Will Los Angeles ever be a luxury condo metropolis? Zoning laws, building costs and buyers’ preference for more space have all conspired to keep L.A. homes close to the ground. But there are signs that the local condo market is gaining some steam.

The $21 million sale of a unit in Beverly West Residences in July made headlines, while actor Matthew Perry listed his Century City condo for $35 million just weeks later. Luxury developments in Beverly Hills and West Hollywood are also pointing to a new era, with Michael Shvo’s 9200 Wilshire project recently launching and the Residences at the West Hollywood Edition opening earlier this year.

Sales data show that there’s a market for this kind of inventory. The Real Deal analyzed condo sales of $2 million and higher in L.A. County that closed between Sept. 1, 2018, and Aug. 31, 2019, and found that 164 units closed during the period, with an average sale price of more than $3 million. But there’s still plenty of room for growth.

“L.A. historically has just never been a vertical town,” said Mike Leipart, managing partner of the Agency Development Group, an arm of the Agency brokerage that works with new properties through the entire development cycle.

Though the brokerage is based in L.A., Leipart said it’s “probably the slowest major market in the U.S. for high-rises.” With clients in Miami and Mexico, the group’s biggest projects aren’t local. But it’s currently working on smaller developments in the city, like Hancock Park’s the Sevens and the eight-unit Meyer at Third in Beverly Center. Leipart said he’s still optimistic about the future of luxury condos in the city, especially when all the right boxes are checked, starting with location.

“There’s great demand for the places you’ve heard of a million times: Beverly Hills, West Hollywood, even Hollywood,” said Leipart. “In Santa Monica, the sky’s the limit. Venice is great. Malibu is great — there’s just nothing new.”

Where this party started

Where this party started

Related Companies developed one of the projects that kicked off the push for luxury high-rises in the city. Its Century City condo project, the Century, opened in 2010, but it took some time to sell out. In 2012, the New York Times reported that the 140-unit building was only 30 percent sold. Compass broker Sally Forster Jones said the timing, in the midst of the financial crisis, and the fact that it was the first of its kind meant it took a while to gain traction. Today, “luxury buyers are really flocking to those types of properties,” she said.

In August, a unit at the Century sold for $9.8 million, and TRD’s analysis showed that four other units in the building sold over the past year, going for between $5.9 million and $6.3 million. Perry’s $35 million listing in the building is currently the most expensive condo on the L.A. market. He purchased it for $20 million in 2017.

“There’s still a great desire for luxury condos because when people move from their big homes, they want to scale down,” said Jade Mills of Coldwell Banker. “They don’t want to move to something where they have to do any work.”

Jim Jacobson, SVP of sales at Douglas Elliman’s Development Marketing Group, echoed the sentiment, adding that luxury buildings provide a perfect way for empty-nesters or people who travel frequently to make sure “their plants are watered, their goldfish is fed, and there’s milk in the fridge when they come home.”

A number of luxury developments are scheduled to hit the market in the next few years, like the 37-unit Harland West Hollywood, which will open in late 2019 or early 2020; the18-unit Gardenhouse, scheduled to open this fall, and the 76-unit 8899 Beverly Boulevard, which doesn’t yet have a launch date. Meanwhile, Emaar Properties’ 35-unit Beverly West finally put its five penthouses on the market this summer, and developer Richard Lewis purchased the first one in the aforementioned $21 million sale.

Jones noted that many of the luxury projects now underway have hotels attached, providing residents with the same full suite of amenities that hotel guests enjoy, like concierge services, wellness offerings and high-end restaurants. The Edition, Four Seasons Private Residences, Fairmont Residences at the Century Plaza and Pendry West Hollywood are all being developed as both hotels and luxury condos.

“I really think the next wave is more personalized service, more service-oriented than ‘Our pool is X amount of feet,’” Leipart said. “A lot of what used to be considered great amenities is outdated.”

Jacobson cited the Edition and the Harland, new buildings that Elliman is exclusively representing, as properties his team worked closely with to make sure the amenities appealed to the potential buyers.

Providing “value” in a slow market

L.A.’s luxury real estate market has seen a slowdown over the past year, but some brokers don’t see it as a downturn, more as a rebalancing as properties are priced closer to what they’re worth.

“As long as you provide a value proposition for buyers in luxury high-rise projects, you’ll find buyers that are out there,” Jacobson said.

Just 10 months after sales launched, Adept Urban’s 105-unit property at 388 Cordova Street in Pasadena is 70 percent sold, according to Robert Montano, vice president of development for the firm. He touted the nine-story building’s unique composition for the area, where most of the buildings are five-story or single-family.

And while luxury buyers tend to gravitate toward brand-new buildings, Jones said older properties still have cachet if they’re unique. She cited a penthouse in Westwood that she sold for $13.33 million this year. Even though the property was built in 2001, she said the rooftop deck, a 1,800-square-foot terrace and its own elevator made it “very, very special.”

