Let’s face it: The commercial real estate scene in Westchester and Fairfield counties isn’t exactly booming. While there are pockets of success, many office buildings sit empty or only partially occupied, with JLL reporting vacancy rates at about 25 percent for both counties in the second quarter of 2017. Though conditions vary from city to city, much of the excess stock lacks the amenities to meet the changing expectations of today’s employees, brokers said. And brick-and-mortar retail spaces in the region — as with many such properties nationwide — are also suffering high vacancy rates as customers gravitate to online shopping.

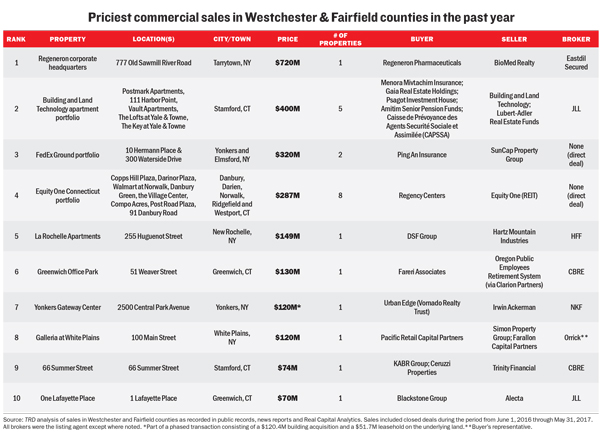

But commercial brokerage firms have still scored some big wins, according to a ranking of priciest sales compiled by The Real Deal using public records, press reports and Real Capital Analytics information on closed deals between June 1, 2016, and May 31, 2017.

Among the more spendy properties that changed hands were mixed-use developments near transportation hubs and a headquarters for a biotech company. Both of these types of properties are the future for a market that has been relatively stagnant, according to brokers.

“It’s a struggle,” said Chris O’Callaghan, a managing director at JLL. “Rents are similar to what they were 30 years ago; there’s been no growth. There’s too much supply and no ability to raise rents.” Average asking office rents are at just over $27 per square foot, according to JLL’s second-quarter report for Westchester County.

The sluggishness of the market has translated to commercial brokers largely staying where they are, without much movement between brokerages, experts said.

One exception was retail broker Carl Wunderlich’s return to Cushman & Wakefield in June. Wunderlich spent the last three and a half years at Greenwich-based Urstadt Biddle Properties and had previously worked at Cushman for eight and a half years.

“We were trying to round out our roster,” said James Fagan, a senior managing director at Cushman who manages its Stamford and Westchester County offices. “When you have three quarterbacks, you don’t need four, but we had a need in retail.”

Moving malls

It’s true that the retail sector at large does need some extra attention, with traditional malls and big-box stores facing an uncertain future all over the country, thanks in large part to e-commerce. Companies heavily invested in brick-and-mortar retail are getting rid of some of their less successful properties.

That includes real estate investment trust Simon Property Group, which, with Farallon Capital Partners, unloaded the Galleria at White Plains for about $120 million in September. California-based Pacific Retail Capital Partners, represented by Orrick, was the buyer. It was the eighth most expensive deal in TRD’s ranking.

That includes real estate investment trust Simon Property Group, which, with Farallon Capital Partners, unloaded the Galleria at White Plains for about $120 million in September. California-based Pacific Retail Capital Partners, represented by Orrick, was the buyer. It was the eighth most expensive deal in TRD’s ranking.

And some REITs are joining forces to survive the turbulence in retail. Taking the fourth slot on TRD’s list is the purchase of an eight-property portfolio of shopping centers by Regency Centers, a national shopping-center REIT. The $287 million transaction was part of the company’s recent merger with Equity One. The properties are located in Danbury, Darien, Norwalk, Ridgefield and Westport.

Medical advances

While office vacancies remain high in Westchester at large, the city of White Plains saw stronger leasing over the last three months, according to JLL’s second-quarter report for Westchester.

Brokerages are looking to the medical and life-science industries to breathe new life into the area’s commercial space. Several multimillion-square-foot developments have come to the area in the past few years, with more in the pipeline. Institutions are attracted to the highly educated workforce in the area as well as a population that is looking for medical treatment closer to home, brokers said.

