Los Angeles is in the throes of a housing shortage and affordability crisis, and one symptom is urban rental prices that are projected to keep rising.

This year’s largest apartment deals reflect a broadening approach to addressing the housing crunch, with four of the five largest deals in the segment joint projects between developers and the California Statewide Communities Development Authority (CSCDA). The joint powers authority that enables local governments to access tax-exempt financing for projects with a public benefit. Where developers and operators agree to keep rents below market in exchange for the financing.

The CSCDA deals, financed with tax-exempt bonds, are intended to convert market rate housing into middle-income or “workforce housing,” which is meant to be affordable to tenants who earn between 80 and 120 percent of the area median income. It’s a class of renters that generally includes working professionals such as teachers, nurses and many municipal workers — residents that cities depend on to function but who, in California, have recently often been priced out of urban areas such as Los Angeles.

Workforce housing gained momentum in 2021, as several developers partnered with the CSCDA and local municipalities, including cities such as Glendale, Pasadena and Long Beach, to ink agreements on major projects.

Altana, Glendale – CSCDA, Waterford Property Company | $300M

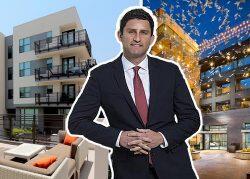

The Altana Complex and Waterford’s John Drachman (Waterford)

With $339 million in tax-exempt bonds issued by the CSCDA, Newport Beach-based Waterford bought the Altana, a 507-unit complex, in April. The seller was Carmel Partners, a firm that months earlier was docked with a $1 million fine for its role in the Jose Huizar pay-to-play scandal.

The deal was one of several in which Waterford partnered with the state agency for planned workforce housing conversions. The Altana, currently a luxury complex, is located at 633 N. Central Avenue, north of downtown Glendale, and markets itself as a building “enriched with resort-style amenities, nestled on an acre of private, open space.”

Next on Lex Apartments, Glendale – CalCHA, Catalyst Housing | $292M

Cypress Equity’s Michael Sorochinsky and the Next on Lex complex (iStock)

This deal was also part of a planned workforce housing conversion.

California Community Housing Agency bought the 494-unit complex, located at 275 W. Lexington Drive, in April from Century West Partners. Century West had completed the development in 2019.

The state-funded California Community Housing Agency was established two years ago; in April, just before closing this deal, the agency also bought another apartment complex property in Glendale. Catalyst Housing was slated to be the manager for both of those properties.

The Residences at Westgate, Pasadena – CSCDA, Waterford Property Company | $237M

Residences at Westgate, The Hudson and Waterford co-founder John Drachman (Waterford Property Company, the CSCDA)

In this deal, completed in June, Waterford and the CSCDA partnered again to purchase a 340-unit complex located at 231 S. De Lacey Avenue in Pasadena.

Waterford bought the apartment complex from Equity Residential, one of the largest apartment owners in the country.

Kings Villages, Pasadena – Jonathan Rose Companies | $223M

Kings Villages (Rent.com)

Jonathan Rose Companies, a New York-based developer and investment firm, bought this affordable housing complex in November.

The seller was the Affordable Housing Development Corporation, an entity based in Fresno County that had bought the property in 2000 for $25 million and renovated it in 2003, according to AHDC’s website.

The 313-unit complex is located at 1141 North Fair Oaks Avenue and receives a 100 percent state welfare real estate tax exemption. The complex has a contract with the U.S. Department of Housing and Urban Development, which provides assistance to tenants, that extends until 2035.

Union South Bay, Carson – CSCDA, Standard Communities | $220M

Standard Communities Co-Founders Scott Alter and Jeffrey Jaeger with the Union South Bay complex (Standard Communities)

In this June deal — another workforce housing conversion — the developer Standard Communities partnered with the CSDA to buy a 357-unit building in Carson. The seller was Carson Avalon Development Company, according to records.

The complex, located at 615 E. Carson Street, also includes 28,000 square feet of retail space, a fitness center, pool and bar. The deal was one of several planned workforce housing conversions for Standard: In a partnership with Faring, in August the developer announced ambitious plans to spend $2 billion on the projects within two years.

Read more