As the city’s investment-sales market heads into its always-important fourth quarter, Clarion Partners is putting a pair of Williamsburg loft buildings on the market, aiming for a price of $70 million.

Clarion is looking to sell the rental buildings at 44 Berry Street and 139 North 10th Street, marketing materials show.

The buildings, which have a combined 78 apartments, were built in the early 20th century and converted in the early 2010s into spacious loft units with 13-foot ceilings.

Read more

With their spacious layouts and prime Williamsburg location near the Bedford Avenue L train station and McCarren Park, the properties are of the kind that are in high demand from work-from-home renters, according to a teaser from Eastdil Secured, which is overseeing the sale.

Rents in the buildings are below-market, which gives a new owner the opportunity to raise once leases roll over, according to Eastdil.

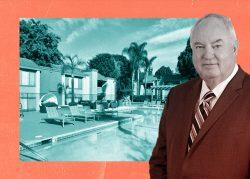

A representative for Clarion Partners, headed by CEO David Gilbert, did not immediately respond to a request for comment.

The New York-based firm, which is majority-owned by Franklin Templeton and has more than $81 billion in assets under management, purchased the two buildings in 2011 and 2014 for nearly $58 million.

The building at 139 North 10th Street, known as the Print House Lofts, is entirely market-rate. The 44 Berry Street property receives a J-51 tax exemption that expires next June; with few exceptions, apartments must be rent-stabilized while their buildings are receiving J-51 benefits.

The Williamsburg buildings join a handful of multifamily portfolios that have come to market as the city’s investment sales landscape heads toward the end of the year with many questions hanging over it.

The market got off to a hot start this year but cooled as the Federal Reserve started hiking interest rates and fears of a recession grew. The Fed last week raised the federal funds rate by 75 basis points, the fifth time this year it raised the rate.

Investor interest has shifted toward multifamily properties as office buildings have become more difficult to deal. The fourth quarter is usually the busiest one for sales.