When President Donald Trump announced in June that the United States would pull out of the Paris climate accord, New York developer Jonathan Rose sensed that something more than an environmental safety net was at stake. He saw retreating dollar signs.

“Bottom line is, these are major economic opportunities,” he said, referring to technologies that promote energy efficiency, such as electric cars and solar energy. “We just ceded them to China.”

Nearly 200 nations, including the U.S., signed the Paris agreement in December 2015, pledging to dramatically reduce greenhouse gas emissions and limit global temperature increases to 2 degrees Celsius or less by 2100. In some ways, supporting the accord is a symbolic gesture — even if every participating country meets its reduction goals, the world is still on track to exceed that amount of warming by 2030. But inaction or silence on the issue accomplishes even less, and in the case of New York City’s real estate industry, rising temperatures could have grave consequences — from regular flooding to major storms like Superstorm Sandy that occur every few years.

Maya Camou, director of sustainability at the Manhattan-based development firm Time Equities, said “it was a no-brainer” for her company to formally sign a letter supporting the Paris climate accord. “Climate change is real, and you see it everywhere,” she said. “Our own properties all over the U.S., as well as internationally, will start being affected by these changes [over the next few years].”

New York real estate developers would seem inclined to support measures that would curb rising temperatures and extreme weather events — threats that could directly impact their assets. While a handful of companies are incorporating climate-conscious designs in new development projects, the industry at large hasn’t stepped up to make climate change a public priority.

“It’s very hard for people to grasp what things are going to look like in 100 years,” said Sweta Chakraborty, a risk management expert and assistant director of the Institute for Global Policy. “Whose job is it to look beyond their lifetime? Builders definitely don’t.”

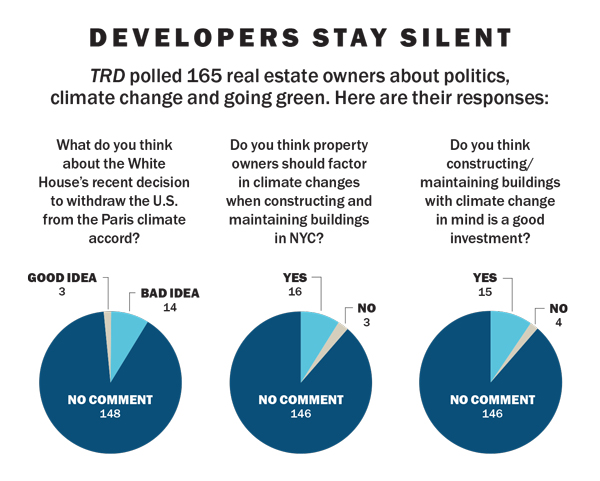

Of 165 real estate firms The Real Deal surveyed on Trump’s decision to remove the U.S. from the Paris agreement, 146 declined to participate. Some later said that they didn’t have an opinion on the matter, but most declined to participate without explanation.

When asked separately, the Real Estate Board of New York’s spokesperson Jamie McShane said that the lobbying group doesn’t have an official position on the agreement.

“To the extent that many in the real estate industry are political conservatives, it isn’t all that surprising that climate change hasn’t been high on their agenda,” said Michael Mann, a professor of atmospheric science at Pennsylvania State University. “It is unfortunate and rather ironic since the real estate industry may be among the hardest hit by climate change.”

New York real estate owners are not only among the most exposed when it comes to rising sea levels and storm damage, but they are also responsible for a majority of the city’s greenhouse gas emissions.

Buildings produce 75 percent of NYC’s annual emissions, which weighed in at an annual 52 million metric tons in 2015, according to the most recent data released by the city. Without dramatic reductions in fossil fuel use, sea levels could rise as much as six feet by 2100, and major storms that were previously expected every 100 years or so could instead occur every two to three years.

Jeff Moelis, director at L+M Development Partners, who was disappointed by the president’s choice to abandon the climate accord, said it’s not as easy for real estate as it is for other industries to collectively make its position known.

“The real estate industry is so fragmented. It’s not like oil or gas, where you have one company that’s the mouthpiece for the industry,” he said. “It’s a lot of small family businesses, so there isn’t one general thought leader.”

