gerald Haddock blamed Hartman for company’s financial woes in message to shareholders

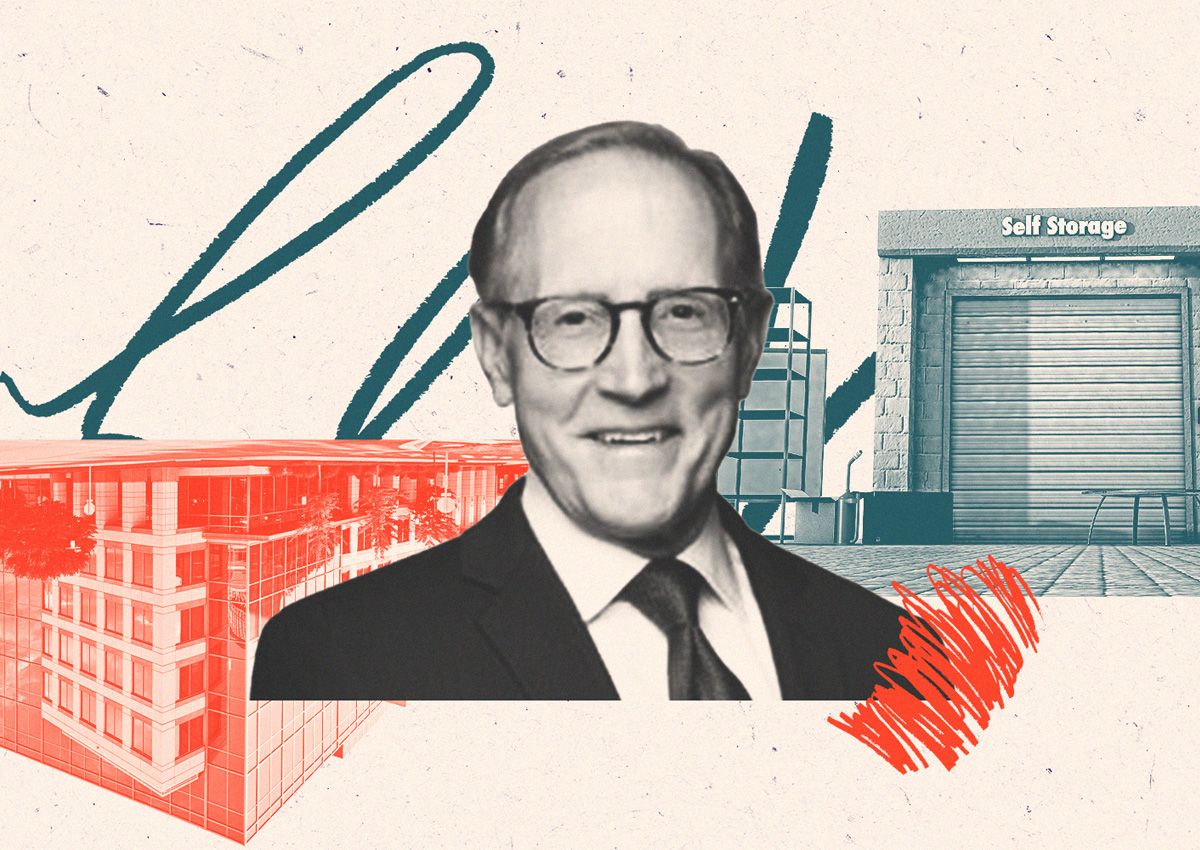

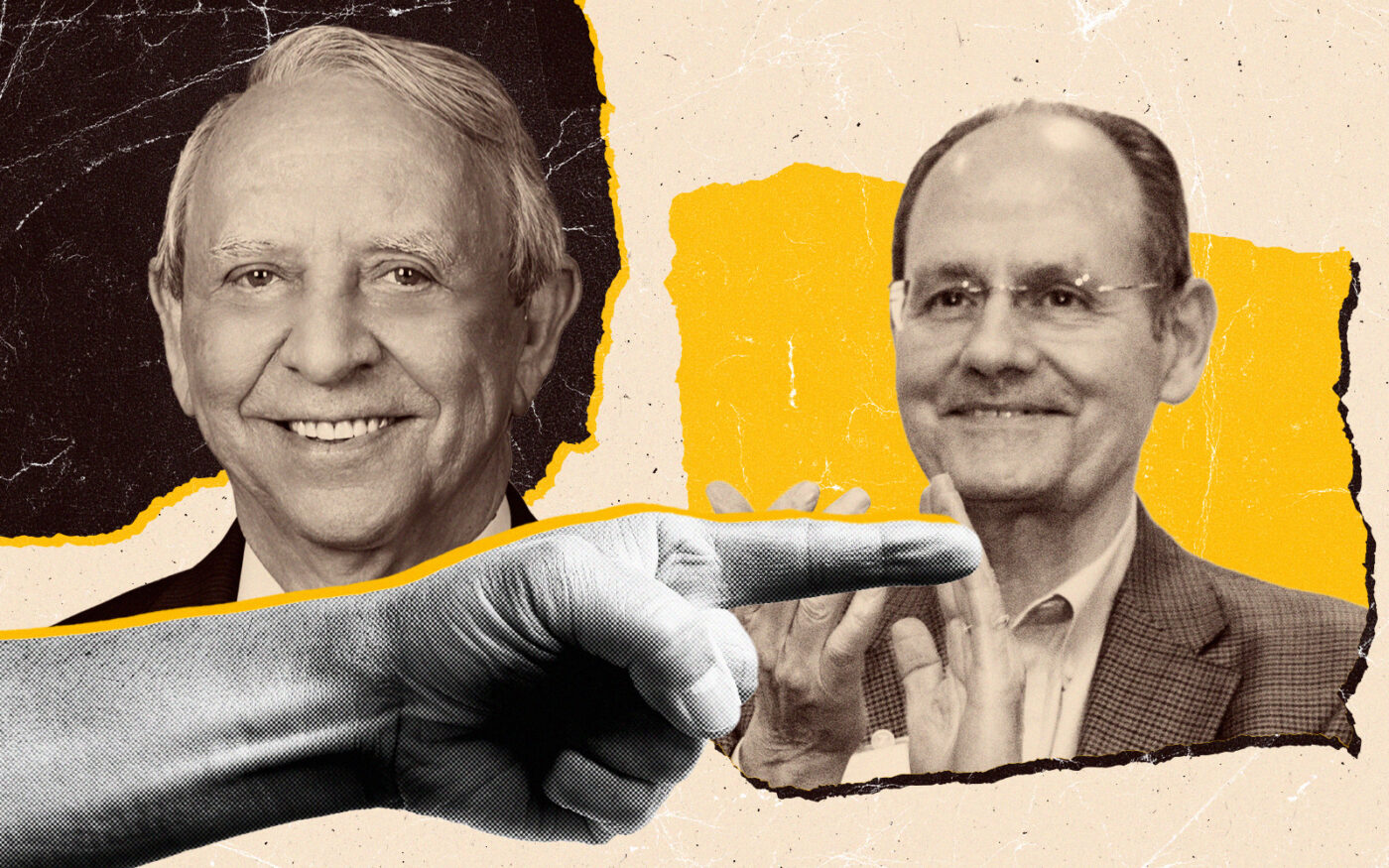

Silver Star Properties executive chairman Gerald Haddock lobbed a series of accusations, including mismanagement and unlawful meddling, at former CEO and founder Allen Hartman.

In a video message sent to the company’s shareholders on Nov. 27, Haddock blames Hartman for financial woes that have befallen the company. A transcript of the video was filed with the Securities and Exchange Commission.

Haddock cites Hartman’s personal, religious and political preoccupations as the culprits for indecisions that have rocked the venture, formerly known as Hartman Short Term Income Properties XX. The company’s fate has become entwined with the missteps of its former namesake, Haddock said.

“Hartman was always busy, but not on company matters. More so, he was involved with developing succession plans for young, inexperienced family members,” Haddock said in the transcript. “Additionally, Mr. Hartman had directed the borrowing of cash from Hartman vREIT XXI to subsidize what the company had been suffering through … these borrowings were not even approved by the Silver Star Board and were also in violation of Hartman vREIT XXI’s charter.”

The REIT’s debt has ballooned to $322 million, according to the SEC filing.

A loan tied to 39 properties reached its full maturity last month, with an outstanding balance of $217 million, after exhausting loan extensions. The firm began shifting its entire 7 million-square-foot portfolio of office and retail properties to self-storage earlier this year. It acquired Southern Star Self-Storage Investment Company in May to help facilitate the pivot and work alongside its existing operations.

Haddock, along with other outside directors Jack Tompkins and Jim Still, recommended a bridge financing option for the now-matured loan at the behest of their investment bank, but Hartman rejected that, saying the cost was excessive, according to the transcript.

“Our bankers told us that if Mr. Hartman is at the helm, Silver Star will not be able to raise any capital,” Haddock said.

