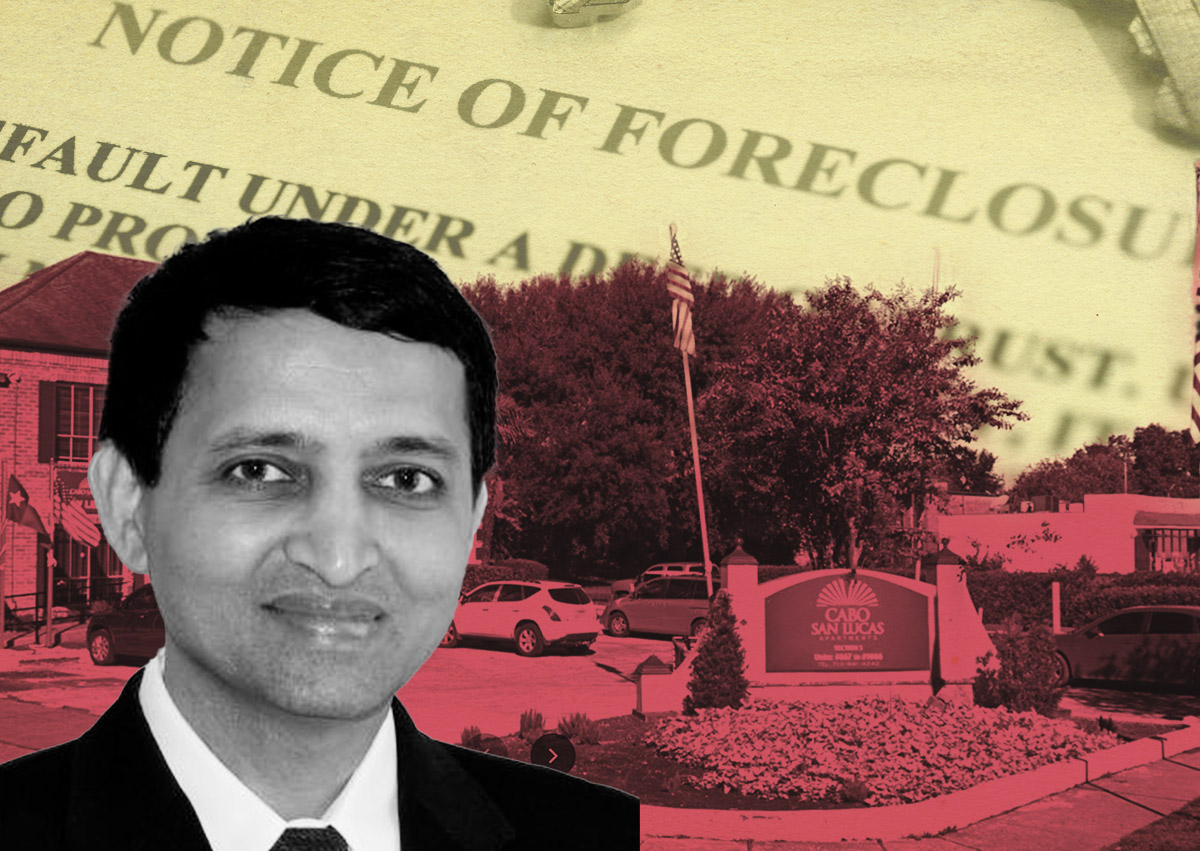

Jetall Companies founder Ali Choudhri is engaged in a legal battle with lender Romspen over its attempt to foreclose on his own Houston office, at 1001 West Loop South.

