Lenders still believe in Dallas multifamily even as the market begins to show signs of distress.

Florida-based developer ZOM Living secured a $109M refinance loan on Atelier Tower, the top property in the firm’s Dallas portfolio. The 41-story luxury resi building located at 1801 North Pearl Street includes more than 400 units ranging from 500 to 2,300 square feet with views of Klyde Warren Park and downtown. Rent prices range from $2,000 to $12,000 a month, according to online rental listings.

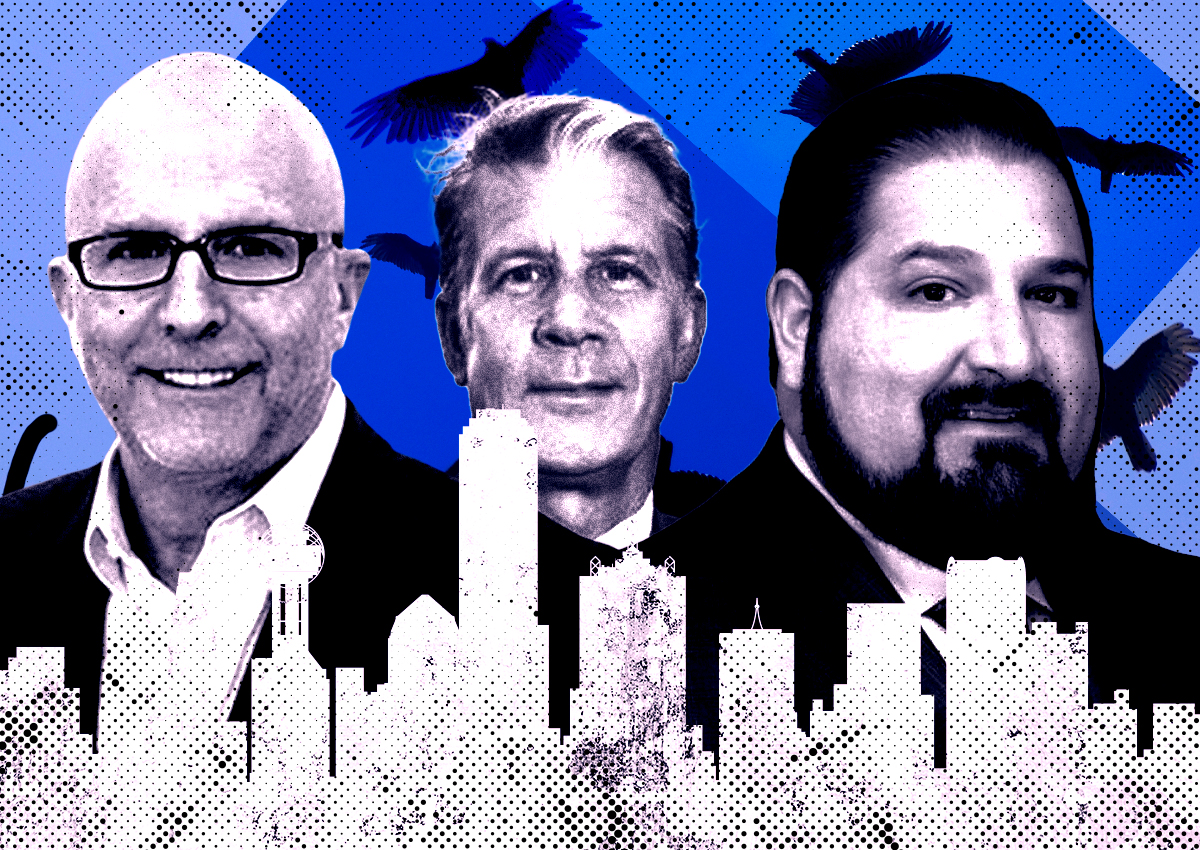

The loan procurement during challenging financial times highlights the strength of the Texas market and the quality of the property, said Matthew Adler, ZOM’s chief investment officer.

The building sits adjacent to the Dallas Arts District and opened in 2021. It was designed by architecture firm Stantec. The luxe tower is 93 percent leased and includes a pool, pet spa, yoga lawn, gym and bar.

ZOM didn’t name its lender or release any other details about the loan. The tower’s 2023 taxable value was set at $168 million, according to Dallas Central Appraisal District records.

ZOM has been active across DFW with a number of multifamily projects including the 398-unit Hazel apartments next to the Galleria Dallas mall. The firm also recently sold the 378-unit Mezzo Dallas complex to Harbor Group International. The Mezzo was ZOM’s eighth multifamily development in Dallas and its 12th in Texas.

Dallas-Fort Worth continues to lead the nation with over 65,000 apartment units in the pipeline, but signs of distress are beginning to show. Texas cities have largely maintained top-tier leasing numbers and high multifamily rents in the post-pandemic landscape, but some firms are building war chests to take advantage of distressed properties including Arbor Realty Trust, Three Pillars Capital and Bradford Companies.

Read more