This red-hot market isn’t slowing down just yet.

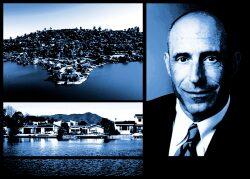

In the last three months of 2021, even after an extended period of soaring prices throughout the pandemic, residential sales in a key swath of Los Angeles and much of the rest of Southern California yet again notched multiple records, according to a report published today by appraiser Jonathan Miller.

“It was a monster quarter,” said Miller. “What we’re seeing is a significant surge in sales combined with a collapse in supply…. The market pace is blistering.”

In the report’s analysis for Greater Los Angeles – a term used by Miller for an area stretching from Downtown L.A. to the Westside – pointed to records on average sales price, median sales price, and inventory.

The average fourth quarter sales price for the area was $3.03 million, up more than five percent compared to the third quarter and more than 14 percent compared to the fourth quarter of 2020, when the average sales price was $2.6 million.

The median sales price, a metric not susceptible to being skewed by extreme sales — such as the $133 million paid in late December for a Bel Air mansion — also reached a new higg of $1.78 million. That figure was roughly three percent higher than the price for the third quarter, and nearly eight percent higher compared to a year earlier.

Fourth quarter closings also shot up, from 1,543 in late 2020 to 1,859.

Underlying the high numbers, said Miller, is both a continually strong demand — especially from the upper half of the market — and a severe shortage of available houses. And that inventory gap has only been growing: The report counted just over 1,600 listings in the Westside and Downtown last quarter, compared to neary 3,300 a year earlier.

“In one year it’s fallen by half — that shows you the intensity of demand has been burning off supply faster than it can be created,” said Miller.

That dynamic also explains another neck-craning data point: Even at such high prices, nearly four out of ten sales in the Greater L.A. market came from bidding wars.

Within the report’s L.A. region, Beverly Hills easily notched the highest fourth quarter median price, at $8.2 million. Bel Air and Holmby Hills saw a median of $4.65 million, Century City and Westwood saw a median of $3.4 million, and Santa Monica was at $3.18 million.

Overall, condos remained significantly cheaper than single family homes, although that housing type, which has been gaining popularity for years, has also seen soaring prices. The median condo sale price in Greater L.A. was $985,000 last quarter, up from $930,000 in the fourth quarter of 2020.

Consistently pricey Malibu and Malibu Beach also saw year-over-year jumps, as did the luxury market overall.

In Orange County — where more than six out of ten sales came from bidding wars — the average sale price jumped from $1.06 million a year earlier to $1.27 million last quarter, a nearly 20 percent rise.

Inventory in the suburban county also reached a record low.

“It’s insane,” Miller said of the OC surge.

The recent rise of the Omicron variant may have played a part in last quarter’s surge by delaying interest rate hikes and prolonging what’s now been an extended period of frenzied demand, Miller said. Yet even with multiple interest-rate hikes expected this year, the Southern California market, in particular, will likely remain relatively hot, thanks to strong economic fundamentals and the extent of the region’s inventory gap, which will likely remain for years.

Read more