A survey from UCLA and USC researchers helps illuminate the extent of Los Angeles tenants’ – and landlords’ – pain during the pandemic. And it comes out to an estimated $3 billion.

The study was released last week and included data from March, as the nation’s economic recovery was heating up but months before California would drop most of its pandemic restrictions. To assess how Los Angeles County renters were faring, the researchers surveyed 1,000 renter households about their ability to pay rent during the pandemic. The report was first reported on by the Commercial Observer.

Roughly half of respondents said they owed their landlord money, at a median amount of $2,800. The 1,000 renters reported owing over $1.5 million in aggregate, which translates to upwards of $3 billion in pandemic-borne tenant debt throughout L.A. County, the authors concluded.

The data also revealed racial inequities. “The rent owed varies across individual households by race and ethnicity,’ the report said, “but Black and Asian households who are behind appear to be further behind.”

The March 2021 data served as a followup to a similar survey of 1,000 different tenants conducted by the researchers in July 2020, toward the beginning of the pandemic. In the initial survey, about 7 percent of tenants said they had not paid rent at all for at least one of the previous three months – more than three times the corresponding figure from before the pandemic. In March 2021, the 7 percent figure remained the same, but 31 percent of respondents also said they owed at least some debt from the previous three months. That percentage was more than double the figure from July 2020.

The new data also showed that tenants had taken on more debt as the pandemic dragged on: In the second survey, among renters who were behind, more than 40 percent said they had used credit cards to help pay rent. In the first survey the number was less than 20 percent.

The data comes at a particularly tense moment for both struggling renters and landlords, who in many cases are also buckling from months of missed tenant rent payments.

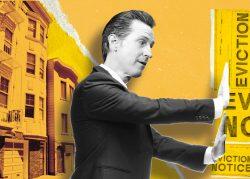

While California Governor Gavin Newsom recently announced $5.2 billion in new rent relief funds, the state’s moratorium is set to expire on October 1, leading to fears of a long-delayed wave of evictions and homelessness. Last May, another UCLA study estimated more than 350,000 L.A. County tenants would be evicted once the state’s ban expired.

[Commercial Observer] — Trevor Bach

Read more