Playing the long game

After Superstorm Sandy pummeled New York City in October 2012 — resulting in $8.6 billion of private property damage — some developers and real estate owners took steps to guard their buildings. They moved mechanical equipment from basements onto higher floors, invested in detachable flood shields and added landscaping designed to intercept rainfall. Rudin Management, for example, elevated the second floor of Dock72, a waterfront office development in Brooklyn, 40 feet above the ground. And Brookfield Properties decided to add floodgates to One New York Plaza after more than 20 million gallons of water rushed into the building’s subterranean shopping mall.

But while these measures acknowledge the need to be proactive in the face of climate change, they only address immediate threats.

Sea levels in New York City are expected to rise 30 inches by 2050 — and by that point, roughly 90 percent of the city’s 1 million buildings will still exist, according to a study released by the city last year. Most of those buildings — 98 percent — span less than 50,000 square feet, according to the report. Because those small and mid-sized properties are rarely vacant and tend to change hands often, their owners are less likely to incorporate technology like solar and wind power or passive-house standards. In addition, some owners are not financially equipped or willing to wait a decade for the benefits of energy efficiency to pay off. Their investment horizons are limited to however long they plan to own the asset, and the added upfront cost and potential loss is enough to dissuade them from trying out new technologies that could cut down on energy use and carbon emissions.

“It’s a challenge to [retrofit] existing buildings when they are fully occupied,” said Justin Palmer, CEO of the sustainable property developer Synapse Development Group.

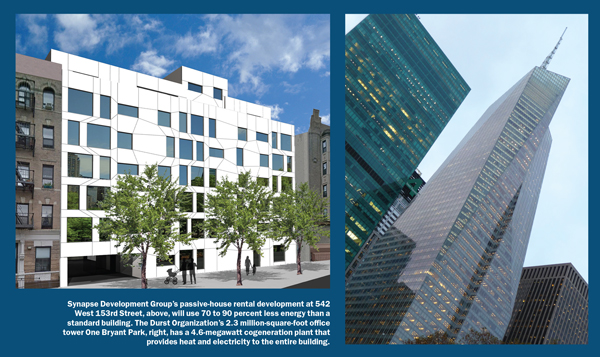

Synapse has had luck building from the ground up, and the company constructed Manhattan’s first passive-house rental apartment building, at 542 West 153rd Street. On average, passive houses use anywhere from 70 to 90 percent less energy than standard buildings, according to the independent research organization the Passive House Institute. The structures require airtight construction and an energy-recovering ventilation system in place of traditional heating and cooling equipment.

While similar projects have sprung up in the city over the past few years — including Cornell Tech’s 26-story residential tower on Roosevelt Island, which will be the world’s tallest passive house — the standard is hardly the go-to due to high costs and limited labor. Building to passive-house standards can cost 3 to 5 percent more than a building with a traditional heating and cooling system, and there are only a handful of contractors equipped to install passive-house facades and ventilation systems, Palmer and others explained.

L+M and Jonathan Rose Companies are teaming up on a 751,000-square-foot passive- house project in Harlem dubbed Sendero Verde, which means “green path” in Spanish. The affordable housing project is expected to use 60 to 70 percent less energy than a standard building of its size.

But building sustainably requires patience. For instance, incorporating solar and wind power — which requires upfront costs of hundreds of thousands of dollars — can take seven to 10 years to pay off, said David Brause of real estate investment firm Brause Realty. His firm, which owns and manages more than 3 million square feet of property, is developing a 38-story, 266,000-square-foot rental building in Long Island City that uses both.

Brause said that not all property owners are thinking long-term, and many plan to sell before the energy savings pencil out. But family-owned companies tend to take the long view, he noted, since they typically build with future generations in mind.

“It’s my duty as a father and the owner of a business to do what I can to make the world a better place,” Brause explained. “It’s not just about making a dollar in the real estate business.”

Another family firm, the Durst Organization, which owns 13 million square feet of office and retail space and another 3 million square feet of residential rental properties in New York, has made efforts to build responsibly. The developer had planned to take its massive Hallets Point residential project off-grid, which means the buildings would operate using their own power plants.