“That’s what the buyer wanted; none of the other properties could offer that,” Jones said.

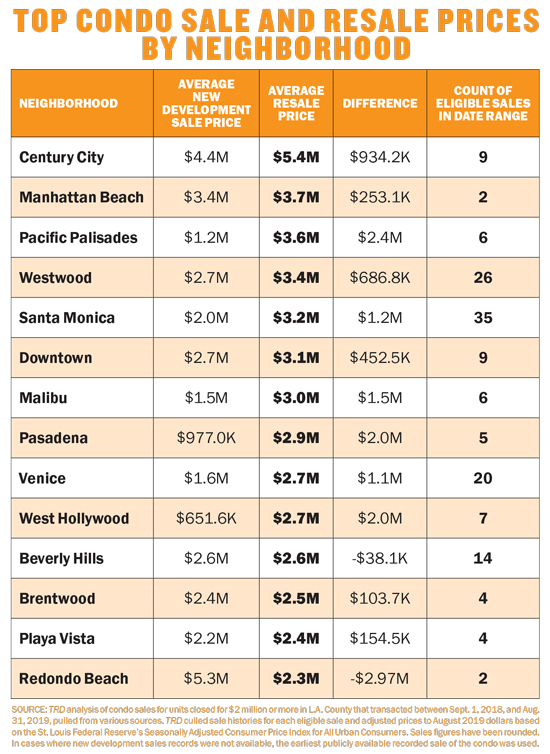

Units in older luxury buildings may also have strong resale value. TRD’s analysis found that luxury resale condos closed for an average of $954,094 more than what they first closed for. Older buildings also tend to charge lower monthly fees.

“There are people who want to not only scale down in size but scale down in the price of the upkeep,” Mills said. “Newer buildings definitely have all of the amenities, [but] some have higher monthly maintenance fees. So for those, certain people will say they don’t want to pay $4,000 to $5,000 in fees, and maybe they’ll go to an older building because of that.”

Montano said the cost of amenities can be prohibitive for some buyers, so as a developer, Adept Urban tries to focus on what residents actually want.

“Throwing amenities at a project isn’t necessarily best for a project. They’re used infrequently but have to be paid for, and it results in higher HOA fees,” he said.

At 388 Cordova, HOA fees range between $588 and $1,531, depending on the size of the unit, and include access to a pool deck, spa, outdoor BBQ,and firepit. Compare that to Matthew Perry’s condo at the Century, which Curbed reported has HOA fees of $8,814 per month.

The trouble with Downtown

The glut of condo buildings Downtown has caused some people to question whether there’s actually a market for high-rises in L.A. But Leipart said it has more to do with mispriced properties and oversupply in that neighborhood in particular.

“If you look at the volume in Downtown, a lot moves out below $1 million, but it clears out quick above [that],” Leipart said. “With acquisition costs, construction costs, all the product being dumped down there, they need big numbers to make it work, but that’s not where people who can afford $3, $5, $6 million are really thinking.”

To Leipart’s point, a report from NorthMarq found that median condo sales were around $282,000 per unit Downtown and that there were approximately 7,000 units in the development pipeline as of the second quarter of 2019.

TRD’s own analysis, meanwhile, showed just nine condo sales Downtown above $2 million between Sept. 1, 2018, and Aug. 31, 2019, compared to 35 in Santa Monica, 26 in Westwood and 14 in Beverly Hills.

The mass of inventory Downtown isn’t the only thing adding to the negative perception of vertical living in L.A. Leipart said California’s financing regulations can make it difficult to launch projects. Unlike in some other major cities, developers in L.A. can’t use deposits to fund the project, meaning there’s not necessarily an incentive to sell in advance.

And yet lenders often want to see presales to guarantee interest in the project, which means that condos can hit the market years before they’re ready. But L.A. buyers are more likely to want units that are move-in ready, making it seem like there’s dwindling interest in luxury buildings even if that’s not the case.

“Projects are on the market for way too long, and it starts to smell bad when there’s really nothing wrong,” Leipart said. “We don’t sell condos three years before you can move in; there’s not a success story to point to.”

“Million Dollar Listing New York” star and Elliman broker Fredrik Eklund, who moved from New York to Los Angeles this year, is also taking on the new development market. The Eklund|Gomes team has already landed the new project developed by Townscape Partners at 8899 Beverly Boulevard in West Hollywood, which will include 40 condo units and eight single-family homes.

Elliman declined to give specifics on when the building will be completed, if Eklund’s team has already started selling units or what the price points will be. But as far as Eklund goes, competitors aren’t worried.

“Anything that elevates the game, anything that establishes L.A. as a market to be buying in and having successful projects in, I’m all in,” said Leipart. “Whatever Fredrik being in town cuts into my market share, I see way more value in him coming in and delivering successful projects.”