An LLC tied to the Colombian billionaire Jaime Gilinski is raising the asking price — by $11 million — on an undeveloped Bel Air property previously owned by the convicted Ponzi schemer Robert Shapiro.

The new ask of $45 million showed up on listing sites last weekThe parcel had been listed in May of 2021 at $34 million.

“Located in arguably one of the most desirable areas in Los Angeles, this almost 1.3-acre flat lot offers endless opportunity,” boasts the listing, held by The Agency brokers Adam Rosenfeld and Jon Grauman. “This is a rare opportunity to own the only available and permitted lot of its kind in lower Bel Air for a world class residence.”

Rosenfeld, the lead broker, did not respond to multiple interview requests. Gilinski also did not respond to an interview request.

The rationale for the dramatic price hike remains unclear, although it could have been inspired by another recent sale: Earlier this spring, TRD reported that a nearby parcel, also vacant and the same size, had traded hands for $39 million, a price that ranked in the region’s top 10 residential sales of the year.

Even for the rarefied hills of Bel Air, both prices — the $39 million sale and the new $45 million ask — represent unusual pricing territory for undeveloped land. In December a different undeveloped property in the neighborhood, a vineyard formerly owned by Sylvester Stallone, sold for $17.5 million. In August the former Elizabeth Taylor estate, which includes a house that will likely be torn down or overhauled, sold to the spec developer Ardie Tavangarian for $11 million.

The property now listed for $45 million is located at 805 Nimes Place, which juts off the winding Nimes Road, in eastern Bel Air. The 1.3-acre site features “panoramic views from Downtown Los Angeles to the [ocean],” according to the listing.

It remains undeveloped, but some construction prep work has been done, according to the listing, including grading, the implementation of retaining walls, and the excavation of a 10,000-square-foot basement. One firm, Bulli Architecture and Development, has prepared plans for a 40,000-square-foot home, the listing adds, while another firm, Woods and Dangaran, is working on conceptual plans for a potential 27,500-square-foot home.

Read more

And while the choice parcel doesn’t have a house, it does have an intriguing recent history — hinted at by the dueling architectural plans.

In 2017, the land was owned by an entity called 805 Nimes Place LLC, which was controlled by the developer Keat Bollenbach, who is also known as a major investor behind the popular Downtown L.A. restaurant Bottega Louie. Bollenbach is the president of Bulli, which prepared the original 40,000-square-foot plans. Through the same entity, Bollenbach also owned 801 Nimes Place, the nearby plot that recently sold for $39 million.

That May, Bollenbach sold 805 Nimes Place to a group called Bishop White Investments, an entity controlled by the former Sherman Oaks-based developer Robert Shapiro, for $35 million. Shapiro turned out out to be the mastermind of one of the largest real estate Ponzi schemes in recent history: In 2019, two years after picking up the Nimes Place parcel, he pleaded guilty to multiple fraud charges, and was subsequently sentenced to sentenced to 25 years in prison.

Shapiro’s scheme, which began in Florida, had spanned five years and defrauded more than 7,000 investors, most of them retirees, to the tune of $1.3 billion. The profligate buyer also used the scheme to support his own lavish lifestyle, with a taste for chartered planes, Picassos and vintage wines.

“He came to the conclusion he would like to take responsibility for his actions,” Shapiro’s lawyer, Ryan O’Quinn, told a federal judge in Miami when he pleaded guilty, the Miami Herald reported.

When Shapiro pleaded guilty, in August 2019, he agreed to forfeit his assets, which included numerous luxe L.A.-area properties, to the government so money could be raised to repay investors. But by then Shapiro’s scheme was already crumbling, and his company had declared bankruptcy and begun offloading assets on its own: Some seven months earlier, that January, his entity Bishop White Investments sold 805 Nimes Place for $25.6 million to an entity called JGDB, a Delaware-registered LLC that records indicate is controlled by Gilinski, the Colombian billionaire, out of his offices in South Florida.

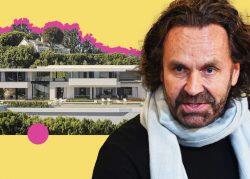

Gilinski — a 64-year-old banking magnate who lives in London but has also recently been acquiring property in Miami — ranks as the Latin American country’s second-richest man, according to Forbes, with a fortune currently estimated at $4.3 billion. After buying 805 Nimes Place in early 2019, the entity listed it in May of 2021 for $34 million before re-lising last week, at the new price of $45 million.

Early this year JGDB also filed a lawsuit against Bollenbach’s entities, claiming that they were attempting to prevent JGDB from building a home on the property based on a prior development agreement Bollenbach’s entities had made with Shapiro that required the home to be built with Bollenbach’s firm’s architectural plans.

“This lawsuit concerns Defendants’ efforts to hold Plaintiff hostage by using an unenforceable agreement entered into between Defendants and a convicted fraudster,” it began, also referring to the proposed home as a “gargantuan structure.”

Records show that JGDB, however, dropped its suit in February, the month after filing it. It was unclear when the new firm, Woods and Gangarian, began developing its development plans.