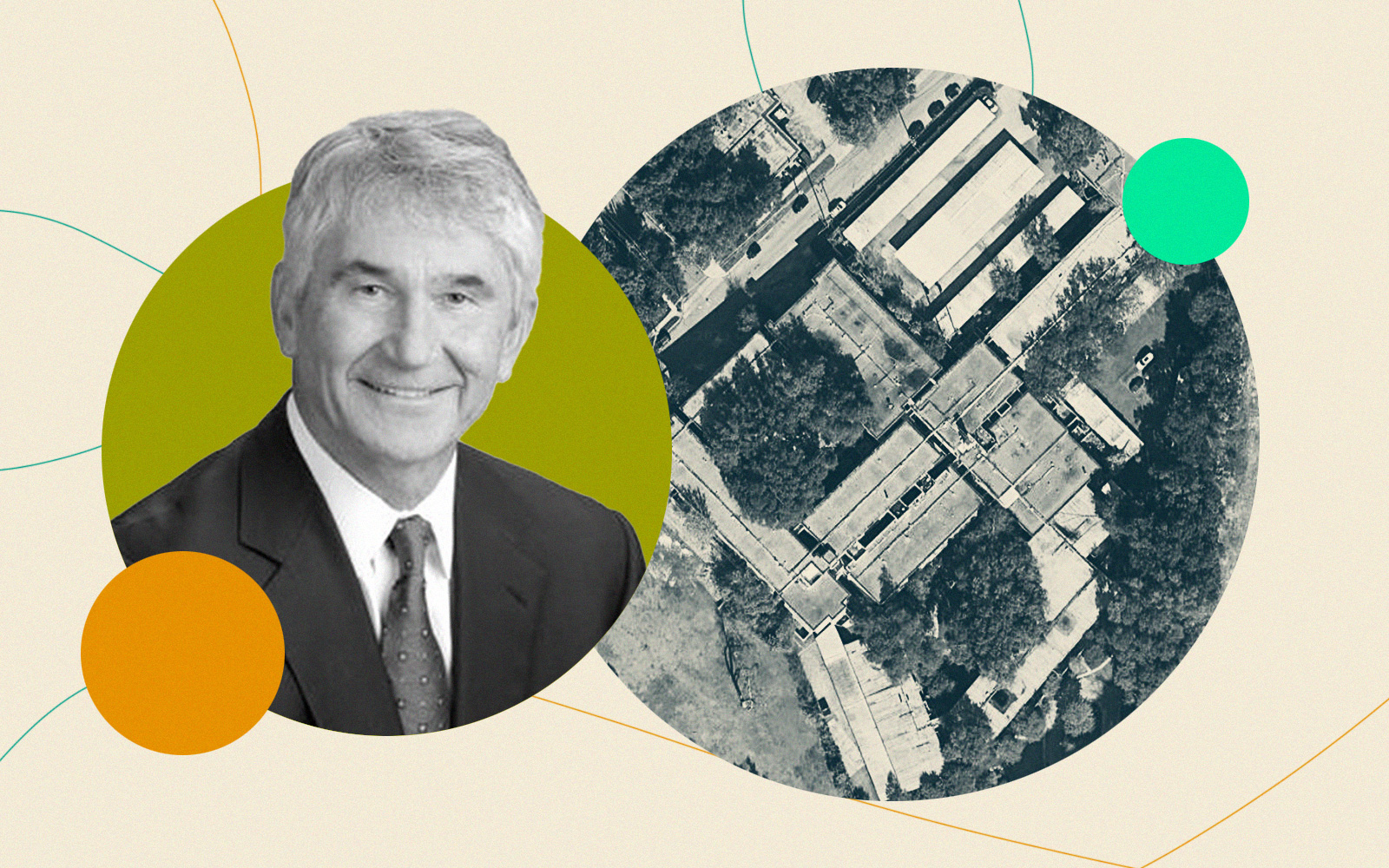

Tim Barton has lost a lengthy legal battle involving a coveted property in Dallas’ Turtle Creek neighborhood.

U.S. District Judge Brantley Starr approved a settlement Thursday, granting ownership of the site at 2999 Turtle Creek Boulevard — once intended for the city’s first Mandarin Oriental hotel — to an affiliate of HN Capital Partners, for $2.5 million, the Dallas Business Journal reported.

The property is across from the HN Capital-owned Mansion on Turtle Creek and includes 2.3 acres of undeveloped land, a two-story office building and a parking garage. It is valued at $14.5 million, according to the Dallas Central Appraisal District.

Barton’s legal team has appealed the judge’s order.

Barton, owner and president of JMJ Development, is losing more than just his Turtle Creek trophy. A court-appointed receiver has also put the firm’s other real estate holdings, including Barton’s personal residence on Rock Creek Drive in Dallas, up for sale.

And that’s not the end of his woes. He’s also facing federal criminal charges.

The Department of Justice in September charged Barton with seven counts of wire fraud, plus conspiracy to commit wire fraud and securities fraud, for allegedly scamming 100 Chinese investors out of $26 million. Barton’s trial for those charges, related to a planned single-family development in North Texas, is scheduled for February 2024. If convicted, he would face a sentence of up to 60 years in prison.

Court-appointed receiver Cort Thomas has been authorized to auction the contents of the office building at the Turtle Creek site, a move that’s “in the best interest of the receivership estate because it maximizes the value of the office contents while avoiding the costs of moving and storing the office contents,” Starr said in the ruling.

In September, the SEC had asked the bankruptcy judge to appoint a federal equity receiver over all of Barton’s holdings, including the Turtle Creek site. The receivership encompasses 160 corporations that were directly or indirectly controlled by Barton. In total, the assets put into receivership are worth over $70 million, the outlet said.

—Quinn Donoghue

Read more