The total amount of available ground-floor retail space along Madison Avenue has been growing in recent months, insiders said.

The total amount of available ground-floor retail space along Madison Avenue has been growing in recent months, insiders said.

“There are a lot of vacancies on Madison Avenue, where normally there would not be,” said Colliers International broker Patrick Breslin, who is representing tenants looking at space on the high-end stretch.

An analysis by The Real Deal backed up that assessment. It found that 17 percent of the ground-floor retail space on the prime stretch of Madison Avenue from 56th to 89th streets is listed or being quietly marketed, making it one of the softest retail markets in the city.

Brokers said rising asking rents on Madison are having a boomerang effect and prompting retailers who would normally opt to take space there to look for cheaper alternatives. The same is happening in other popular areas such as Soho and Times Square, which are dealing with the reality of being so pricey that they are turning off potential tenants.

“All of the high-profile retail corridors are seeing many empty and/or occupied-but-available spaces,” said Robin Abrams, a broker at commercial firm Lansco, noting that tenants are reacting to steep rent increases that went into effect over the past few years.

Figures from the Real Estate Board of New York, the industry’s biggest trade group, found that asking rents broke a staggering $2,200 per square foot in prime stretches of Madison Avenue last fall. Those sky-high rents have, in turn, scared tenants who have become particularly sensitive to the possibility that the entire real estate market is softening, brokers said.

Some tenants who signed deals near those levels — such as Qatari jeweler Qela, which in 2014 announced plans to move into Thor Equities’ 680 Madison — actually never moved in. That space was returned to the market where it remains.

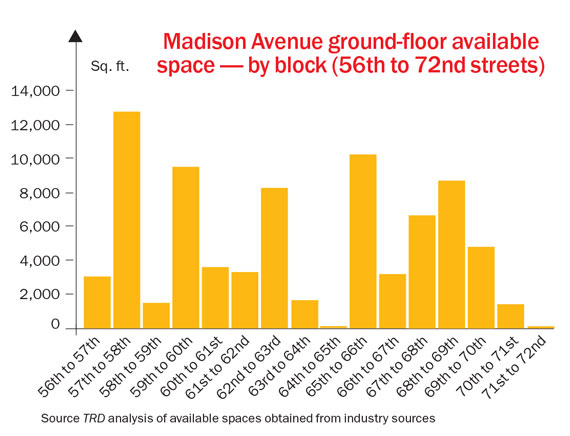

TRD’s analysis, which was compiled from lists provided by industry sources, found that roughly 134,000 square feet of ground-floor retail space is up for grabs on the 33-block stretch. By comparison, an analysis of property records maintained by the Department of City Planning, pegged the total amount of existing ground-floor retail space at 790,000 square feet.

The largest chunk of available space is concentrated on Madison in the 60s, with nearly 50,000 square feet in play along those 10 blocks.

The biggest individual spaces are a 7,052-square-foot store at 706 Madison, which landlord Friedland Properties is redeveloping, and a 5,993-square-foot space at Vornado Realty Trust’s 595 Madison Avenue, which insiders said is quietly on the market.

Retail insiders said some of the buyers who acquired properties over the last year or two at eye-popping prices have their hands tied by investors, partners or banks who won’t let them lease to retailers below certain target amounts or “pro forma” numbers. That, they say, is exacerbating availabilities.

“New owners who bought at record prices that required record rents are less likely to cut pricing because they can’t satisfy their investment returns,” said Jeremy Ezra, a broker at RKF.

But brokers said this slowdown is different from the recession in 2009 and 2010 when retailers did not have the financial wherewithal to make deals. That’s not the case today.

“Plenty of people want [to sign deals],” said Chase Welles, a broker with SCG Retail. “They just don’t want to pay the rent.”