The board decided to oust Hartman as executive chairman in March, six months after firing him as CEO. That led to the formation of the executive committee composed of Haddock, Tompkins and Still. The company said it was investigating “certain violations of fiduciary and other duties to the company by Mr. Hartman,” in a statement after his departure.

Negotiations for an amicable separation between the company and Hartman continued to sour when Hartman sought a higher net asset valuation for his shares, derailing negotiations, Haddock alleged.

“He immediately filed illegal lis pendens liens and claimed erroneous interest in title with respect to assets that were being sold by Silver Star,” Haddock said in the transcript. “To get around this nuisance, Silver Star was required to cause its Hartman SPE subsidiary, not the parent company, to file a strategic chapter 11 bankruptcy in an effort to clear these sales from the hurdles of Hartman’s illegal actions.”

Silver Star interim CEO David Wheeler declined to comment on the accusations, citing ongoing litigation.

Last month, Silver Star sued Hartman and his wife, Lisa, who are both stockholders. In addition to mismanagement, the complaint alleges Hartman attempted to “unlawfully solicit” the proxies of various stockholders. Hartman denied all allegations of fiduciary irresponsibility and legal wrongdoing.

Silver Star expects that Hartman SPE will exit bankruptcy with $370 million, earmarked for investments in its self-storage ventures. The firm will employ 1031 exchanges in its pivot to self-storage. Wheeler, with a wealth of real estate experience, is set to lead the company’s strategic initiatives. The company plans to leverage its position as a buyer of choice in the self-storage space, targeting secondary markets.

In the latest quarterly report, Silver Star disclosed the sale of three properties collateralized in the $217 million loan, with proceeds amounting to $41 million.

Silver Star is under contract to sell nine properties across the Texas Triangle in an attempt to pay down the loan balance, with an aggregate sales value exceeding $80 million, according to bankruptcy court filings. The firm expects to fully pay off the matured loan by the end of January, Wheeler said.

Read more