The No. 1 transaction on TRD’s list was for a biotech firm, and it was closed by one of the biggest investment sales brokerages in the business: Eastdil Secured. Regeneron Pharmaceuticals purchased its headquarters at 777 Old Saw Mill River Road in Tarrytown for $720 million in March. Banc of America Leasing & Capital financed the deal; the seller was BioMed Realty, the San Diego-based company bought out by Blackstone Real Estate Advisors in early 2016. Blackstone and Eastdil have partnered on a number of multimillion-dollar deals nationwide.

Regeneron has been a tenant at the campus for 25 years. “This agreement will result in cost savings and also provide Regeneron with operational control of our site and future development plans,” said spokeswoman Erin Loosen in a statement.

Regeneron is one of the biggest players in the area, but changes in the medical industry at large are also bringing commercial brokers more business, said Fagan of Cushman & Wakefield. Smaller hospitals and medical centers are joining forces to develop long-term real estate programs, he said. That includes everything from exploring municipal incentives for expansion to investing in building out their current spaces, with Cushman advising on those moves.

“Medical is undergoing a metamorphosis,” he added. “It used to be a medical practice would take a space, put the lease in a drawer and no one would look at it again. Now companies are much more active.”

The millennial market

Current conventional wisdom dictates that the office market’s revitalization will come about if more spaces are designed with the millennial worker in mind.

Cushman is trying to get ahead of the game with several big listings that it hopes will appeal to that “live, work, play” lifestyle in the suburbs, where the cost is less than in the city. “A good living wage here is a really good wage,” Fagan said. “You can have a good life.”

The company is working with landlords to create appealing spaces within their buildings. Traditional tenant improvement packages often include bonuses like free rent and a budget to build out the space, but some buildings are building space before tenants get a peek at the property, Fagan said.

These prebuilds may be as small as 5,000 square feet, but they can be appealing to companies that want to move in without much hassle.

“Someone can come in and see the space and might say, ‘I’ll take that,’” Fagan said. “We try to get landlords to make the product more attractive to clients.”

Updates like these are key in keeping aging office buildings relevant, brokers said.

The most important amenity, however, is easy access.

“Investors want train-centric buildings,” said Jeffrey Dunne, vice chairman for capital markets and institutional properties at CBRE.

Greenwich Office Park, which took sixth place on TRD’s list of top commercial deals, is only about a mile from the Stamford Metro-North station. The $130 million sale is the largest office deal in Greenwich in the last five years, according to CBRE, the listing broker on the deal.

The buyer, real estate investment and construction company Fareri Associates, “plans to add retail and residential to the project,” Dunne said. Building amenities there already include a shuttle service, a fitness center and on-site car detailing.

Investing in Stamford

As in Westchester, Fairfield County tenants are moving toward cities rather than suburban campuses, brokers said.

Although the vacancy rate in Stamford is still high, JLL said that the city could soon see a renaissance. The city’s population increased by 5 percent over the last five years, and there’s been an uptick in residents between the ages of 18 and 34, according to the report. With all those millennial workers, JLL predicts more firms will gravitate back to the area.

A Stamford transaction ranked No. 2 on TRD’s list of most expensive commercial deals: the sale of five apartment buildings in the Harbor Point mixed-use development in the city’s South End. The $400 million deal, completed in December of 2016, included the Postmark, 111 Harbor Point, the Vault, the Key at Yale & Towne and the Lofts at Yale & Towne, with a total of 1,214 units changing hands. That works out to about $327,800 per unit.

And CBRE closed the $74 million sale of 66 Summer Street in Stamford, which took the ninth-place spot in the ranking. The luxury apartment building, which also has 6,600 square feet of retail space, was purchased by the New Jersey-based KABR Group and Ceruzzi Properties of New York. Several representatives from both CBRE’s Manhattan and Hartford offices facilitated the deal for the buyer; CBRE Capital Markets’ investment sales team represented the seller, Trinity Financial.

Stamford’s largest sale so far in 2017 was the $97 million purchase of an office complex in a transaction that closed after TRD’s cut-off for the ranking. Stamford Towers, at 680 and 750 Washington Boulevard, and 734 Washington Boulevard were purchased by CBRE Global Investors on behalf of an entity named SPUS8 Washington Blvd in July.

The building buys, close to multifamily properties, will spur on a trend that’s been raging on throughout the country.

Brokers hope the new owner of these buildings will work to draw a younger workforce, which, paired with the increase in nearby multifamily properties, will encourage the lifestyle trend on every developer’s lips.

—Harunobu Coryne provided research for this article