The following is a preview of one of the hundreds of data sets that will be available on TRD Pro, the one-stop real estate terminal that provides you with all the data and market information you need.

While San Francisco’s office market has been among the hardest-hit by the pandemic, the 52-story office tower at 555 California Street in the Financial District has locked in some of its big-name tenants for the long haul.

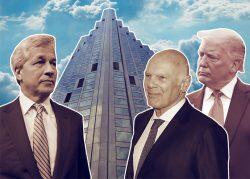

The owner, New York-based Vornado Realty Trust, announced big renewals with the likes of Bank of America and Goldman Sachs on an earnings call, highlighting the quality of a trophy asset that it had just spent several months trying to sell.

“These are great buildings that should and will command premium pricing and deserve premium pricing,” CEO Steven Roth said on the call, referring to 555 California and Manhattan’s 1290 Sixth Avenue, both of which the real estate investment trust co-owns with former president Donald Trump.

Refinancing the properties would be “basically a layup,” Roth added, noting that 555 California in particular was “extremely underlevered.” Sure enough, Vornado locked in a $1.2 billion CMBS loan for the San Francisco property a few months later. JPMorgan originated the financing.

Ratings documents associated with the refinancing provide an inside look at the property’s finances and rent roll.

The 1.8 million-square-foot campus, which also includes two smaller towers at 315 and 345 Montgomery Street, was 93 percent leased to 41 unique tenants as of February, according to a report from DBRS Morningstar. Tenants pay a weighted average of $79.85 in annual rent, slightly below average for the North Financial District submarket.

The largest tenant, Bank of America, is the only tenant taking up more than 10 percent of the rentable area. The investment bank has a long history with 555 California Street, having built it in 1971 and used it as a headquarters until its 1998 merger with NationsBank.

Bank of America recently executed a 10-year lease extension at the property and will consolidate its San Francisco offices into the tower. The base rent for the extended lease will be determined in 2023, based on the “fair market value rent” at the time.

Goldman Sachs, which has 90,000 square feet at the property, executed a five-year renewal which pushed its rent to $110 per square foot from a range of $59 to $75. Since 2019, the property has seen a total of 513,000 square feet in leasing, with a weighted average rent of $101.56 per square foot.

Nineteen tenants, accounting for 69 percent of the rentable area, are investment-grade or ranked in the Am Law 100, according to the DBRS report.

Read more

The pandemic had a limited impact on 555 California Street’s rent roll, with just five tenants covering 2 percent of the total space — mainly retailers — seeking rent relief. But physical occupancy dropped significantly during San Francisco’s lockdown, with only about 200 people entering the building on an average day in April, compared to more than 4,500 pre-pandemic.

The five-story office building at 345 Montgomery Street was fully leased to Regus before the pandemic, but the flexible office provider backed out last May, prompting Vornado to sue. The 78,000-square-foot space, which is said to be best suited for a single tenant, is being actively marketed for lease.

The floating-rate CMBS loan, which has an initial term of two years plus five one-year extension options, returned more than $600 million in equity to the borrower entity, in which Trump has as 30 percent passive economic interest.

“He doesn’t have anything to say about the decisions that we make” about the properties, Roth said of Trump on an August earnings call.