Two firms dominated the high-value commercial mortgage brokerage business in New York City last year: Eastdil Secured and Meridian Capital Group, an exclusive analysis by The Real Deal found.

Two firms dominated the high-value commercial mortgage brokerage business in New York City last year: Eastdil Secured and Meridian Capital Group, an exclusive analysis by The Real Deal found.

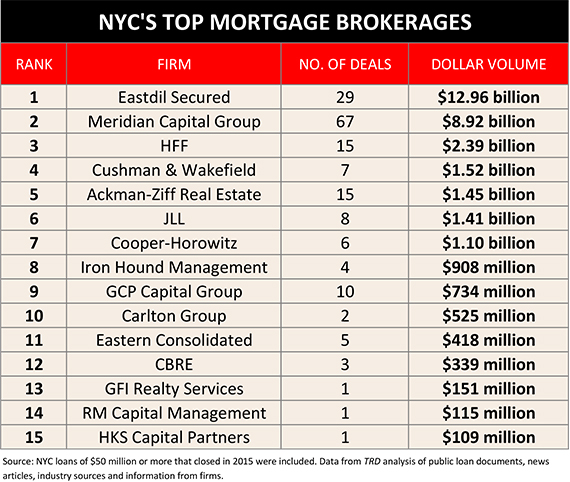

Eastdil Secured took the top spot in TRD’s ranking, brokering commercial loans on 29 deals valued at just under $13 billion. Meridian Capital Group, meanwhile, racked up 67 deals valued at just under $9 billion.

Together the two companies arranged a staggering 65 percent of the roughly $34 billion in secured loans of $50 million or more that closed in New York City in 2015 — and which had a broker advising on the deal. While there are no official numbers available, brokers pegged financing of all NYC deals (including those that didn’t involve a broker) at about $120 billion in 2015.

While the world of mortgage brokering does operate quietly, there is, of course, big money on the line. And last year all firms that made the ranking benefited from a record year for investment sales in 2015. That’s because where there are building sales there is financing.

However, most insiders TRD talked to don’t expect 2016 to be a repeat year.

“We anticipate that 2016 will be characterized by relatively modest growth and possibly some measure of increased caution on the part of investors and lenders,” Meridian’s CEO Ralph Herzka said in an email.

Still, the deals these firms are arranging are across the spectrum, from trophy building sales to giant multifamily portfolio sales.

Rounding out the top five on the ranking were HFF with $2.4 billion, Cushman & Wakefield with $1.5 billion and Ackman-Ziff Real Estate with $1.45 billion.

Robert Verrone, principal of the boutique commercial brokerage Iron Hound Management, which took the No. 8 spot, assessed the market more bluntly than Herzka did.

“It’s going to be worse this year,” said Verrone, who during the early aughts earned the nickname “large loan” Verrone. His firm’s largest deal was a $350 million loan taken by owners SL Green Realty and Moinian Group at 3 Columbus Circle.

To broker or not to broker?

The last time TRD ranked commercial mortgage brokers, back in 2013, we looked at loans of $100 million and up. And sure enough, Eastdil and Meridian topped that list but with less of a lead.

This year’s ranking — which involved scouring city property filings for recorded loans and then matching them with firms through news articles, industry sources and the brokerage firms themselves — reveals not only the powerful position Eastdil and Meridian have in the market, but also the opportunity for other firms to expand.

In Manhattan alone, TRD reviewed more than 350 loans of $50 million or more totaling more than $65 billion. Of those, TRD was able to identify brokers on 94 of those deals. That leaves more than two-thirds of the deals either un-brokered or brokered by under-the-radar agents.

For example, Related Companies, which secured several billion in loans for Hudson Yards last year, did not use a broker, a spokesperson for the developer told TRD.

While some say those un-brokered deals show that borrowers are well equipped to negotiate for themselves, those in the business of brokering financing say it’s an opportunity. “That’s because investors who are sourcing deals and managing assets do not have the time or wherewithal to scrutinize the debt markets on a real time basis,” Herzka said.

Brokers and lenders are marketing their services aggressively to landlords or buyers.

“Most of the groups we represent are getting hammered by other brokers and lenders directly and constantly,” said Scott Singer, a principal with the brokerage firm Singer & Bassuk Organization, which did not appear on the ranking this year. TRD was not able to identify deals totaling more than $100 million — the cutoff for the ranking — for the firm and Singer would not disclose any deals it arranged.

The firm does, however, often work with multigenerational owners such as Rockrose Development and Jack Resnick & Sons. Earlier this year, Singer secured an agreement to be the real estate advisers for Resnick’s entire portfolio, which is valued at billions of dollars. It’s likely that the firm would also act as its mortgage broker as part of that deal, but Singer declined to elaborate on the details of the arrangement.

Another big firm that declined to disclose its deals was Midtown-based Estreich & Company, which works closely with major owners such as A&E Real Estate Management and Thor Equities.

All in the family

Eastdil, which also dominates New York City’s investment sales brokerage world, has mastered the art of feeding itself business.

Not only did the firm broker the sale of the 11,200-unit Stuyvesant Town and Peter Cooper Village to Blackstone Group and Ivanhoe Cambridge in December, it also brokered the $2.7 billion loan they used to buy it. And the debt was supplied by its parent company Wells Fargo.

Still, according to public records, Eastdil has tapped a wide array of lenders other than Wells Fargo on its deals, including insurance companies such as New York Life and private equity firms like TPG Capital.

Meanwhile, Meridian’s top deal was RXR Realty’s $785 million loan secured by 230 Park Avenue.

But the firm also did several large multifamily portfolio loans, including a $592 million loan for Blackstone, which was used to buy a large group of apartment buildings formerly known as the Caiola portfolio. That loan was issued by Annaly Capital Management.

Several new firms debuted on this year’s ranking as well. They included the Great Neck, Long Island-based GCP Capital Group and the Midtown-based RM Capital Management.

GCP Capital — founded by Paul Greenbaum, Matthew Classi and Alan Perlmutter —completed 10 deals totaling $734 million in loans with a focus on multifamily assets.

The firm’s largest deal last year was the $121 million refinancing of several Stellar Management apartment buildings. RM Capital — headed by Marc Sznajderman and Romano Tio — placed one large loan last year totaling $115 million from Deutsche Bank for Savanna and the Silvermintz family’s commercial development project at 540 West 26th Street in Chelsea.

While more deals do equal more financings, there may be a silver lining for these high-value commercial mortgage brokerages if the market continues to soften a bit — at least that’s the sales pitch that mortgage brokers make.

They argue that in rockier markets mortgage brokers can add value. If, for example, a developer is working with a bank on its own, and that bank decides to stop issuing construction loans, a mortgage broker will be in better position to tap into the market to find other lenders.

Michael Gigliotti, managing director at HFF, said borrowers may not get “what they need” from their existing relationships with lenders when times get tough.

“As things get a little bit choppier, we are seeing phone calls pick up,” he said.