Compass’ hotly anticipated IPO is finally (almost) here.

The venture capital-backed residential firm is set to go public in the coming days, after federal regulators on Monday approved its initial public offering, SEC filings show. Compass could start trading under the ticker symbol “COMP” as early as today, according to the New York Stock Exchange.

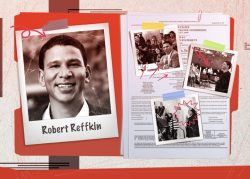

Founded in 2012 by Robert Reffkin and Ori Allon, Compass jolted the brokerage industry by raising $1.5 billion from investors, including SoftBank, and aggressively hiring top agents from competitors. It later scooped up firms wholesale in an unprecedented growth spurt.

Compass’ impending IPO — the subject of intense speculation over the years — became real when it filed confidentially to go public earlier this year.

Read more

Ahead of its stock market debut, Compass indicated it would seek a $10 billion valuation — testing, once and for all, whether investors believe it’s a tech company or simply a gussied-up residential brokerage.

In a March 29 research note, investment firm New Constructs argued the latter. “Currently, the company looks more like a traditional brokerage with flashy marketing, whose only advantage is a virtually unlimited ability to burn cash,” wrote David Trainer, the firm’s founder. (The analysis was republished in Forbes.) “SoftBank needs this IPO more than investors do.”

Here’s what else you need to know about Compass’ IPO.

Who? (Agents)

Compass’ S-1 was all about its agents — 19,000 and counting. The firm said in the IPO filing that 88 percent of agents use Compass tools at least once a week and 66 percent use them daily. No doubt agents who deferred commissions in exchange for Compass equity are looking forward to the IPO, too. In 2018 and 2019, agents invested $70 million into stock and stock options.

What? (NYSE debut)

Compass could raise nearly $1 billion in its IPO, and that cash would fuel its continued growth. The firm’s revenue more than doubled to $2.4 billion in 2019. Last year, boosted by the hot U.S. housing market, it raked in $3.7 billion. But Compass isn’t profitable, and its S-1 revealed $1 billion in cumulative losses. In 2020, losses narrowed to $270.2 million after a $388 million loss in 2019.

Where? (46 markets)

Compass operates in most major U.S. cities and was the No. 1 independent brokerage in the country last year with $151.7 billion in sales, up from $91.3 billion in 2019, according to Real Trends. Between 2018 and 2020, Compass spent $300 million to acquire brokerages such as Pacific Union International and Stribling & Associates, and to beef up its tech offering with companies including Contactually and Modus.

When? (While housing is hot)

The residential brokerage is striking while the housing market is hot. In February, home sales were up 9.1 percent year-over-year, according to the National Association of Realtors. It’s also riding a tech boom: Lemonade, Airbnb and Opendoor have gone public over the past year.

Why? (Tech valuation)

Compass is offering 36 million shares, priced between $23 and $26. It’s aiming for a $10 billion valuation, positioning itself as a tech company, as such firms are valued more highly by investors relative to earnings. For example, Zillow has a market cap of $33.5 billion, or 10 times its 2020 revenue of $3.3 billion. Brokerage giant Realogy’s market cap is $1.7 billion, a fraction of its $6.2 billion in revenue last year.