After years of taking a back seat to the booming technology, advertising, media and information (TAMI) sector, financial firms have gotten behind the steering wheel of Manhattan’s office leasing market.

Banks and financial services firms inked one-third of new leases in Manhattan during the first half 2017, up from their average of 24 percent between 2014 and 2016, according to Cushman & Wakefield. Meanwhile, TAMI firms accounted for roughly 20 percent of new office leases signed in the borough, a decrease from their 29 percent average over the prior two years.

Wall Street has had a rosier outlook since Donald Trump assumed office, mainly due to his promises to deregulate the financial markets and simplify the tax code — and the recent jolt in activity may be the result of pent-up demand.

“After playing defense for 10 years and shrinking their space, there’s very little room available at their current premises for growth,” said RXR Realty CEO Scott Rechler. “Now they’re thinking about playing offense.”

BlackRock takes the cake for the largest lease by a financial firm in the city so far this year. In May, the asset manager agreed to take 847,000 square feet at Related Companies and Oxford Properties Group’s 50 Hudson Yards. Less than a month later, Mizuho Americas, the stateside division of Japanese bank Mizuho Financial Group, inked a lease for 148,000 square feet at Rockefeller Group’s 1271 Sixth Avenue.

And there appears to be more demand on the horizon. Morgan Stanley has been shopping for a new headquarters spanning 1.9 million square feet. The banking giant is looking to consolidate its offices at 1585 Broadway and 522 Fifth Avenue in Midtown. The firm has been looking at the Far West Side, according to reports.

SL Green Realty CEO Marc Holliday said on the company’s latest earnings call that he’s seen “some big international corporate headquarters requirements” that could fill the firm’s 1.7 million-square-foot One Vanderbilt. TD Bank is the only tenant signed on at the tower, which is slated for completion in 2020. Holliday also noted that financial services firms account for roughly 40 percent, or 500,000 square feet, of the company’s pending leases.

Big banks and hedge funds, similar to other types of tenants, are moving into new construction or recently renovated buildings, said Evan Haskell, a member of CBRE’s landlord representation group. Earlier this year, his team worked on Citigroup’s 11,000-square-foot lease at the Cornell Tech campus on Roosevelt Island.

But when it comes to the boutique hedge funds that pay top dollar to be in Manhattan’s priciest trophy buildings, Haskell said Park Avenue and the Plaza District still can’t be beat. “You can’t get Central Park views over at Hudson Yards,” Haskell said.

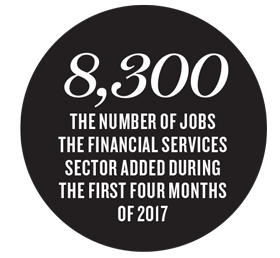

Cushman & Wakefield’s principal economist, Ken McCarthy, pointed to job growth in the financial services sector as one of the reasons for the uptick in office leasing. In the first four months of the year, financial firms added 8,300 jobs in the city, its best four-month period in history, he said. Over the last eight years, the industry only added an average of 1,600 jobs every four months.

Cushman & Wakefield’s principal economist, Ken McCarthy, pointed to job growth in the financial services sector as one of the reasons for the uptick in office leasing. In the first four months of the year, financial firms added 8,300 jobs in the city, its best four-month period in history, he said. Over the last eight years, the industry only added an average of 1,600 jobs every four months.

“You can’t prove it, but we suspect a lot of these jobs may not be [for bankers or for securities folks],” McCarthy said. “They may be technology professionals.”

Indeed, banks in particular have been inking big deals for their technology arms.

In May, Capital One agreed to expand its footprint at Savitt Partners’ 11 West 19th Street in the Flatiron District. The bank already occupies 78,000 square feet in the building, and it needed an additional 52,000 square feet for its tech division. And in June, JP Morgan Chase tripled its footprint at Brookfield Property Partners’ 5 Manhattan West on the Far West Side, signing a 15-year, 305,000-square-foot lease to expand its financial-technology division. The bank reportedly expects to increase its head count from about 650 employees to somewhere between 2,000 and 2,400 people.

Job growth in the financial industry lagged behind the TAMI sector each year since 2010, a trend that reversed in the first half of 2017, when tech firms actually saw a decline. It should be noted, however, that while tech firms have grown faster over the last seven years, financial firms have continued to be the largest employers in the city.

“Let’s not mistake it, New York is still a financial services town,” McCarthy said.