But that plan was foiled when the 421a tax break lapsed for 15 months starting in 2016, Phil Skalaski, vice president of engineering and energy services at Durst, told TRD. Without the exemption, it wasn’t clear if all five buildings would be constructed, and the off-grid concept hinged on the entire project moving forward. Instead, Durst incorporated an alternative air-conditioning system, where cold water is circulated through a building’s pipes and tenants are able to control exactly how much energy they are using.

While the chilled water apparatus increases the initial cost of each building’s mechanical system by about 8 percent, the projection is that the energy-savings costs will more than make up for that, Skalaski said.

He said that the complexity of alternative air-conditioning and other forward-thinking technologies can be a deterrent for property owners, noting that many aren’t willing to front the extra money and are often wary that the new systems won’t work properly.

“I don’t know if that’s going to change,” Skalaski said. “A lot of developers have one way of doing things.”

Pat Sapinsley, managing director of cleantech initiatives at Urban Future Lab, NYU Tandon School of Engineering’s incubator for smart-grid energy solutions, echoed that sentiment, calling the real estate industry acutely “liability conscious.” But she noted that there are some climate-conscious players in the industry and named Rudin Management’s John Gilbert, who last year helped pioneer a cloud-based building operations system. The new technology allows the company to monitor and adjust energy use in its buildings based on occupancy and other factors.

But many developers and property owners remain wary of that and other energy-saving technology. “They don’t trust the energy-savings calculations,” Sapinsley said.

David Schwartz, principal of the multifamily developer Slate Property Group, said that while he supports the Paris climate accord, there isn’t enough “compelling data available” to convince landlords that energy-saving technology, like passive house or cogeneration, is a glitch-free way to cut costs.

“You never want to be the first guy to do it if it doesn’t work,” he said.

Inefficient efforts

Other initiatives such as Energy Star and Green Globes exist, but over the last 20 years, many developers have built to the requirements of the Leadership in Energy and Environmental Design (LEED) certification program, which the United States Green Building Council launched in the late 1990s to evaluate the environmental performance of a building.

However, architects and engineers alike have spoken out against the international certification program, claiming that it detracts from more effective initiatives. Critics argue that LEED is prohibitively expensive and hinges on a point system that doesn’t always add up to an energy-efficient building.

Geoffrey Lynch, director of architecture at the New York office of engineering giant AECOM, said that he still views LEED as a powerful tool but has seen some developers move away from the system. They either feel that they can make their buildings energy efficient without it or seek a more advanced certification program.

“When it first came out, it was new and different and it was something to show off,” he said. “It’s not exotic anymore.”

In April 2010, architect Frank Gehry caused a stir when he told Bloomberg News that developers were given LEED awards for “bogus stuff” and that the program served as more of a marketing tool than a meaningful way to promote energy efficiency.

“[LEED has] become fetishized in my profession. It’s like if you wear the American flag on your lapel, you’re an American,” he told Bloomberg at the time.

A few months later, the Brooklyn-based development firm Forest City Ratner announced it would not pursue LEED certification at its Gehry-designed rental tower at 8 Spruce Street in Manhattan.

“As much as we can, we designed the building to be sustainable. And as we look at the ongoing operations, we look to make it as sustainable as possible,” Susi Yu, an executive vice president at Forest City Ratner, told TRD last month.

Most recently, some of the building’s residents began participating in a composting program as part of a pilot run by the city. Eventually, Forest City plans to make the program available to all residents in the roughly 900-unit building to significantly cut down on trash input.

But on the whole, Yu said she feels that developers are increasingly making climate-conscious decisions as a selling point for younger tenants.

Regulatory pressure

Demand is not only coming from everyday New Yorkers. Local officials are also putting increased pressure on property owners to start retrofitting their buildings, especially in the wake of the country’s withdrawal from the Paris agreement and President Trump’s move to dismantle the Environmental Protection Agency. State and city leaders have pledged to adhere to the climate accord despite the president’s decision.

In late June, seven City Council members introduced a bill that would essentially require certain buildings to meet passive-house standards beginning in 2025. And just a few weeks earlier, Council members Jumaane Williams and Brad Lander called on Mayor Bill de Blasio to require retrofits across the city, which was met with fierce opposition from the real estate industry. Williams, who serves as chair of the Council’s committee on housing and buildings, said the city needs to target buildings under 25,000 square feet and require energy-saving upgrades to electrical systems.

