The following is a preview of one of the hundreds of data sets that will be available on TRD Pro — the one-stop real estate terminal that provides all the data and market information you need.

Manhattan has over 13,000 condo units in the pipeline, and nearly half of them are slated for a string of neighborhoods running up the western edge of the island.

Of the ten neighborhoods with the most units on tap, seven — if you include the Financial District — are in this western condo corridor, including each of the top five.

FiDi has the fattest pipeline, with 1,434 units on the way across eight high-rise developments. Next is Chelsea with 1,142 units spread across 29 projects. The Upper West Side, Lincoln Square and Hell’s Kitchen round out the top five.

The only neighborhoods on Manhattan’s East Side to rank in the top 10 were Yorkville, the Lower East Side and the East Village.

The Real Deal analyzed condo offering plans submitted to the state Attorney General’s office from 2016 through 2021, including those that have been approved and declared effective.

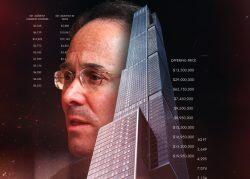

The Financial District’s chart-topping total was boosted by the biggest new development in Manhattan’s pipeline — Macklowe Properties’ 566-unit One Wall Street, the largest office-to-residence conversion in the city’s history. The neighborhood also hosts the third-largest development — the 308-unit Broad Exchange Building at 25 Broad Street — as well as the 244-unit 130 William Street, which ranked seventh.

Manhattan’s second-largest new development is the 352-unit conversion of the iconic Waldorf Astoria hotel in Midtown East — the only of the 10 largest new developments that isn’t in a neighborhood bordering the Hudson.

Not all units are created equal, of course. Times Square North, which includes a slice of Billionaires’ Row between Ninth and Seventh avenues, has only 266 units in the pipeline across two projects — but those two projects are Vornado Realty Trust’s hugely profitable 220 Central Park South and Extell Development’s Central Park Tower at 217 West 57th Street. Their combined sellout figure averages out to nearly $28 million per unit. The 1,434 new units on tap for the Financial District are expected to sell for less than a tenth of that, on average.

But sellout projections in condo offering plans — especially for luxury developments — can often be aspirational. An analysis of sales at Gary Barnett’s Central Park Tower, which began a year ago, shows that his firm, Extell, is selling units for 25 percent less, on a per-square-foot basis, than the prices stated in the project’s offering plans.

The area where new condo units are expected to command the second-highest prices, on average, is the Plaza District, which emcompasses the majority of Billionaires’ Row from Seventh Avenue to Madison Avenue. The four new developments there expect a combined sellout of nearly $2.68 billion, which pencils out to about $15.7 million per unit. But the average unit prices for the Plaza District’s two most prominent developments are much higher than the neighborhood average.

JDS Development Group’s distinctive Steinway Tower at 111 West 57th Street — where Corcoran Group recently took over marketing from Douglas Elliman — expects more than $23 million for each of its 60 condo units. The 26 condo units in the Crown Building at 730 Fifth Avenue are expected to make more than $34 million each for Vladislav Doronin’s OKO Group and partner Aman Group.

Condo projects in commercial hubs such as the Financial District haven’t fared as well as others during the market’s 2021 recovery, but some of the neighborhood’s new developments — including One Wall Street, 130 William Street and the Broad Exchange Building — enjoyed strong sales in January, despite a general slowdown elsewhere, according to Marketproof.

One Wall Street, projected to be the neighborhood’s most lucrative new development with a $1.7 billion sellout, booked seven sales in the first month of the year, tying with Extell’s One Manhattan Square in Two Bridges for the most new development sales in January.

Read more