Amidst all the political maneuvering and grandstanding on 421a—or “Affordable New York” as it’s now called—it’s easy to forget about another program that is much more consequential for the construction of affordable housing in New York City: the Low-Income Housing Tax Credit (LIHTC).

But the expectation that Trump and Congress will cut corporate taxes is already making the tax credits worth less to investors, experts say. And that could mean more than 16,000 units of affordable housing a year won’t get built across the country.

Established by Congress in 1986, LIHTC is a dollar-for-dollar credit that allows corporations and banks to off set tax liability by investing directly in affordable housing projects, buying up a finite number of government-issued tax credits from housing developers.

By the federal Department of Housing and Urban Development’s own conservative estimates, this program helped finance more than 102,000 low-income housing units in New York State, most of them in New York City, between 2005 and 2014.

Compare that pace with the 421a program, which according to the city’s Department of Preservation and Development, subsidized 7,600 affordable apartment units between 2009 and 2014.

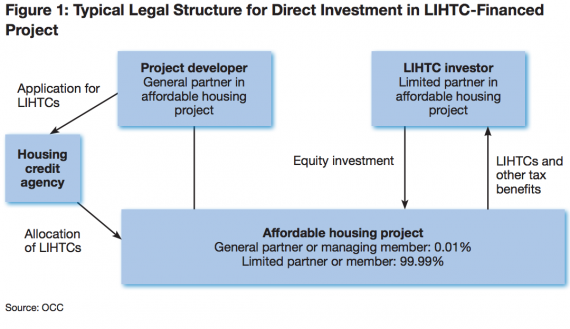

In case you’re curious, the Office of the Comptroller of the Currency has a simplified flow chart that shows how LIHTC finances affordable housing:

The big problem with any system built on tax credits, of course, is that if tax rates ever drop, so does the value of the credits, making them worth much less to investors.

President Donald Trump and his Treasury Secretary nominee Steven Mnuchin are calling for corporate taxes to drop big league, from 35 percent all the way down to 15 percent. House Republicans have called for big cut too—they proposed a rate of 20 percent in June.

With Obama out and Trump in, a thorough slashing of rates seems inevitable.

In fact, all of this discussion over even the possibility of comprehensive tax reform was enough to rock the market for housing tax credits this fall, said Ben Metcalf, former HUD official and current director of the California Department of Housing and Community Development.

“Even though no legislation has even passed, the marketplace is already discounting these credits because of the expectation of corporate tax reform,” Metcalf said. The state of California is already looking at a $200 – $250 million hit to affordable project equity year-over-year, he said.

And in New York, some major stakeholders are making it clear to the next administration that the LIHTC program is in need of real strengthening.

The New York State Association for Affordable Housing (NYSAFAH) is a trade group for affordable housing developers, and its board of directors boasts executives at some of the most active for-profit affordable developers in New York City, such as L+M Development Partners [TRDataCustom], BFC Partners, Richman Group and OMNI New York. In a Jan. 5 letter, NYSAFAH and a dozen other state groups urged HUD Secretary nominee Dr. Ben Carson to support legislation that would increase the number of credits awarded annually to developers by 50 percent. Carson, if appointed, would oversee the LIHTC program.

But even if the program is expanded, any weaker demand or value due to tax reform (or simply the discussion of) is still a big problem. Tax credits that were once trading for a dollar have dropped closer to 90 cents in some cases, and if corporate taxes drop, that could continue.

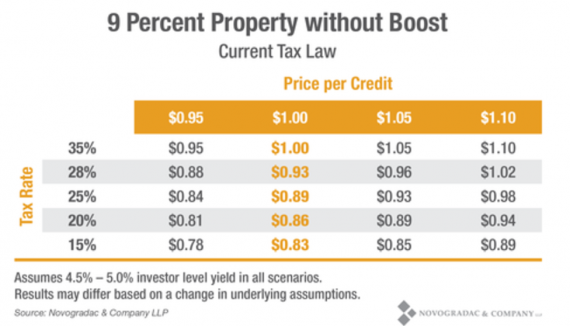

In fact, LIHTC prices slipped over three consecutive months to close out 2016, according to an analysis by Novogradac, an accounting firm. Furthermore, Novogradac estimates that prices for credits currently worth a dollar — so-called “9 percent” credits that can typically be sold to cover 70 percent of a developer’s costs in a project — could drop all the way to 83 cents per credit if the corporate tax rate is lowered to 15 percent, the way Trump and Mnuchin say they want want it to. That could lead to more than 16,000 fewer affordable housing units a year nationally.

“I frankly don’t know how they can mitigate that basic economic reality,” said Jim Parrott, a former Obama White House economic advisor and a current senior fellow at Washington’s Urban Institute.

Jolie Milstein, the director of NYSAFAH, is more optimistic. She says even though the value of individual credits is already dropping, demand is still high enough that simply issuing many more credits, even at lower prices, can help make up the equity gap.

“We believe there is sufficient demand,” Milstein said. “We still have a vast shortage of credit in many states like New York and California… we way exceed demand for the credit.”

Metcalf echoed that, saying the government can “put more credits into place to compensate for the fact that each individual credit is worth less.”

Stephanie Sosa, a senior associate and LIHTC underwriter for the Association for Neighborhood and Housing Development (ANHD), said she supports the government issuing more credits, but is more skeptical about whether that would actually make up for lagging prices in a lower tax environment.

“I’m not sure it would help projects,” Sosa said. “There would be more demand to develop more units, but investment would have to be there.”

Such a proposal to increase credits does exist on the hill. Senators Orrin Hatch (R-UT) and Maria Cantwell (D-WA) introduced a bill to expand the credits by 50 percent last spring. Many observers expect it to resurface sometime this year.

Mark Stagg, the president of Bronx-based affordable developer Stagg Group, said he wasn’t particularly concerned about the sagging LIHTC market. He’s confident the state would step in and make up for any gap in equity.

“I think we’re always going to find a way to build housing. I’m really indifferent,” Stagg said. “Subsidy will come in to fill that gap and if we have to eat a little less, we’ll eat a little less as well.”

“There are a number of places people can go to fill that gap,” Milstein said, “presuming the Governor’s budget or something close to it gets passed. We’re lucky in New York State to have a lot of state resources that we put forward to accomplish our statewide affordable housing goals.”

Eugene Schneur of OMNI New York, one of city’s most prolific affordable developers, said he’s done deals with tax credits worth only 90 cents in the past and could do it again. Schneur also pointed out that in finance-heavy New York City, credits still trade for higher than the national average, due in part to federal regulations that incentivize banks to invest in things like affordable housing. But in smaller cities, the program might need some extra help, Schneur said.

“Some of those municipalities are going to require other government funding,” he said.

Interestingly, Trump himself once went to Congress to complain that lower tax rates were discouraging investment in low- and middle-income housing. In his 1991 testimony he said, “…frankly, by having cut the high income tax rates to 25 percent, as an example, people don’t have the incentive any more to invest. They’re saying, ‘Why should I take a chance on investing in low or moderate-income housing? I might as well just pay the tax.'”

Ben St. Clair contributed research to this report