UPDATED, 6:18 p.m., March 16: There are early indications that Manhattan’s ailing luxury residential market is beginning to recover, with a jump in the number of contracts signed on the borough’s most expensive pads.

So far this year, 152 contracts on Manhattan condominiums and co-ops asking $5 million and above were signed, according to a new report from Stribling & Associates. The figure represents an almost 29 percent increase from 118 during the same time period of 2016. A total of 106 contracts on luxury condos were signed, according to the report — a 61 percent increase from 66 in the first two months of 2016. There were 29 contracts signed on co-ops priced at $5 million and above — a decline of 9 percent from the year before.

“In the last six months [of 2016], people were very concerned because the market seemed to wither — particularly on the luxury end,” said Stribling’s Kirk Henckels. “Because of Brexit and remarkably high anxiety over the presidential election, a lot of the luxury buyers went to ground — people were really panicky about it.”

Recent reports from other city brokerages also show a boost in the city’s luxury market. The number of contracts on properties priced $5 million above jumped 28 percent in January and 43 percent in February, the Wall Street Journal reported, citing Brown Harris Stevens analytics. Corcoran’s Kelly Kennedy Mack [TRDataCustom] told The Real Deal late last month that deals above $5 million were up 30 percent in the first month-and-a half of the year. There were 108 contracts signed at $4 million and above in February, according to Olshan Realty — the second-best February since the brokerage started keeping track in 2006, and a 42 percent increase on contracts signed in February 2016.

However, Henckels said while there is a “building momentum” there were still many segments of the Manhattan residential market that lost 10 to 15 percent in prices just prior the election. “I do think some of that has been recovered, but I don’t know how much yet,” he said.

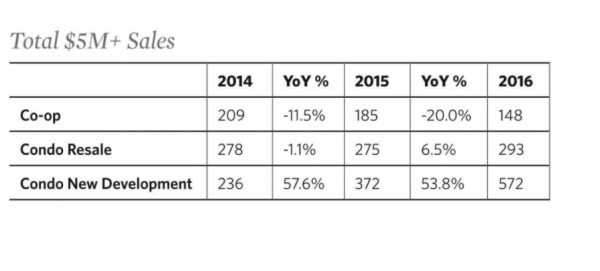

For its report, Stribling analyzed closed sales of Manhattan condos and co-ops priced at $5 million and above in 2014, 2015 and 2016 — as well as contracts signed between Jan. 1 through March 6 this year.

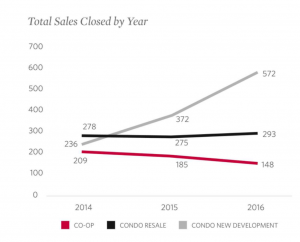

In total, the report found 1,013 luxury co-ops and condos sold in the city in 2016. For the first time ever, more than half of all luxury units closed — and over 62 percent of the dollar volume — were new development.

There were 572 new development sales in the over-$5 million market in 2016 — a jump of nearly 54 percent year-over-year, and an increase of more than 140 percent from 2014. Luxury condo resales were flat in 2016, increasing just 7 percent year-over-year to 293 closed sales.

Henckels said buyers choose new development for its ease – “consumer preferences [like] style, location and convenience.”

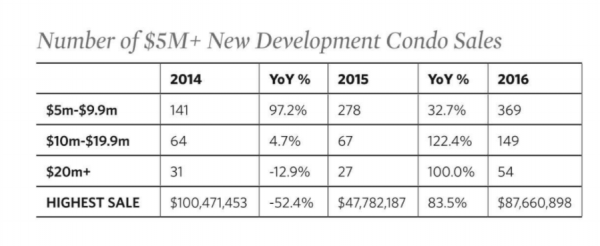

Closings of new development units priced between $10 million and $20 million saw the steepest increase. Sales in that particular price bracket jumped 122 percent year-over-year and more than 130 percent from 2014. However, Henckels cautioned the figure was inflated by closings at developments like Macklowe Properties and CIM Group’s 432 Park Avenue and Extell Development‘s One57. Last year — for the first time ever — there were more closings on Downtown luxury than uptown units.

Last week, there were 37 signed contracts in the over-$4 million market, according to Olshan. But the average property was discounted 14 percent from its original asking price before it went into contract, and the average days on market was 421.

These figures may be encouraging, but there have still been significant price reductions on the city’s most expensive properties in recent weeks. In some cases, sponsors are offering concessions to buyers and higher commission splits to brokers in order to move product.

But Henckels believes there’s reason to be optimistic. “Let’s see how the spring develops,” he said. “We’re definitely on an up-trend — we’ll see how much strength there is in it.”