The week’s market reports looked back at 2016, which Avison Young called a “hangover” year. Median rental prices dropped in Manhattan, Brooklyn, and Queens, as did median sales price in Manhattan. Investment sales dollar volume in Manhattan dropped a whopping 38 percent to 38.9 billion, but leasing volume remained stable. Nationally, CMBS issuance dropped 30 percent and the foreclosure rate dropped to a 10-year low.

Residential

Manhattan sales: Douglas Elliman

For co-ops and condos, median price was down 8.7 percent relative to 2015, to $1.05 million, luxury supply declined as did resale inventory, but new development inventory pushed the median price up 9 percent. Read the full report here.

Manhattan, Brooklyn and Queens rentals: Douglas Elliman

Rental prices decreased in all boroughs; 0.3 percent in Manhattan, 1.3 percent in Brooklyn, and 6.6 percent in northwestern Queens. Read the full report here.

FiDi report: Platinum

In the Financial District, the average price per unit hit $1.2 million, an increase of 4.8 percent, one-bedrooms accounted for 42 percent of sales, and sales volume was down 17.2 percent compared to 2015. Read the full report here.

Improving access to affordable housing: NYC HPD and DCA

In New York City, 56 percent of renters pay more than 30 percent of their pre-tax income, and a third pay more than half, and vacancy rents are at “emergency” levels, defined as below 5 percent. Read the full report here.

Residential foreclosure report: CoreLogic

Approximately 325,000 homes in the U.S. were in foreclosure as of November 2016, a 30 percent decline compared to November 2015. The foreclosure rate of 0.8 percent is back to June 2007 levels. Read the full report here.

Foreclosure report: RealtyTrac

Foreclosure rate fell to a 10-year low nationally. New York County had one of the highest rates of legacy foreclosures, with 74 percent of foreclosures originating in mortgages made in 2006 to 2008. Read the full report here.

Commercial

Source: CBRE

Office leasing and investment sales: Avison Young

In office leasing, total volume in 2016 declined slightly to 28 million square feet, vacancy rate remained flat at 10.2 percent, and rent grew 9 percent. Investment sales in Manhattan declined 38 percent to $38.9 billion after 2015’s astronomical $63 billion. Read the full report here.

State of CRE markets: Commercial Real Estate Direct

Issuance of Commercial Mortgage Backed Securities in 2016 declined by 30 percent in 2016 to $68.3 billion, in the first decline since 2009. Read the full report here.

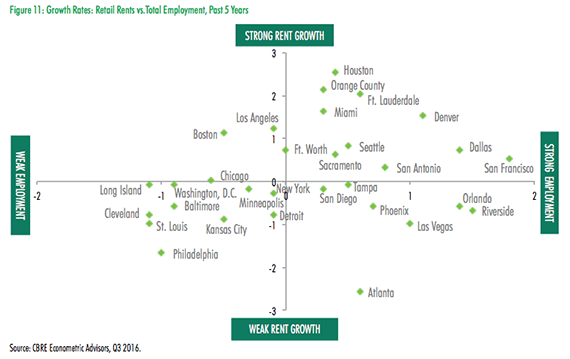

U.S. Market Outlook 2017: CBRE

Office rents are projected to grow 1.5 percent in 2017, and retail rents to grow 1.7 percent. Read the full report here.

Economic impact: REBNY

The $20.4 billion in taxes generated be the real estate industry make up 43 percent of total New York City taxes collected. Owner occupied properties account for another 17 percent. Read the full report here.