In late June, seven City Council members introduced a bill that would essentially require certain buildings to meet passive-house standards beginning in 2025. And just a few weeks earlier, Council members Jumaane Williams and Brad Lander called on Mayor Bill de Blasio to require retrofits across the city, which was met with fierce opposition from the real estate industry. Williams, who serves as chair of the Council’s committee on housing and buildings, said the city needs to target buildings under 25,000 square feet and require energy-saving upgrades to electrical systems.

Last month, John Banks, president of the Real Estate Board of New York (REBNY), told Politico that although the group shares the city’s goal to reduce emissions, a call of mandatory retrofits does not reflect “economic reality or credible methods of implementation.”

Carl Hum, REBNY senior vice president for management services and government affairs, later told TRD that “tenants will ultimately feel the impact in their monthly rent bills.”

It’s not the city’s first attempt to seek mandatory retrofits, however. In December 2009, then-mayor Michael Bloomberg tried and failed. He backed off amid objections from building owners that the plan would prove too costly. Instead, the city left it up to property owners to make changes on their own.

Sapinsley of Urban Future Lab said mandatory retrofits would be an important next step to actually get owners to take energy-saving action. “I have no patience for [the real estate industry’s] whining,” she said.

However, some developers have run into regulations that make going green a lot harder — and far more costly. The Durst Organization is jumping through various regulatory hoops at One Bryant Park, where it has its own 4.6-megawatt cogeneration plant that provides both heat and electricity to the 2.3 million-square-foot office tower. Though the developer boasts that the system is twice as efficient as a conventional plant, Durst is still required to pay Consolidated Edison some $1 million each year in standby rates, fees paid for the utility’s backup energy systems — energy that the building isn’t actually using.

Skalaski said Durst has been working with REBNY and public officials to get Con Ed to reform its rates and incentivize the use of combined heat and power units.

“There’s got to be some level of payback for that. It can’t be a loss every time, or no one will do it,” he said.

Financial shortfalls

Rose of Jonathan Rose Companies said the country’s withdrawal from the climate accord is in some ways a positive development in that it’s shifted the onus of combating climate change on local government and private businesses.

And indeed, at a meeting in late June, the United States Conference of Mayors, a nonpartisan organization comprised of more than 1,400 mayors, stated that it would not only urge the federal government to rejoin the accord, but also find ways to combat climate change in individual cities, the New York Times reported.

Republican and Democratic mayors alike committed to a slew of green initiatives, including enforcing more building codes and creating more incentives for property owners to reduce energy use.

Although environmentalists, city officials and a handful of developers push for more green-building requirements, the bottom line is something any real estate owner can understand: cost. Even when it comes to the city’s efforts to safeguard itself from another Sandy, funding for some New York City-run projects has dried up.

In June, city officials announced that a plan to protect Red Hook from the next “100-year flood” would need to be significantly scaled back. A feasibility study showed that the $100 million project to raise streets in the neighborhood would actually only protect it against a 10-year event. A larger project, the Wall Street Journal reported, would cost $300 to $500 million.

The city’s “Build It Back” program, which is overseeing the rebuilding of thousands of homes in the hardest hit areas such as Staten Island and Red Hook, is $500 million over budget.

And it doesn’t look as though the city will be able to bank on additional federal funding. The president’s proposed budget cuts $667 million from the Federal Emergency Management Agency (FEMA) and local grant programs. He also gutted all $3 billion in funding provided by the Department of Housing and Urban Development after a disaster.

Alan Blumberg, a professor at Stevens Institute of Technology who studies coastal waters and how they interact with urban areas, noted that cities are increasingly planning according to more specific scientific data, not just the broad-brush predictions provided by FEMA. Last year, at the request of the city, the agency agreed to redraw its flood maps to better reflect both current and future flood risks.

For New York, it’s a delicate balance between allowing people to enjoy the waterfront, while they still can, and preparing for a future when they can’t, sources inside and outside of the real estate industry say.

“Pay attention to 2050. Sea level will be at maybe a foot or two more in New York City,” Blumberg said, noting beyond that it’s unclear what things will look like. “People ask me, when is the next 100-year storm coming?” he added. “I say maybe never. Or maybe next year.”

Correction: An earlier version of this story misstated the owner of One New York Plaza. It’s Brookfield Properties.