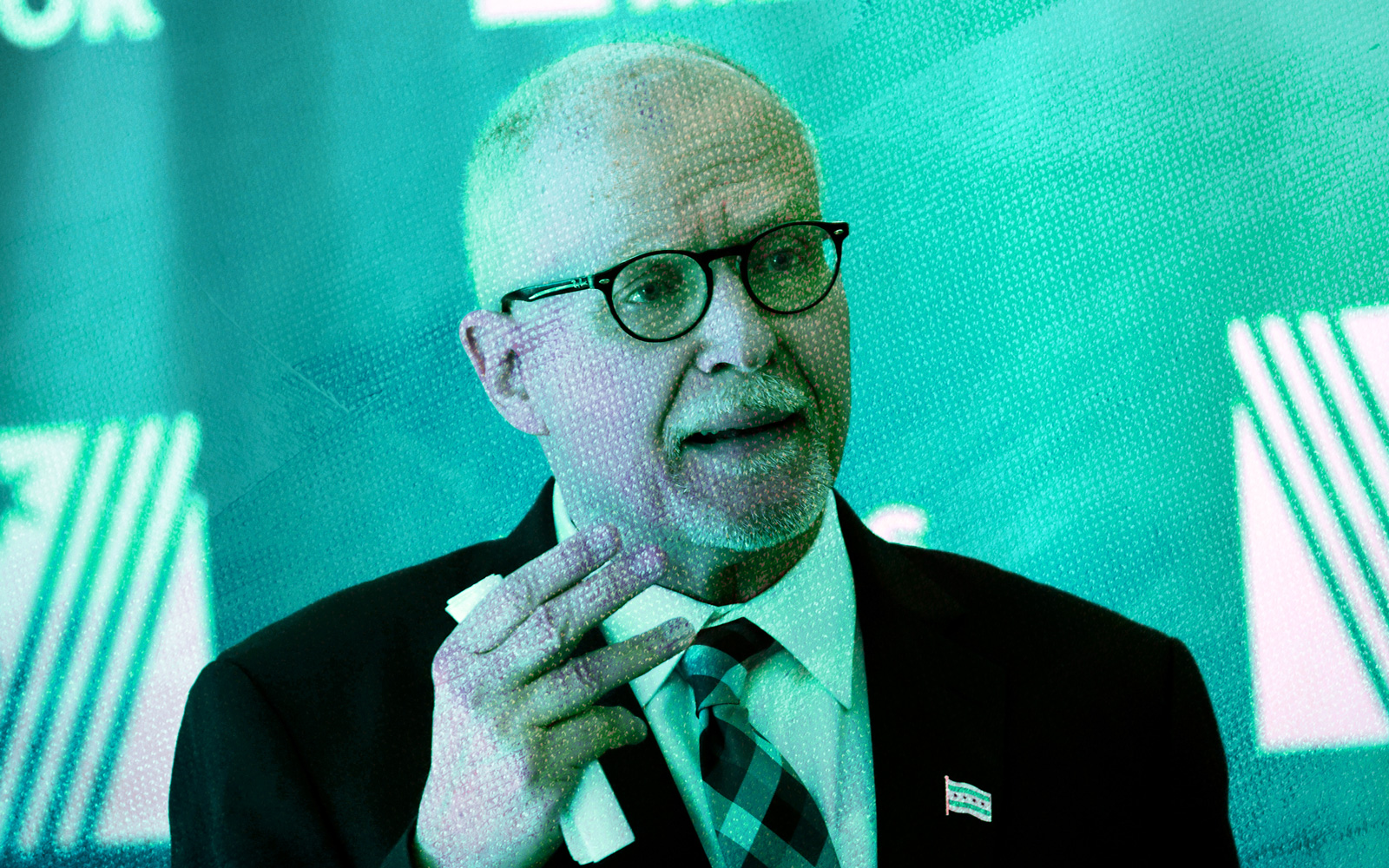

While Michael Jacobson was encouraged by getting one of Brandon Johnson’s first phone calls after his election as Chicago’s mayor last week, the head of Illinois’ hotel lobby is still focused on killing the progressive politician’s proposed lodging tax.

Jacobson, CEO of Illinois Hotel & Lodging Association, said Johnson called him the morning after winning the April 4 runoff over Paul Vallas, who was supported by the IHLA and other business and real estate trade groups.

Jacobson’s group is also monitoring two other components of Johnson’s tax plan: a so-called “head tax” on businesses whose employees commute from the suburbs and a real estate transfer tax hike on property sold for $1 million or more. The Johnson-backed transfer tax increase has much of the real estate industry’s focus as a proposal its lobbyists will aim to halt or water down.

But the hotel group in particular voiced opposition to a provision in Johnson’s proposed $800 million tax plan to raise revenue for social services that would hike the Chicago Hotel Accommodations Tax.

It has no room to budge on its position against a lodging tax increase included in the plan. It’s unwilling to concede to a smaller jump in taxes than the $30 million in additional annual revenue Johnson’s proposal has been projected to generate on top of the $116 million in taxes on hotels raised last year, a figure that includes state and county taxes, as well, according to the hotel industry group.

“I don’t know that there’s a middle ground,” Jacobson said. “We’re already the highest [tax rate] of the major meetings markets in the U.S., so any increase would just exacerbate that.”

Yet Jacobson didn’t pounce upon the proposal in his first conversation with the mayor-elect, and is instead charting a course to have a dialogue with Johnson over the next several weeks as he transitions into power.

“We didn’t go into policy yet, there’s plenty of time for that as he prepares to take office,” Jacobson said. “I think that he realizes how important tourism is to the city’s broader economy and I think that we’re going to continue to educate him on the impact that raising the hotel tax would have on future growth and tourism for the city.”

The hotel group’s position is that the city should increase tax revenue by encouraging more people to visit Chicago rather than increasing the tax rate. The 17.4 percent tax rate on hotel stays in the city — which includes state and other taxes that wouldn’t be impacted by Johnson’s proposal — is a strike against the city for meeting and convention organizers planning events, according to the group.

Johnson is open to conversation and “everything is on the table to discuss,” Jacobson said.

His talk with the mayor-elect is one of several Johnson had with business leaders as both sides attempted to extend olive branches in the days following his election, which had most people in Chicago’s investment and real estate communities in Vallas’ corner. Illinois Restaurant Association’s Sam Toia also received a call from Johnson.

Jacobson said the IHLA will be paying attention to how the new mayor builds out his team and prioritize “helping them realize the importance of tourism to the economy” and communicating the impact of some of their proposals on workers.

Read more