Trending

DTLA tower gets $389M refi from Goldman Sachs

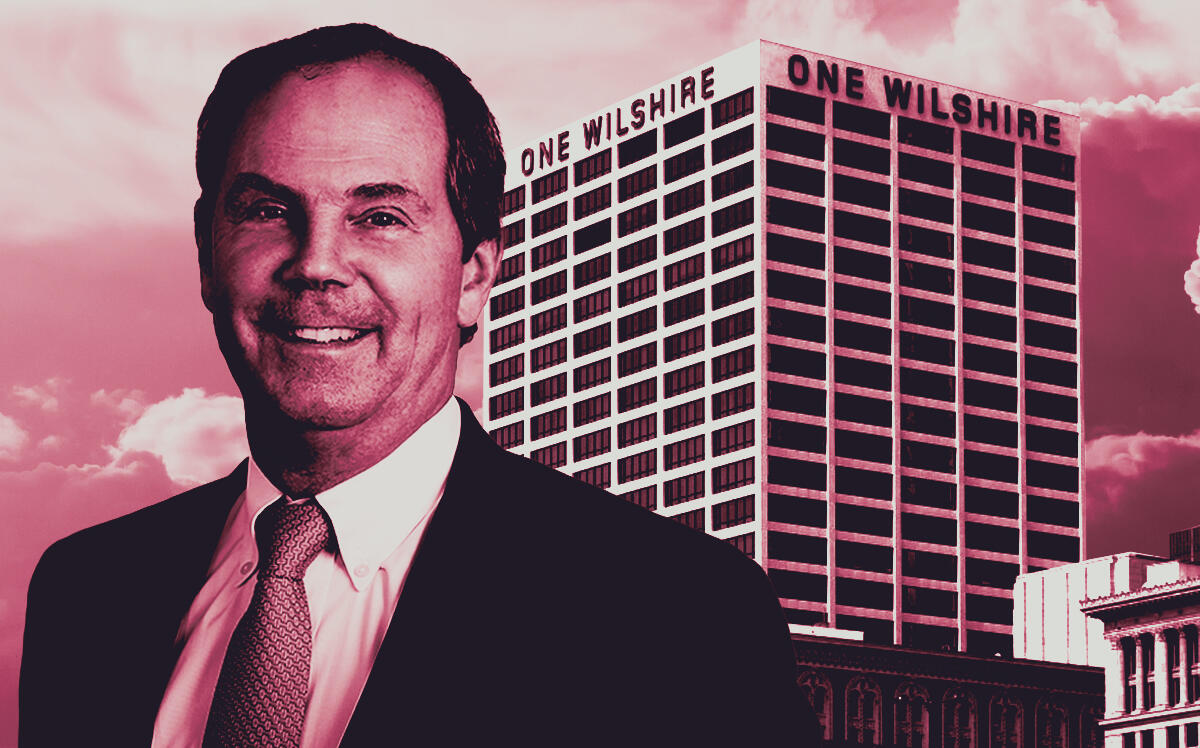

GI Partners takes loan on 661K sf data center at Wilshire & Grand

A tower with a lot of data storage just scored a lot of new cash.

GI Partners obtained a $389.25 million refinancing package for the 661,000-square-foot One Wilshire, situated where Wilshire Boulevard starts at Grand Avenue, according to JLL, which arranged the financing.

Goldman Sachs provided the 10-year, fixed-rate, interest-only loan. GI Partners will use the funds to pay off an existing loan and buy out a portion of the equity.

The 30-story tower at 624 South Grand Avenue operates as an internet exchange, with 13 onsite generators, five utility power hubs and onsite fuel storage.

GI Partners bought the property from Hines for $437.5 million in 2013, records show. It secured a $180 million loan on the property from Cantor the same year.

AT&T, Verizon, Time Warner Cable and Coresite are among tenants at the property, which is currently 89 percent leased.

Though demand for urban office space in L.A.’s has shrunk during the pandemic, the area has seen more demand for data center space.

In the first half of 2021, developers and investors took up 7 megawatts worth of data center space, compared to around 2 megawatts for the entirety of 2020, according to JLL. As people shifted to working, shopping and consuming content online during the pandemic, more data center space was needed to handle demand.

Relatively few refinancing deals for office towers closed in 2021, though interest rates remained low. In February of last year, Brookfield scored a $465 million refinancing deal for its 54-story Gas Company Tower at 555 West 5th Street in Downtown Los Angeles.