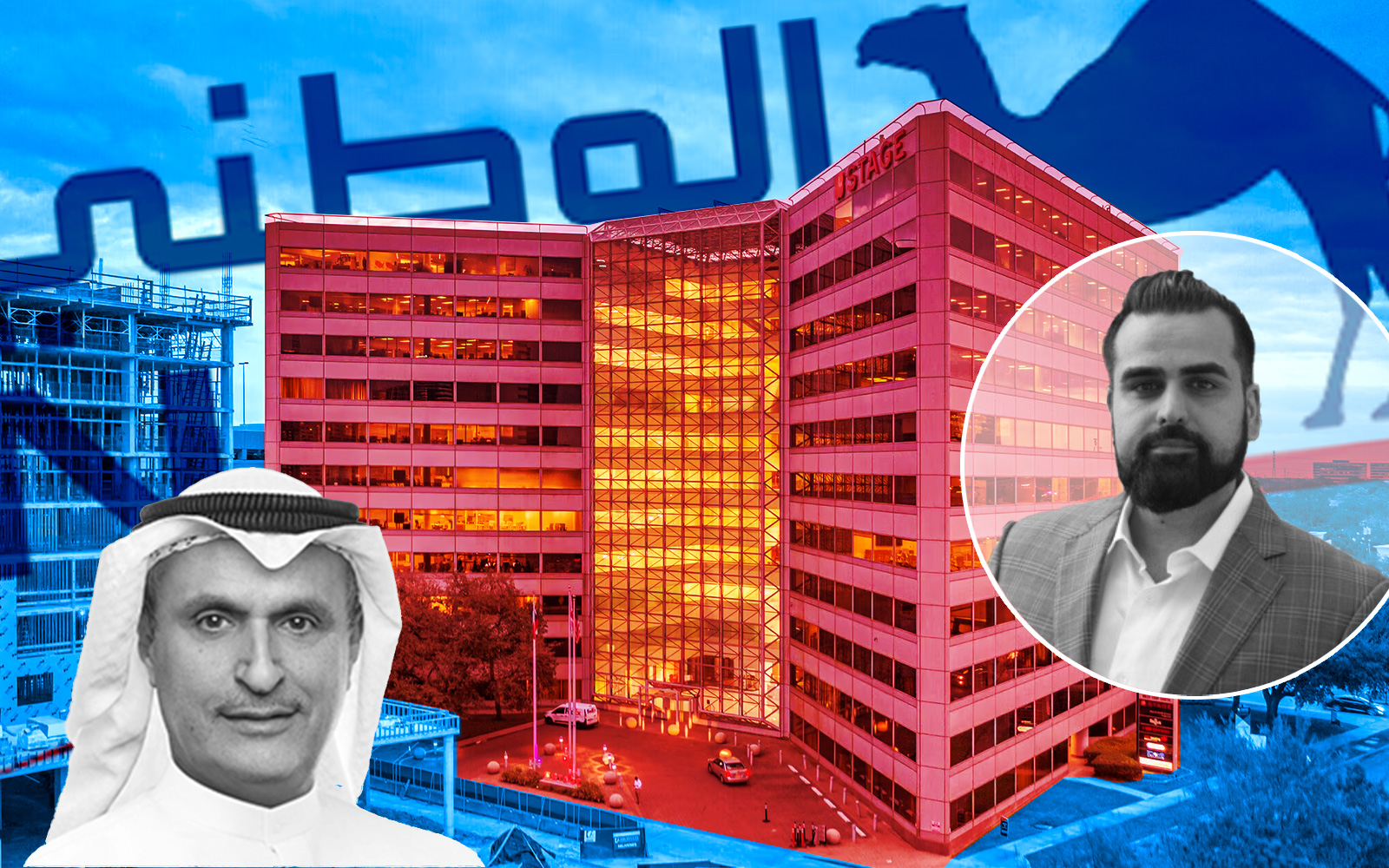

Situated in the Galleria neighborhood, the office is the former Xerox building, standing eight stories and spanning some 255,000 square feet of net rentable area. The Class B office was built in 1979. Other tenants include Uptown Fitness and private school Xavier Educational Academy.

The property was fully acquired via an LLC called Galleria Loop Note Holder—which lists Choudhri as the sole member— in September 2019 for an undisclosed amount. It was appraised at $26.7 million in January 2019, according to the Harris County Appraisal District.

The subsidiary borrowed $18.5 million from the Ontario-based Romspen in May 2019 to fund its acquisition of the office property via the purchase of matured liens, the claim alleges.

Representatives of Romspen initially filed a notice on May 16, detailing instances of default on the 2019 loan and scheduling a foreclosure sale for June 6 in Harris County, according to court filings. However, the borrower filed an emergency temporary restraining order against the lender on June 5 to block the foreclosure. The restraining order was granted because the subsidiary said it was not properly informed of the foreclosure sale.

The potential foreclosure is seeking $21 million, which includes the full promissory note amount plus accrued interests and late charges, according to a notice of removal filed on June 6 in compliance with the court order.

The emergency restraining order claims the borrower missed payments due to Romspen’s failure to fund improvements that were previously agreed upon. A representative for Romspen declined to respond to inquiries regarding the court proceedings.

The LLC subsidiary went on to “incur a significant financial shortfall and ultimately caused certain tenants to stop paying rent as a direct result of [Rompsen’s] failure to fund the tenant improvements,” according to the court documents.

The restraining order, initially scheduled to remain in effect until June 27, was mutually dissolved by the two parties on June 12. Romspen denied the breach of contract claims made in the emergency temporary restraining order. Romspen contends that it notified Choudhri, specifically his subsidiary Galleria Loop Note Holder, about the foreclosure sale on May 15, as evidenced by a notice included in the court documents.

Romspen filed a new notice of foreclosure sale on June 14, two days after the dissolution of the emergency restraining order. Currently, the property is scheduled to go to foreclosure auction on July 6, according to the new notice of substitute trustee’s sale. The property’s latest taxable value is estimated to be $27.2 million.

In May, Choudhri successfully battled off a notice of foreclosure filed by lender Bank of Kuwait for another large Galleria office building, 2425 West Loop South. He has been involved in multiple lawsuits related to his properties, businesses and professional relationships since 2016. Choudhri declined to comment on the legal dispute.

Read more